Opec+ slashed its output by 2 million barrels per day in October last year. Reuters

Opec+ will most likely roll over its existing output cuts when it meets on April 3 despite the recent market turmoil that dragged oil prices to their lowest in more than a year, according to analysts.

The group of 23-oil producing countries, which slashed its collective output by 2 million barrels per day last year, has so far taken a “wait and see” approach as governments and regulators attempt to quell panic in global financial markets.

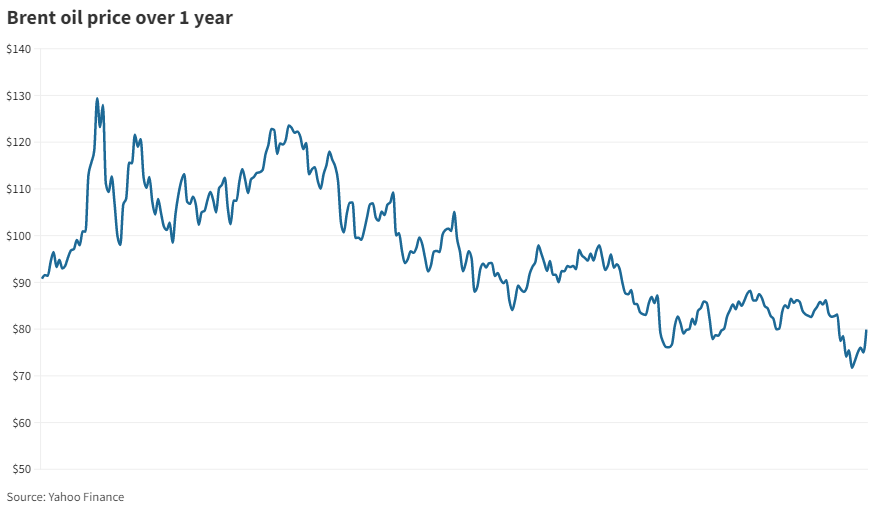

Brent, the benchmark for two thirds of the world's oil, fell to a 15-month low amid a banking crisis in the US and Switzerland. It is down about 7 per cent since the start of the year.

The international benchmark was last trading at $79.89 a barrel on Friday after surging to nearly $140 last year following Russia’s invasion of Ukraine.

“Crude’s macro-driven price collapse has raised questions about whether Opec+ will step in to stop the rout, and our answer is no, not yet,” Energy Aspects analysts Amrita Sen and Matthew Holland said in a note last month.

“The group fears that any action taken in reaction to non-fundamental drivers could create unintended consequences. It should be clear that should any deterioration occur in its balances, the group will backstop the market as it has always done,” the analysts said.

Less than two weeks ago, Opec further raised its 2023 forecast for Chinese oil demand growth as the country gradually reopens its economy after ending nearly three years of zero-Covid regulations.

But, the group maintained this year's crude demand estimate at 2.3 million bpd on concerns of an economic slowdown in the US and Europe.

"We foresee no policy change," said Ha Nguyen, executive director for global oil at S&P Global Commodity Insights.

"We expect [oil] prices ahead to increase slightly due in large part to a rise in jet fuel demand within China and higher gasoline demand in the Western portion of the world ... rising demand in the second half of 2023 will tighten the supply-demand balances."

Opec Secretary General Haitham Al Ghais has said that the group is seeing a “divided market” with one segment showing signs of “promising” growth and the other experiencing a decline.

“There is phenomenal demand growth in Asia [but] what concerns us more is actually the slowdown we see in Europe and the US in terms of the financial situation [and] the inflation,” Mr Al Ghais said at the CeraWeek energy conference in Houston this month.

Central banks aggressively raised interest rates last year to tame high inflation as the Ukraine war sent shockwaves across global commodity and food markets.

Last month, the US Federal Reserve raised interest rates by 25 basis points and hinted that it may pause future rate increases following the recent turmoil in financial markets.

The European Central Bank, which recently raised interest rates by 0.5 percentage points, has said that there was no need for its monetary policy plans to be adjusted.

Opec+ may be hesitant to suggest further production cuts because it fears that the market might see it as an indication of weak demand, despite the fact that the group is seeing “strong” demand in Asia and steady fuel consumption in regions to the west of Suez, according to Energy Aspects.

“For Opec+, oil-specific fundamentals remain unchanged, at least for now.”

The International Energy Agency expects global oil demand to rise “sharply” this year on the back of pent-up Chinese demand and a rebound in air traffic.

In its latest oil market report, the agency said oil demand growth would “accelerate” to 2.6 million bpd in the fourth quarter.

However, rising crude stocks in the US and stubborn Russian production in the face of western sanctions prompted Goldman Sachs to lower its oil price forecasts for 2023.

The investment bank now expects Brent to trade at $94 a barrel for the 12 months ahead and $97 in the second half of next year.

It had previously projected that the benchmark would trade at $100 in both scenarios.

While near-term oil prices are likely to remain volatile — influenced by the current financial market turmoil — Swiss bank UBS has retained a positive outlook.

It expects rising Chinese crude imports and demand, plus lower Russian production, to tighten up the oil market and lift prices over the coming quarters.

"We think fundamentals support a tightening of the oil market," UBS strategist Giovanni Staunovo, said in a research note last week.

"China's recovery is pushing Chinese crude imports higher, and the US saw a large drop in refined product inventories" in the March 20-24 week, he said.

"More of this data should support prices. So far, the pledged production cut by Russia is not visible in Russian crude and refined product exports, which are both higher versus February."

Last month, Goldman Sachs revised up its first quarter and 2023 full-year GDP growth forecast for China to 4 per cent and 6 per cent, respectively, from 2.7 per cent and 5.5 per cent previously. China's economy grew about 3 per cent last year.

In January, the investment bank said the reopening of China’s economy and a full recovery in the country's domestic demand may raise global output by around one per cent in 2023 and lead to a rally in oil prices.

Carole Nakhle, chief executive at Crystol Energy told The National the factor that is probably putting the most "pressure on oil markets is the economic outlook particularly whether the collapse of certain banks will lead to a full-blown crisis or not”.

“The situation is still unfolding hence Opec+ might decide to wait for greater clarity before making output changes,” she said.

In January, the International Monetary Fund raised its global economic growth estimate for this year to 2.9 per cent from a previous forecast of 2.7 per cent, but warned that the fight against inflation would continue to weigh on the global economy along with the Ukraine war.