A project led by two major European gas transmission system operators (TSOs) has successfully tested blending rates of up to 25% hydrogen on a Titan 130 SoLoNOx Solar Turbines gas turbine that serves as a prime mover on a natural gas compressor in Germany.

The project’s success marks a triumph for Europe’s gas transmission sector, which is seeking to diversify fuel used to mechanically compress gas used at different stages in the gas pipeline—from extraction to distribution to end-consumer.

GRTgaz Deutschland, OGE, and Solar Turbines have successfully tested a low-emissions Titan 130 SoLoNOx Solar gas turbine as a prime mover on a natural gas compressor using hydrogen blending rates of up to 25%. Courtesy: Solar Turbines

The six-week project stems from a collaboration between GRTgaz Deutschland, a company that operates a 1,200-kilometer (km) gas transmission system in southern Germany, OGE, one of Europe’s leading gas TSOs, and Solar Turbines, a California-based gas turbine manufacturer owned by Caterpillar. The companies set out to test hydrogen blends in a Titan 130 SoLoNOx gas turbine that drives a gas compressor at the MEGAL compressor station in Waidhaus, Bavaria, which OGE and GRTgaz Deutschland jointly own (Figure 1).

The compressor serves the MEGAL natural gas pipeline system, which offers a bi-directional cross-border point at the German-Czech border in Waidhaus. “Preparations for the project started two years ago when a mobile blending plant the size of a 40-foot ISO shipping container and a temporary hydrogen supply were set up for the tests,” the companies noted in a statement in February. “The entire configuration was acceptance tested by an independent expert in accordance with the rules and regulations applicable to public energy supply and approved for operation. For these tests, it was crucial not to compromise the safety and availability of the compressor station.”

The Challenge: Readying Key Gas Grid Components for Hydrogen Demand

A natural gas compressor prime mover is a key piece of equipment that provides power to drive the compressor. While reciprocating engines and electric motors are sometimes used as compressor prime movers, gas turbines are the most common, mainly because they are typically lower cost than other options. They also offer reliability and have fairly low emissions. Gas turbines, however, are usually powered by natural gas taken from the pipeline system.

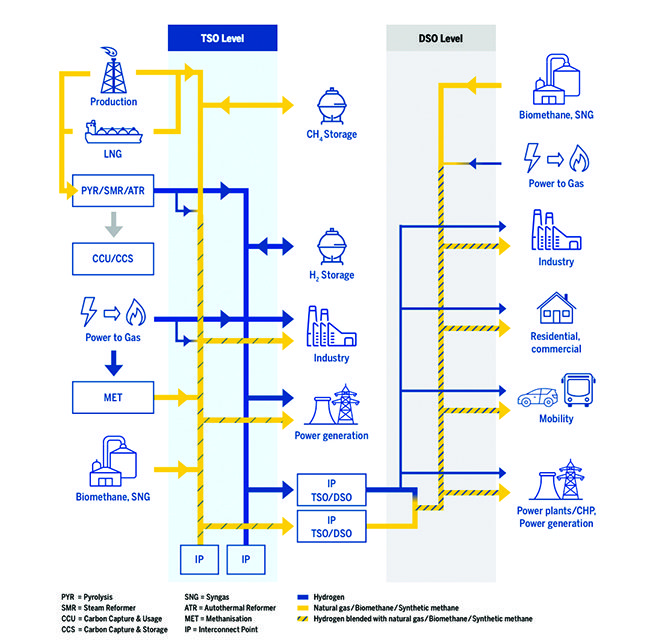

As decarbonization gains steam, however, gas grids—including at the transmission system operator (TSO) and distribution system operator (DSO) level—will need to be equipped to meet hydrogen demand, suggests industry group European Network of Transmission System Operators for Gas (ENTSOG).

The entity last year noted that blending percentages of up to 2% volume of hydrogen into natural gas is already so far possible. However, blending hydrogen volumes of up to 20% may be required over the mid-term, depending on national and regional conditions, as well as customer needs, requirements, and grid topology. “In the long run, most sectors will retrofit to dedicated hydrogen systems. Yet, this may not be possible for specific industrial processes e.g., the production of chemicals, which are largely dependent on the methane molecule. As a consequence, methane networks using natural gas, biomethane and/or syngas depending on the region, will also play a role in the future,” it said.

The European Network of Transmission System Operators for Gas (ENTSOG) is hosting a working group to enable decarbonization of the gas value chain. This graphic illustrates an example of a potential future scenario within a more interconnected energy system. Courtesy: ENTSOG

For now, however, gas TSOs and DSOs must manage and accommodate “diversity of technological choices for the benefit and safety of the climate and all consumers while ensuring that achievements of the internal energy market for gas and interoperability between the different energy carriers are maintained and further developed, including hydrogen,” ENTSOG said (Figure 2).

ENTSOG noted that 2% hydrogen volume blending is a “reasonable value” as a starting point. “Even though some sectors can already handle up to 10% vol. H2 or even 25% vol. H2, 2% vol. H2 reflects the common minimum denominator due to the fact that some industrial processes cannot handle more than 2% vol. H2 nowadays. It is also worth mentioning that throughout Europe the connected customers to the DSO or TSO vary widely,” it said.

The shift to higher shares of hydrogen blends in natural gas, however, will prompt new challenges for TSO assets, including for steel pipelines, which could suffer hydrogen embrittlement, and valves, whose internal and external tightness at higher hydrogen shares is still under study, ENTSOG added. And because hydrogen has a significantly lower molar weight than natural gas, higher shares of hydrogen may require changes to compressors. Compressor drivers must also adapt to hydrogen admixtures, it suggested.

“Most common gas turbines for pipelines can already burn a significant amount of H2 in the fuel,” ENTSOG explained. “However, based on the materials used, control systems, stoichiometry, and blading, suitable H2 thresholds for existing turbines can vary between 1–20% vol. H2,” it said.

A Multi-Company, Cross-Border Collaborative

According to GRTgaz Deutschland and OGE, the successful testing of blending rates of up to 25% at the MEGAL compressor station marks a good first step. “This test is a good example of working collaboratively across national borders to tackle and solve important issues in the energy industry,” said Nicolas Delaporte, managing director of GRTgaz Deutschland.

The companies noted that the testing, which used only “green” hydrogen, was conducted with various hydrogen blending rates under different loads for more than 200 hours. “Emissions and turbine performance were measured, demonstrating the turbine’s ability to operate with the same available power while meeting the required emission levels,” they said. “The ability of the gas turbine to safely start on the fuel blend was also demonstrated.”

The successful testing is good news for Solar Turbines, too. The company’s 16.5-MW Titan 130 gas turbine, which is equipped with a SoLoNOx combustion system, is a widely used industrial turbine. Introduced in 1997, the company sells the gas turbine as a two-shaft model for compressor and mechanical drive applications. It says the compressor set is designed to deliver a simple-cycle thermal efficiency of 36%.

The company says it has nearly 40 years of experience in providing hydrogen-capable packages, logging more than 2 million hours of operation with up to 70% hydrogen gas. “As market and customer demands come into play, more focus is on the [Dry Low Emissions (DLE)] configurations for higher hydrogen concentrations. Our team is committed to operate gas turbine packages on natural gas fuel with increased volumetric concentration,” it said.

The larger impact of the testing on industry efforts, however, remains to be seen. “The project shows the desire and ability to expand and realize the hydrogen economy,” noted Dr. Thomas Hüwener, a member of OGE’s board of management. “But to do this, we now need the right legal and regulatory framework to accelerate Germany’s hydrogen economy supported by a strong financing model.”