Leading South African alternative investment manager Westbrooke Alternative Asset Management has announced the launch of its new Renewable Energy Alternatives investment strategy (Westbrooke REAL).

The Westbrooke REAL strategy is to invest in and partner with small and medium-scale embedded generation solar projects and allow investors to participate in the returns generated by such projects which are enhanced by tax incentives, which have recently been expanded by government. Westbrooke REAL provides investors with access to a portfolio of solar photovoltaic (“PV”) projects underpinned by long-term cash flows through power purchase agreements concluded with high-quality end-users.

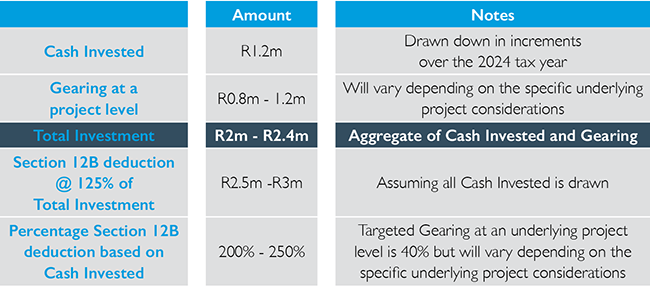

Dino Zuccollo, Westbrooke Alternative Asset Management’s Head of Product Development and Distribution provided insight into how the strategy can deliver sustainable returns beyond conventional investments. “By providing funding solutions to a ‘real’ crisis in South Africa’s energy availability, we plan to become a key equity funder to green energy solar projects alongside our partners. The unique Westbrooke REAL investment structure allows clients to enhance the normal 125% Section 12B tax deduction to up to 250% of their cash invested*, thereby providing for a full return of their investments within a maximum 2-year period. Notwithstanding the short capital repayment period, investors will thereafter remain invested in a high-quality solar project that will deliver them attractive yields of up to 20 years.”

A key aspect of the strategy is the use of Government’s attractive Section 12B tax deduction. During the 2023 Budget Speech, the Minister of Finance expanded the Section 12B tax incentive to enable taxpayers to claim up to a 125% up-front tax deduction for all renewable energy projects with no thresholds on generation capacity. The expanded deduction is only available for projects brought into use for the first time between 1 March 2023 and 28 February 2025.

Previously, the use of Section 12B was limited to corporate and institutional renewables investors. Westbrooke’s REAL strategy changes this paradigm by enabling investors to use this deduction against their taxable income calculations while promoting and facilitating investments in alternative renewable energy production in South Africa.

“The timing for the launch of the strategy is opportune, for both investors and solar asset owners alike,” says Saul Maserow, Fund Manager of the Westbrooke Real strategy, “Currently, South Africa’s energy demands far surpass its supply. There is a significant shortfall in the supply of electricity from traditional sources. As an active investor in the space, we aim to offer our solar co-partners more than just equity funding. Westbrooke provides fast, flexible, value-add solutions. Our investment risk philosophy and proven approach to partnering on similar projects allow us to understand inherent complexity and help our partners scale and grow. This has already allowed us to build a strong pipeline with aligned, reputable, high-quality experienced partners within the renewable energy industry.”

Westbrooke seeks to invest in the following:

· Small scale and medium scale embedded generation projects which are either grid tied or in a hybrid system (batteries/generators). This will range from project sizes of 100KW (c. R1 million) up to 10MW (c. R100 million) with the ability to invest in larger products.

· The focus is on commercial, industrial and agricultural solar PV systems.

· Hybrid systems linked to Battery Energy Storage Systems (“BESS”) or tied in with generator power to maintain operation during load-shedding

· Existing and greenfield solar PV projects, with the mandate including equity invested in the development phase of a greenfield project

· Exclusions from the mandate include residential solar projects which don’t qualify for the Section 12B incentive. If the Section 12B incentive is expanded to allow residential systems, these will be included in the mandate at a later stage.

It is anticipated that South Africa’s small-scale solar PV embedded generation capacity will reach a total capacity of 7.5GW by 2035, roughly equating to an investment value of R75 billion, based on an annual growth rate of 300 MW to 500 MW per year or roughly R5 billion.[1] Strategies like Westbrooke REAL will help South Africa get there faster and give both the corporate and private sectors sustainable energy security. At the same time, investors can now harness natural energy for sustainable returns.

If you are interested in partnering with Westbrooke, please visit https://westbrooke.co.za/real/.

[1] Greencape Energy Services: MIR 2022