kidsnord/Shutterstock

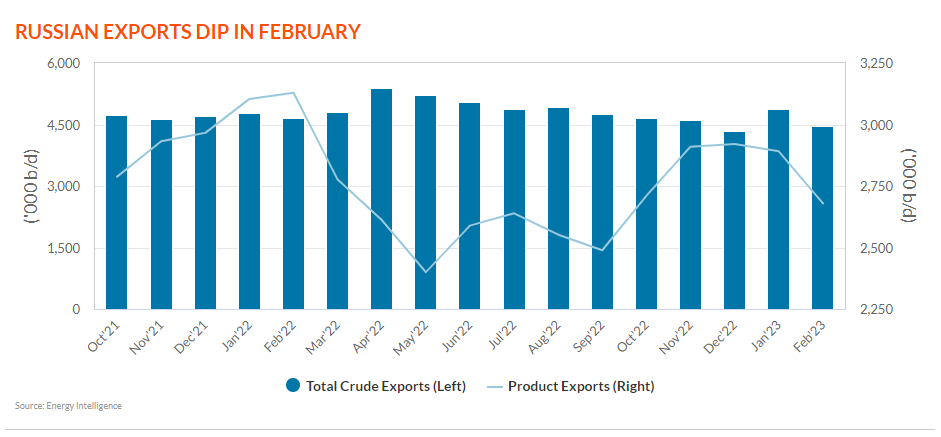

In total, Russia exported 7.14 million barrels per day of crude and products in February, down approximately 600,000 b/d compared with January. A large part of this decline is believed to stem from icy and stormy conditions at key ports, which are now seeing a rebound this month.

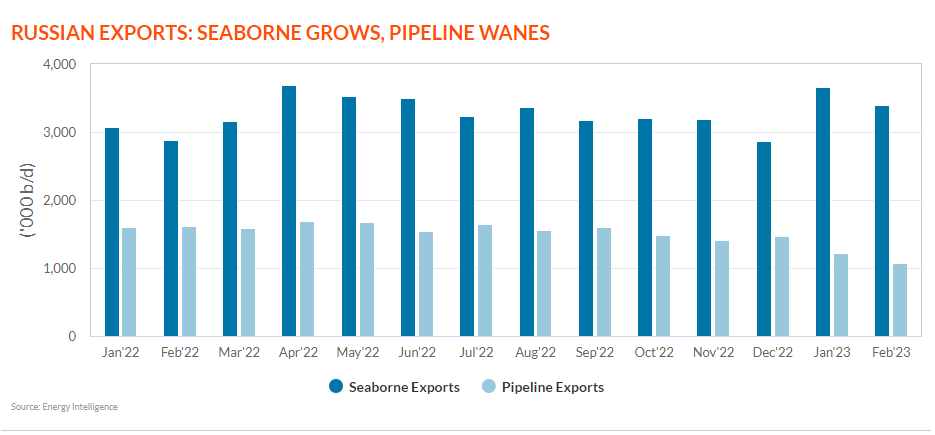

Data from Kpler, a ship tracker, shows that Russia shipped 3.43 million b/d of crude oil by sea during Mar. 1-14, roughly flat compared with full-month February. Pipeline deliveries, meanwhile, were 1.07 million b/d for the two weeks, also steady, Energy Intelligence estimates.

To be sure, Druzhba shipments to Europe are now seen at around 250,000 b/d, one-third the volume from average throughput in 2022. This decline is expected to become permanent, forcing Russia to rely more on tankers to get its crude to market.

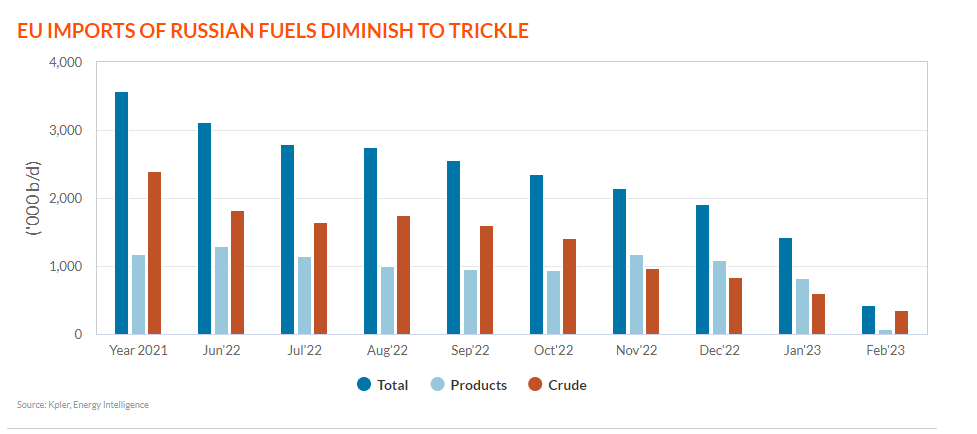

Europe Closes the Door

Europe’s aim to rid itself of dependence on Russia’s oil and petroleum products reached full expression in February, at the beginning of which an embargo on the import of products went into effect. Crude has been banned since Dec. 5, although some Druzhba shipments and seaborne deliveries to Bulgaria are exempted.

Compounding the downtrend, Moscow announced that it would cease all shipments of crude to Poland, where state-controlled refinery Orlen had contracted some 60,000 b/d from Tatneft through 2024.

As a result, Europe imported only 252,000 b/d of crude via Druzhba last month and another 94,000 b/d was shipped to Bulgaria. The total of 346,000 b/d was 23% of average European purchases of Russian crude in 2022.

Observers say that Druzhba deliveries could decline further if Russia decides to cease supplying Orlen’s Czechia-based refinery. Last year, the Czech Republic imported an average 85,000 b/d from Russia.

Asia Now Dominates

As Moscow hunts for new markets, the world’s two most populous nations are lapping up nearly all Russian oil.

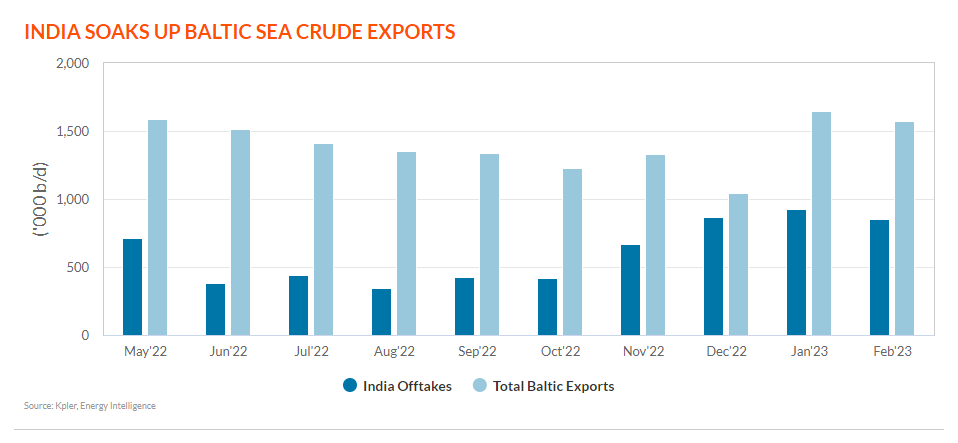

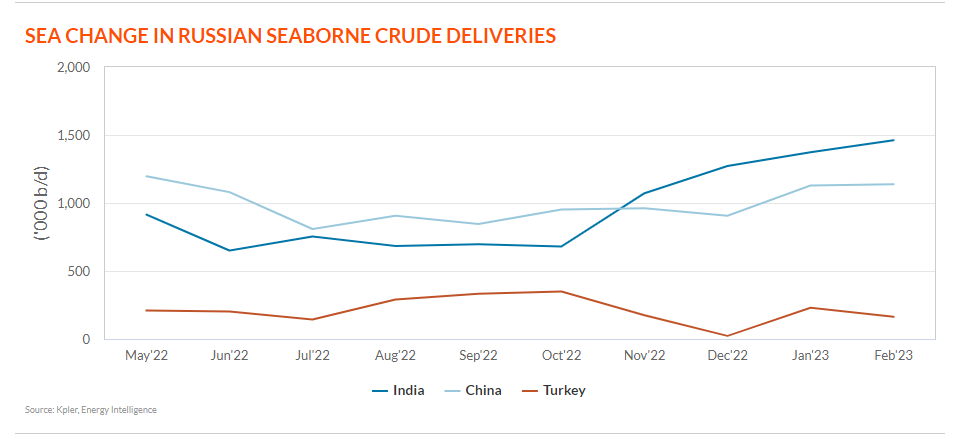

In February, India imported 1.46 million b/d of crude, the largest monthly result yet and the fourth-consecutive month that it has taken more seaborne crude than China. The country is now soaking up the bulk of Urals flows from the Baltic Sea, which is striking considering that it ordered virtually nothing from this distant zone a year ago.

For its part, China took 1.14 million b/d from Russia last month by sea, flat compared with January. However, it also imported 825,000 b/d by pipeline, which means that China remains by far Russia’s largest oil client.

After a buying spree last fall, Turkey has reined in purchases of Russian barrels in recent months. Russia shipped some 165,000 b/d to Turkey last month, down from an average 325,000 b/d in August-October last year.

Taken together, China, India and Turkey accounted for 90% of Russia’s seaborne exports in both January and February, according to shipping data.

March Madness

Experts agree that March will be a pivotal month for Russia’s oil complex — in terms of production, export volumes and refining throughput.

Crucially, Russian authorities are tightening the dissemination of data on hydrocarbon production and exports, sources familiar with the situation say. That makes it more complicated to understand the extent to which the country follows through with the planned 500,000 b/d export cut in March.

In the first two weeks of March, Russia’s exports of crude oil amounted to 4.5 million b/d, on par with January, according to shipping data and Energy Intelligence’s assessment of pipeline shipments.

Indications of steady flows have surprised observers, who expected Russia to reduce oil exports this month by 500,000 b/d in a bid to fetch a better price for its heavily discounted barrels. Some analysts have speculated that part of the March volumes are leftover volumes from February, when the Novorossiysk port in particular was stymied by storms.