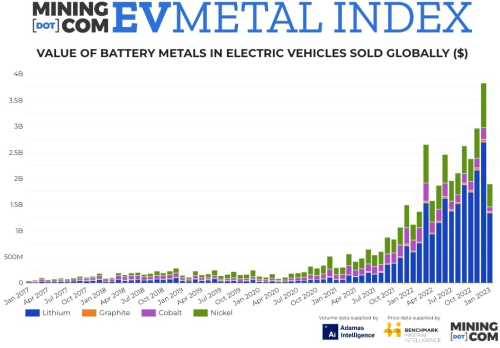

Mining.com’s EV Metal Index, which tracks the value of battery metals in newly registered passenger EVs (including full battery, plug-in and conventional hybrids) worldwide, totalled $26.9 billion in 2022—an increase of 232% compared to the prior year. As much EV battery metal business was done in 2022 than the combined total of the preceding five years.

The value of battery metals deployed in December 2022 alone surpassed all of 2019 and 2020 combined. Total battery capacity of the 1.64 million EVs sold during December set a new monthly record, expanding 29% year on year to 63.6 GWh, according to Adamas Intelligence.

In December 2022, a record 38,061 tonnes of lithium carbonate equivalent were deployed onto roads globally (55% carbonate, 45% hydroxide), up 46% over the same month the year prior. Lithium prices were also peaking in December around $70,000 a tonne, which lifted the lithium subindex to $2.7 billion during the month, surpassing December 2021 by 280%.

A record 27,676 tonnes of nickel in newly-sold EVs in December was up 40% over the same month the year prior. The value of the nickel in hybrids and battery electric vehicles jumped to $856 million, 15% above the previous record set in March last year when the London nickel market was in the throes of a crisis and prices spiked.

The cobalt subindex dropped 28%, after prices for the metal halved over the course of the year and declining cobalt use in batteries eroded growth in absolute deployment tonnage.

According to Adamas data, average cobalt use in EVs in the second half of last year was flat as LFP batteries continue to grow in popularity. In contrast, lithium use per vehicle jumped 17% as average battery pack sizes grew and the global EV sales mix reached 89% full battery-powered cars.

In December 2022, a record 57,980 tonnes of synthetic and natural graphite were deployed, up 48% year on year setting a new record in terms of value as prices consolidated around the early $800s per tonne.

January 2023 saw the index halve from December, dragged down by the end of government subsidies in China, and there is likely more weakness ahead given sharp decline in lithium prices in China in recent weeks, a ‘normalizing’ nickel price and ongoing troubles for cobalt both in terms of price and usage.