The surge adds to an already deep backlog of interconnection requests throughout the U.S., despite major slowdowns in CAISO and PJM, two of the largest grid regions. In order to manage its backlog, CAISO did not accept any new requests last year, while PJM won’t review any new requests until at least 2025 as the grid operator wrangles with a litany of procedural issues.

The slowdowns in CAISO and PJM were offset by substantial growth in the non-ISO West, MISO, and ERCOT markets.

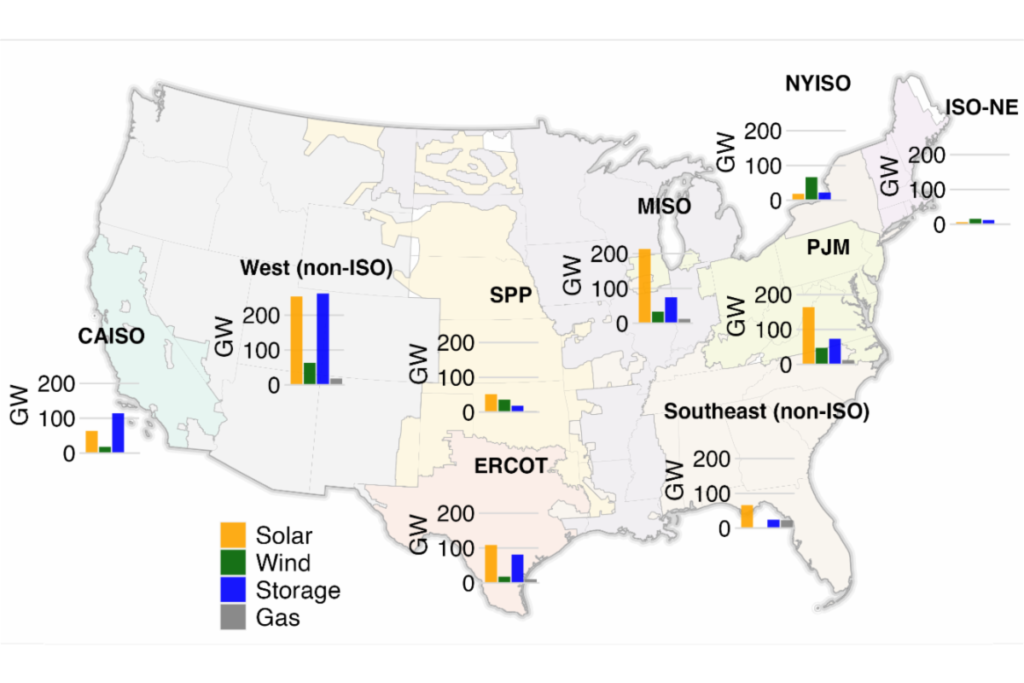

Regional distribution of proposed solar, wind, storage, and gas capacity (Courtesy: LBNL)

Hybrid power plants continue to be of high interest to developers, especially solar paired with storage. At least 456 GW of solar capacity in the queues is proposed as a hybrid plant (48% of all solar in the queues), as is 24 GW of wind (8% of all wind in the queues). An estimated 358 GW of battery capacity is proposed in hybrid configurations with generation, representing 53% of all storage capacity in the queues.

and 81% of the cumulative proposed solar is in a hybrid configuration, respectively.

Based on statistical interconnection trends from 2007-2017, about 20% of projects, or 14% of overall capacity, are expected to be built.