Geothermal Seminar 2023 - Raising the ambition (source: SPE Aberdeen)

Geothermal Seminar 2023 - Raising the ambition (source: SPE Aberdeen)Geothermal 2023: Realising the Ambition was organized by the Aberdeen, Scotland, section of SPE. Kirsten Pasturel, Founder and Director of ZeGen Energy and a conference organizer, noted that the event itself was a sign of increasing traction in the geothermal market, being held over two days rather than 2022’s one. Ann Robertson-Tait, President of GeothermEx, agreed, adding that one trend she’s noticed over the last year is that more oil and gas companies have started “really digging into the geothermal space.”

Why? “Arguably, the oil and gas [sector] has more relevance to geothermal than any other renewable sector. Just think about it: exploration, geoscience, wells, completions…it’s all there,” said Pasturel. “Oil and gas doesn’t have all the answers to successfully scaling geothermal, but it can undoubtedly assist with many pieces of the puzzle.”

Toward the Holy Grail

The geothermal energy stored beneath our feet exceeds our annual energy demand as a planet by a factor of a billion, said Matt Houde, a speaker at the conference and a co-founder of Quaise Energy, a geothermal startup.

Right now, however, we can’t drill deep enough to unlock the mother lode of the resource, which is some two to twelve miles beneath the Earth’s surface. There rock is so hot (temperatures are over 374 degrees C, or 704 degrees F) that if water could be pumped to the area, it would become supercritical, a steam-like phase that most people aren’t familiar with. (Familiar phases are liquid water, ice, and the vapor that makes clouds.)

Supercritical water, in turn, can carry some 5-10 times more energy than regular hot water, making it an extremely efficient energy source if it could be pumped above ground to turbines that could convert it into electricity. That could lead to “a step change improvement in terms of the power output that can be produced compared to a traditional hydrothermal well,” Houde said. “So there’s massive potential, but [accessing deep geothermal] is financially prohibitive.” Conventional drilling technologies can’t withstand the conditions miles down.

As a result, “a number of projects in the last few years have been focused on improved drilling,” said Catherine Hickson, CEO of Alberta No. 1 and a keynote speaker at the conference. “It’s the drilling costs that make geothermal a very expensive proposition if we are going for deep geothermal and higher temperatures.”

How to Get There

Several presenters at the conference addressed the drilling challenge. One session, for example, focused on oil and gas “movers” in geothermal drilling where representatives from Roemex, Adrilltech, and Expro described a variety of approaches to cut costs.

Houde, of Quaise Energy, joined Tony Pink, VP of Sub Surface Energy Technology at NOV, in a separate session titled “What’s Hot in Geothermal?” The two discussed novel drilling technologies being developed by their companies.

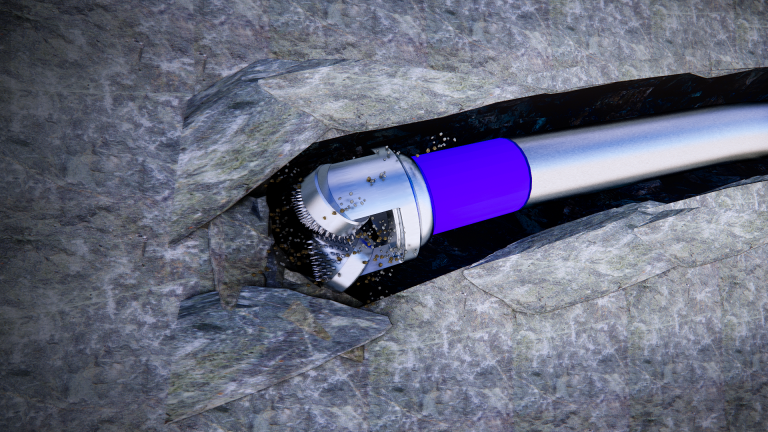

“Our solution at Quaise is to replace the mechanical drilling process with an energy-matter interaction that we call millimeter-wave drilling,” said Houde. Those millimeter waves, which are related to the microwaves people cook with, travel down a metallic pipe to literally melt then vaporize the rock deep below.

Geothermal energy—the heat beneath our feet—has the potential to be cost competitive with other renewables and even fossil fuels if we can drill deep enough to access the mother lode of the resource. Quaise Energy is developing a technology to do so with millimeter-wave energy. (source: Quaise Energy)

At the same time, the melted rock in the outer ring of the hole cools and solidifies to form a solid glass liner “that can enable borehole stability while we are drilling,” Houde said. That, in turn, could replace the more conventional steel and cement casings for that purpose, which may run into challenges at the extreme conditions deep below.

The Quaise technology also takes advantage of conventional drilling technologies. These will be used to drill down through surface layers to deep basement rock. “We then switch to millimeter-wave drilling…as we encounter diminishing returns for the conventional drilling operation,” Houde said.

Drilling would begin with conventional technology that then switches to millimeter waves. (source: Quaise Energy)

Pink described NOV’s approaches to drilling deep. These include changes in the drillbit technology, such as making the diamond in the bit thicker. NOV is also looking at non-traditional technologies such as the particle impact drill. In collaboration with Particle Drilling, they are firing two-millimeter steel shot out of a bit at the rate of 12 million a minute. The shot “goes down hole, accelerates out the bit, and then comes back to the surface and is recycled,” Pink said.

Cutting costs

Houde said that the Quaise millimeter wave process is mostly independent of depth, so drilling costs are going to scale linearly with depth rather than exponentially, as happens with conventional technologies. “Combined with the power potential of superhot geothermal wells, we believe we can achieve a levelized cost of energy (LCOE) of less than $40 a megawatt hour for the most conservative cases, where we target those temperatures at a depth of 10 to 20 kilometers.”

He suggested that other factors, such as drilling to superhot temperatures at shallower depths, could get the LCOE down to below $20 or $30 per megawatt hour. At that point “it becomes incredibly competitive with the energy infrastructure today, as well as the incoming energy infrastructure—primarily wind and solar—that’s being brought online as part of the energy transition.”

Both Houde and Pink were optimistic about the future. Pink remembered how in 2006 it took 80 to 90 days to drill oil wells in the Permian Basin. They are now drilled in 15 days. “We’ve done it in unconventionals, we can do it again in geothermal.”