SolarReserves Crescent Dunes CSP Project, near Tonopah, Nevada, has an electricity generating capacity of 110 MW. Photo from SolarReserve

Episode 40 of the Factor This! podcast features Craig Wood, CEO of the Australian next-gen concentrated solar power company Vast, which thinks it can change CSP's fortunes in the US. Subscribe wherever you get your podcasts.

The story behind concentrated solar power is complicated. But that's not because it's a poor resource.

Using mirrors and towers, CSP can cleanly generate electricity, provide long-duration thermal energy storage, and decarbonize heavy industry by producing heat. Its attributes only increase in value with higher penetrations of intermittent renewables, like solar photovoltaics and wind.

CSP has a less-than-sunny history in the U.S, though. Installed solar PV capacity dwarfs that of CSP 113 GW to 2 GW. High costs associated with construction have led to bankruptcies and shuttered projects. The story isn't much rosier for international markets either.

So why, then, is the Department of Energy investing millions in CSP research, as international players circle the U.S. as an untapped opportunity?

Vast, an Australian CSP company, is preparing to list on the New York Stock Exchange at a value of up to $586 million. The company's next-gen technology aims to overcome CSP's limitations by combining modularity with a novel approach to thermal energy storage.

Vast CEO Craig Wood joined the Factor This! podcast from Renewable Energy World to break down CSP's partly cloudy past and why it may be poised for a resurgence.

Two generations

Concentrated solar power plants have been deployed for more than 40 years, with some of those pioneering projects still in operation today.

At its core, CSP uses mirrors to concentrate and capture the sun's energy in the form of heat. In most systems, that heat is stored through a medium, typically molten salt, to become a large thermal battery. The energy can be dispatched in the form of process heat or electricity when needed.

The evolution of CSP technology can be grouped into two generations.

Generation 1

Parabolic trough collectors from a concentrated solar project (Courtesy: Abengoa)

The most widely deployed CSP technology uses a series of linear collectors called parabolic troughs. These focus the sun's energy on a pipe filled with thermal oil. As of 2020, parabolic trough systems represented 4,000 MW of the 6,128 MW of total installed CSP capacity.

The thermal oil does have limitations, though, as it can only heat up to 400 degrees Celsius. By the time that heat passes through a storage medium and is ultimately used to create steam and spin an electric turbine, the power cycle operates between 330-350 degrees Celsius, which is relatively inefficient.

The power cycle limitation raises the cost of the energy, though the systems are still widely deployed. A significant portion of Spain's overnight energy comes from parabolic trough systems.

Generation 2

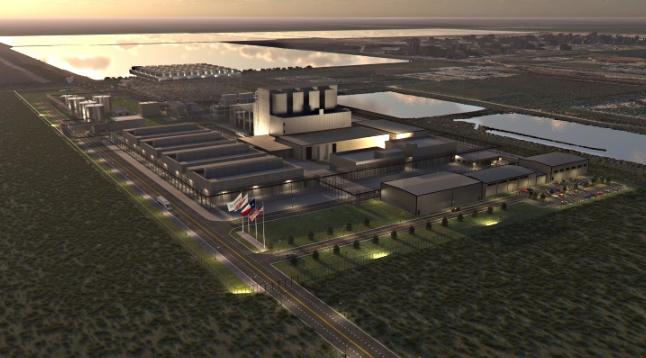

SolarReserves Crescent Dunes central tower CSP Project, near Tonopah, Nevada, has an electricity generating capacity of 110 MW. Photo from SolarReserve

Central tower CSP systems feature a tall, central tower, typically around 750 feet in height. Positioned around that tower are a field of curved mirrors, called heliostats, that bidirectionally track the sun and focus the light toward the central tower. These systems have been deployed in the U.S., Morocco, Dubai, Chile, and China.

The advantage of the central tower system is that it uses molten salt both as the storage medium and as the medium that collects the heat. Salt is pumped up the tower and heated by the concentrated sunlight.

Central tower systems support higher temperatures because molten salt can operate up to 600 degrees Celsius. That allows a steam turbine to run at 538 degrees Celsius, which is the typical steam turbine operating temperature, improving the power cycle and economics over parabolic trough systems.

Central tower systems face their own sets of challenges, though, both due to technical and scale limitations.

As for the technical limitation, the systems don't adequately absorb changes in solar penetration due to clouds. Fluctuations in the salt temperature that is heating downstream equipment can cause failures.

Then there's a fundamental scale limitation. The heliostats positioned around the central tower can extend to a mile away. Adding mirrors to such a wide-flung array becomes uneconomical beyond a certain point.

Next-gen tech

Vast’s 1.1 MW CSP Demonstration Plant in Forbes, Australia was in operation for a 32-month period (Courtesy: Vast)

Vast aims to combine the best attributes of both the parabolic trough and central tower systems in its next-gen concentrated solar power technology.

The company's system combines the modularity of parabolic trough plants with the heat attributes of central tower systems. The modular systems can then be linked together to overcome scale limitations.

Vast's advantage may be its use of liquid sodium metal instead of oil or molten salt as its distribution conduit, borrowing technical expertise from the nuclear industry, which uses it as a coolant in reactors. The sodium passes through modular towers, transferring the heat to molten salt for storage. The heat from that molten salt can then be used to create steam and spin a turbine or to create process heat.

"We've got the best of both worlds," Wood said.

Capital from a wealthy investor in Australia allowed Vast to perfect the technology over the past decade.

In 2018, a 1.1 MW demonstration plant was connected to the grid near Sydney and operated for 32 months. Now, the company is setting its focus on a 30 MW/288 MWh utility-scale reference plant project in Port Augusta, Australia. The facility is expected to reach a final investment decision by the end of 2023.

The Australian Renewable Energy Agency has committed to providing up to AUD$65 million ($43.19 million) of grant funding for the project alongside concessional financing of up to AUD$110 million ($73.1 million) from the Australian government. Taken together, Vast said it has secured 80% of financing for the project, with the remainder of the funds likely coming from the company's NYSE listing.

Wood said construction of subsequent Vast next-gen CSP projects is unlikely to begin until 2025, once the Port Augusta plant is operational.

"There's a couple of things that happen when you're building a utility-scale power station," Wood said. "The most important limiting factor is that if someone is going to buy power from you, then they want to visit a working power station."

Vast also sees an opportunity in using the technology to produce e-fuels, like green methanol.

The Port Augusta CSP plant will be co-located with a solar methanol demonstration plant, which will be used to produce green methanol to help decarbonize hard-to-abate industries, like aviation and shipping. The plant will feature a 10 MW electrolyzer and a methanol process partly-powered by the neighboring CSP plant.

The project will receive funding from the German-Australian Hydrogen Innovation and Technology Incubator (known as HyGATE) of up to AUD$19.4 million (US$13.1 million) and EUR13.2 million (US$14.15 million).

Concentrated solar power's moment?

Vast's plans to enter the U.S. market were in motion long before passage of the Inflation Reduction Act, which provides millions of dollars for clean energy deployment.

The legislation may, however, help Vast build large, or more, projects. The sunny attributes of Texas, New Mexico, Nevada, Arizona, and California all present opportunities for CSP development, Wood said.

But maybe the biggest factor in selecting the U.S. is the success of solar PV and wind. While markets don't yet adequately reward long-duration energy storage, resources that can dispatch clean energy when the sun isn't shining or the wind isn't blowing will only become more critical with further penetration of intermittent renewables.

"PV, wind, and some batteries run into a wall at somewhere between 20% and 40% to go" in decarbonizing the grid, Wood said. "You need different technologies. You need dispatchable long-duration renewable technologies."

Wood is excited about the future despite CSP's troubled past.

While the application of CSP may not have been well-timed 10, 20, or 30 years ago, the energy transition requires a backstop resource that can support the retirement of fossil fuel-powered assets.

"There's a massive need for what we do," Wood said. "Is it going to be hard? Absolutely. It's been ridiculously hard so far. But we've got to get on with it to actually decarbonize these hard-to-abate sectors."