Last Energy, a U.S.-based micro modular nuclear technology firm and project developer, has secured power purchase agreements (PPAs) for 34 PWR-20 small modular reactor (SMR) units with four industrial partners in the UK and Poland. The deals, which represent a combined $18.9 in power sales, mark “the largest pipeline of new nuclear power plants under development in the world,” Last Energy said.

The Washington D.C.-based company on March 22 said it signed PPAs for 10 20-MWe plants with Katowice Special Economic Zone (KSSE), a 1997-established special economic zone in southwestern Poland that hosts 540 companies. “The agreement represents over USD $4.3 billion in electricity sales over the lifetime of the contract and USD $1 billion in inward energy and infrastructure investment in the zone,” the company noted. The first of the 10 plants supplying power to KSSE could be commissioned in 2026, it said.

Last Energy on Wednesday also unveiled PPAs for 24 SMRs in the UK as part of three industrial partnerships. While Last Energy did not disclose details about the new partnerships, said they “represent a diversity of UK industries, including a life sciences campus, sustainable fuels manufacturer, and a developer of hyperscale data centers.” Specific details are expected “over the coming months, as project teams on both sides finalize arrangements for site selection and engagement with appropriate stakeholders,” the company said. Last Energy, however, noted that the first UK plant could also be commissioned in the 2026 timeframe.

Quick Rollout, Quick Deployment for the PWR-20

The development is a significant leap for Last Energy, a 2020-established commercial spin-out of the Energy Impact Center, which is a Washington D.C. research institute focused on near-term climate solutions. The company rolled out its completed PWR-20 design last year. Its flagship offering, the PWR-20 is a 20-MWe (60-MWth) single-loop pressurized water reactor (PWR) that has a 300C continuous output. The design uses standard full-length PWR fuel enriched to 4.95% and closed-cycle air cooling.

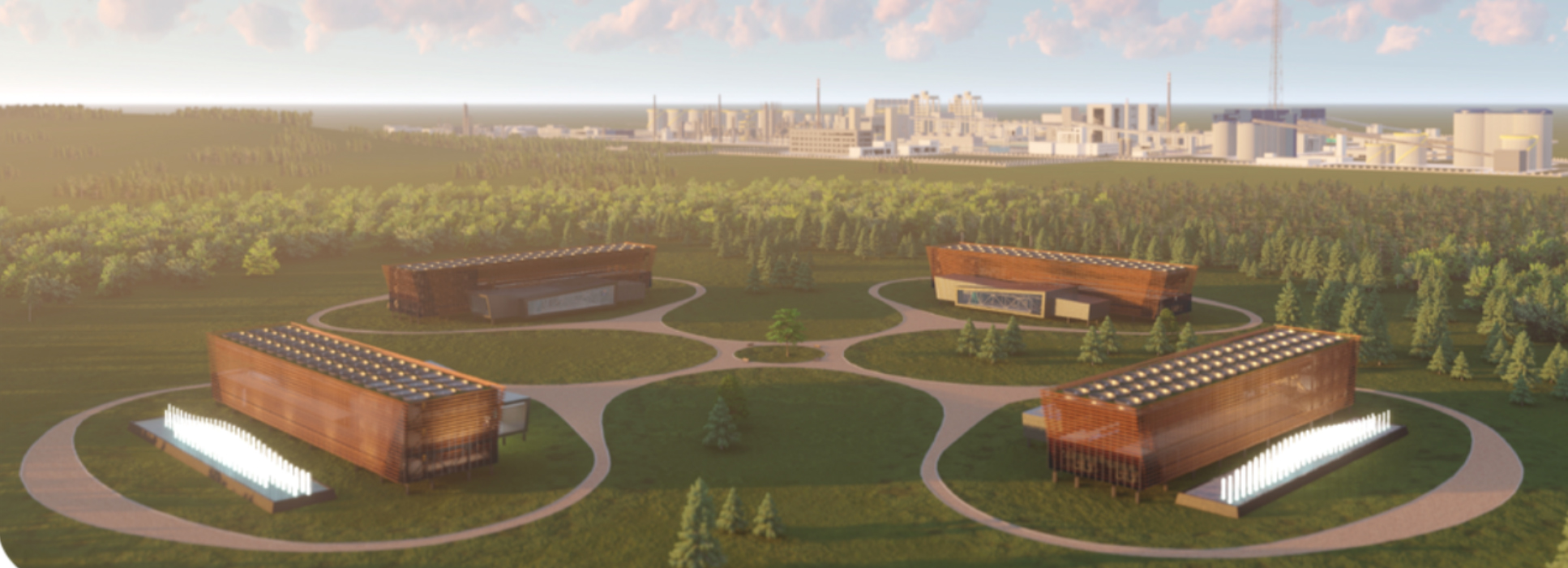

Last Energy says its PWR-20 is uniquely suited to support rapid industrial decarbonization because of its small yet scalable combined heat and power output. “This model allows us to produce electricity and process steam/heat on site and grow with customer needs. The modular air-cooled design means units are not constrained by the presence of water resources—a municipal water connection or well will meet all water requirements,” it said. Courtesy: Last Energy

However, as the company last year told POWER, the technology’s competitiveness thrives on an innovative delivery model for its “miniaturized, modernized, and modularized” standard PWR design. The model “promotes scalability and rapid deployment through multiple, small-scale facilities that rely on repeatable frameworks and off-the-shelf components allowing nuclear to follow the best practices of the renewables industry: scaling of quantity rather than size,” the company said.

And because the technology uses a standardized balance of plant configuration and modular construction, a Last Energy plant could be fully factory fabricated and can be installed “on-site in as little as three months.” The factory-made model “simplifies the regulatory process, keeps project costs below $100 million, and unlocks both private financing and customer validation,” the company said. In addition, that delivery is focused. “We cover all aspects of the investment process, including design, construction, financing, service, and operation,” it noted.

“Our vision is to create a new model for what’s possible with nuclear development at scale, and you’re seeing it quickly come to life through these partnerships,” Last Energy CEO, Bret Kugelmass said on Wednesday. “For too long, nuclear has been too big, too costly, and failed to create a product that meets customer demand. From the outset, we started with studying our customer’s energy requirements, and we designed our power plant, and our entire business model, around delivering them what they need.”

The PPAs—Revenue Guarantees—Mark a Big Leap in the Advanced Nuclear Space

The newly announced PPAs, however, also represent extraordinary progress for the burgeoning advanced nuclear reactor industry—which encapsulates small modular reactors (SMRs, which are typically less than 300 MW) and microreactors (of 10 MW or less). While several advanced nuclear reactors are under development around the world, few have raised significant public or private financing. For example, of 21 advanced technologies assessed by the Nuclear Energy Agency (NEA) in its March 13–released SMR Dashboard, only half have made significant progress toward fully financing a first-of-a-kind project or demonstrated progress toward financing Nth-of-a-kind projects.

But even fewer advanced nuclear project and technology developers have secured revenue guarantee mechanisms, such as PPAs. PPAs are contracts under which off-takers agree to purchase power generated by a project installed, owned, and operated by a developer. The mechanisms allow project developers to pay back invested capital and generate acceptable returns for their investors.

PPAs, which often span terms of 10 to 20 years, also provide crucial commercial certainty that is attractive to power buyers, particularly in the commercial and industrial space. Terms often include the cost of power, when a project will begin commercial operation, a schedule for power delivery, penalties for under delivery, and payment terms. PPAs have notably become an increasingly popular way to finance renewable energy projects, given their potential to mitigate risks for both power producers and buyers.

Michael Crabb, vice president of Finance at Last Energy, on Wednesday told POWER the PPA for the 10 units with KSSE in Poland is a revenue guarantee agreement. “We will work with them to supply that energy directly to their industrial zone customers,” he said. The agreements in the UK for 24 units for three different partners include “two physical PPAs and one virtual PPA,” he said.

However, while the PPAs cover a novel micro modular technology, at their core, the agreements echo contracts structured for other generation. “The product is a baseload product, which customers value,” Crabb said. “High reliability factors are a driver,” he said. “That’s one of the key pain points that we are solving for our customers, matching their demand for energy.”

Another Significant Indicator of Demand for Nuclear from the Industrial Sector

Last Energy’s deals, meanwhile, also bolster new progress by the advanced nuclear industry to secure supply agreements from the industrial sector to fulfill demand for decarbonized power and heat. For advanced nuclear developers—which offer smaller plants—market signals from the commercial and industrial sector are important because they support investments in new projects or innovation.

Earlier in March, advanced nuclear technology firm X-energy announced it would site its four-unit 320-MWe Xe-100 demonstration at a Dow site in the U.S. Gulf Coast region. Part of a federal demonstration under the U.S. Advanced Reactor Demonstration Program, that project is slated to receive $1.23 billion in funding from the November 2021–enacted Infrastructure Investment and Jobs Act (IIJA) over its seven-year demonstration period. The Department of Energy and Dow have highlighted the project’s crucial role in showcasing how energy-intensive industries can achieve carbon neutrality by 2050.

Last Energy’s approach, however, is focused on sustainable financing with industrial needs in sharp focus, the company suggested. “Rather than requiring government financing for new nuclear development, Last Energy is leveraging private capital looking to invest in clean energy and infrastructure projects,” it noted on Wednesday. The newly announced PPAs will support the buildout of 34 units—a combined 680 MWe. These units will be on-site baseload sources for industrial partners, designed to fill a “critical gap for heavy energy users as they seek a reliable solution for rapid decarbonization,” the company added.

In Europe, the drive for reliable, affordable, and decarbonized industrial energy is especially pronounced, it suggested. “Industrial energy use accounts for a quarter of global greenhouse emissions and European industrial competitiveness depends on securing a stable supply of cost-competitive power, with many companies and regions struggling to secure adequate power to attract and retain industrial partners,” it said.

Last Energy’s PPAs signed with KSSE for output from 10 units, notably, are separate from a deal for 10 20-MWe PWR-20s announced in August 2022 with Legnica Special Economic Zone (LSSE), another special economic zone sited in northern Poland. While that deal was Last Energy’s first long-term contract, it fell into place quickly as Poland sought to explore alternative sources of power as Russia’s aggression roiled the region’s energy security. LSSE in August told POWER that while SMR technology is still a “novelty” in the Polish energy sector, “experts predict that in the coming years, due to high energy prices, limited availability of power in the electricity network, and the availability of fossil fuels, there will be increased development and interest in nuclear reactors.”

Dr. Janusz Michałek, president of the Management Board of KSSE, on Wednesday echoed these comments. “Industrial investors are looking for a secure supply of carbon-free power to power their operations today, and seamlessly scale as their power requirements increase,” he said. “This project would provide the type of security and certainty in energy supply and price that our industrial partners need to make long-term investments in our area.”

The UK, meanwhile, faces similar challenges.“Industrial energy users are increasingly facing energy supply constraints, not to mention extreme price volatility and uncertainty,” noted Lily Frencham, CEO of the UK’s Association for Decentralised Energy.”Last Energy’s micro nuclear power plants meet the energy requirements of heavy industry, capable of providing zero carbon heat and electricity and doing so in a way that can scale over time to meet their energy needs.”

An Intensified Race to Commission FOAK Plants

Along with the KSSE and UK projects, which now have PPAs, Last Energy’s pipeline of projects are in “various degrees of development and contracting,” a Last Energy spokesperson told POWER on Wednesday. These include the deal with LSSE and a separate agreement to explore two plants in Romania. In total, the pipeline comprises 46 PWR-20 SMRs.

Still, efforts to put the first units online in Poland and the UK within the next three years may face hurdles, particularly from uncertainties posed by licensing. The company is “very engaged” with relevant regulatory bodies in target markets, Last Energy’s spokesperson noted. Other factors like fabrication of the plants will be “intrinsically linked to licensing strategy” within each country and the final set of commercial terms” for each project, he said.

Last Energy is meanwhile also heavily investing in its supply chains. “Inward investment”—investments that support customers across the country’s supply chain—amount to $1 billion for KSSE and $2.4 billion in the UK, it noted.

Potential delays are factored into the PPAs, the spokesperson said. “One of the major reasons why we pursue this approach is it aligns with our incentives to deliver the electricity with our buyers’ incentives to procure that electricity, but they don’t pay until we deliver,” he said.

For now, Last Energy is “actually already in a position to begin fabricating our power plant modules,” the spokesperson said. That’s a huge advantage, he noted. “One of the reasons why we have a high degree of conviction that we can accelerate the eventual timeline for deployment is that we will begin to be able to move forward … where we are able to fabricate in parallel with our licensing process,” he said.