The first quarter of 2023 has continued the trend of land rigs from the latter stages of 2022, with utilisation remaining high in the US and Gulf Cooperation Council (GCC) countries. The GCC in particular has seen strong demand, with an average rig utilisation of over 70 per cent, compared to a global average of ~50 per cent.

Despite the recent announcement of a further production output reduction from those in the Opec+ group, Westwood forecasts GCC utilisation of rigs to grow over the coming years, reaching nearly 80 per cent by 2027, driven by production capacity targets.

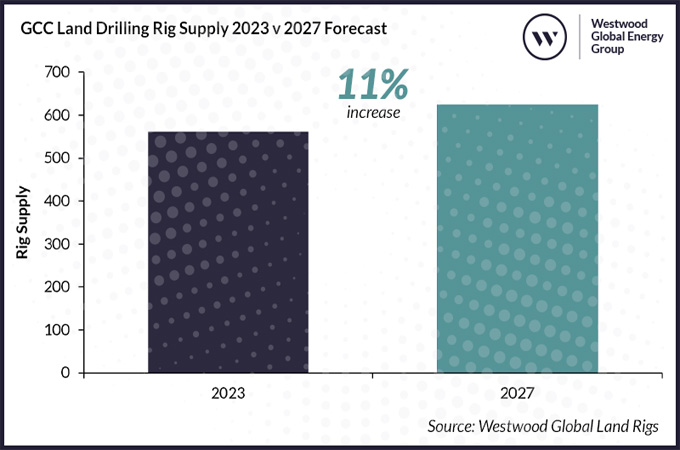

Growing demand in GCC countries is ultimately driving demand for high specification drilling rigs, which is expected to lead to a major uplift in rig supply. Westwood forecasts GCC drilling rig supply to increase by 11 per cent between 2023 and 2027.

Notably, NOCs Aramco and Adnoc have committed to significant rig fleet expansion projects through subsidiaries Saudi Aramco Nabors Drilling (Sanad) and Adnoc Drilling respectively.

Demand for high spec units is a trend expected to follow in a number of other locations, including the two countries with the largest rig fleets globally: China and the US. In the US for example, Tier 1 rigs are said to be almost sold out with attention turning towards upgrading Tier 2 rigs to meet demand.

The onshore industry has been making breakthroughs this quarter, from drilling milestones to key approvals and mergers and acquisitions (M&A) activity.

In February, PetroChina Southwest set the record for drilling Asia’s deepest wildcat after completing drilling of the Pengshen-6 oil well at a depth of 9,026 meter. Since 2011 PetroChina Southwest has drilled eight super deep wells (>8,000m) and two ultra-deep wells (>9,000m) and following this recent record, now has a 10,000m well planned for 2023.

Good news occurred for TotalEnergies with the Ugandan government approving construction of the $3.5 billion East Africa Crude Oil Pipeline (EACOP). The EACOP is expected to complete in 2025 and will connect Uganda’s ~1.4 billion barrels of oil to international markets.

Thus far, China’s CNOOC has started drilling the first well employing its LR8001 drilling rig at the Kingfisher oil field. CNOOC announced the rig will be used to drill a further 31 wells – 20 production wells and 11 water injection wells. These wells will vary in depth from 2,600m to 7,400m, with the field extended ~3,000m into the lake.

Three more rigs to be provided by Chinese contractor ZPEB and operated by TotalEnergies, are set to be deployed in the Tilenga project area to drill a total of 426 production wells. The first of these rigs, ZPEB Rig 1501, arrived in Mombasa on 19 October 2022, and is currently at JBR-5, awaiting assembly.

The remaining two rigs have both been 100 per cent constructed in China by Chinese manufacturer Honghua, with assembly inspection, Factory Acceptance Test (FAT) and endurance tests at 100 per cent and 85 per cent, respectively.

M&A activity this quarter included SLB acquiring Gyrodata Incorporated, a gyroscopic wellbore positioning and survey technology company, in a bid to improve wellbore quality and reduce drilling risks by employing Gyrodata’s wellbore placement and surveying technologies.

KCA Deutag also completed the acquisition of Saipem Onshore Drilling’s Kuwaiti fleet consisting of the 3,000 horse power (HP), 5913 and 5946 rigs, adding to the 33 Middle East and North Africa based rigs transferred back in October 2022.

KCA is expected to finalise its acquisition of Saipem Onshore Drilling’s Latin American business as well as its fleets in Romania and Kazakhstan in 1H 2023.

NEW LICENSING ROUNDS PUT SPOTLIGHT ON UNDEREXPLORED ACREAGE

On March26, 2023, the Omani Ministry of Energy and Minerals (MEM) launched its 2023 Bid Round offering three oil and gas concessions, Block 15, 36 and 54, to international and domestic investors.

The blocks contain a mixture of tested production wells, discoveries and prospects. Bidding is open until 25 June 2023 and MEM has provided an online data room for interested parties.

The Angolan Secretary of State for the Ministry of Mineral Resources announced country plans on offering 12 onshore blocks, CON: 2, 3, 7 and 8 and KON: 1, 2, 7, 10, 13, 14, 15 and 19 in the Kwanza and Congo basins in a bid round scheduled for September 2023.

Angola hosted its debut onshore bid round in 2021 when the state put nine blocks on offer, all of which were awarded to successful bidders. Angola is striving to attract more foreign investors and will thus be carrying out an international promotional roadshow for the onshore blocks in May 2023.

In the Caribbean, Trinidad and Tobago received 16 bids for the 11 onshore and nearshore blocks offered in its 2022 bid round.

The onshore blocks on offer were the Aripero, Buenos Ayres, Charuma, Cipero, Cory D, Cory F, Guayaguayare, Southwest Peninsula, St. Mary and Tulsa.

St. Mary received the most bids with four offers submitted by A&V Oil & Gas, Decker Petroleum, Hunter Resources and Primera Oil & Gas. All 16 bids were from smaller energy companies.

Cory D, Cory F and South-West Peninsula Offshore failed to receive any bids. The round winners will be announced in the coming months.

Through this investment the country is aiming to increase gas production and LNG exports and create sustainability in Trinidad and Tobago’s energy sector.

Following renewed interest in its oil and gas industry due to curtailed hydrocarbon supply from Russia, Kazakhstan’s state-owned oil producer, KazMunayGaz, received approval to gather seismic data in the Bolashak, North Ozen, Zharkyn, Mugadzhary and Berezovsky blocks investing $64 million between 2023 and 2025.

Since the country’s last bid round in 2021, the Kazakh government has sold exploration and development rights for 32 of the 34 prospective blocks it put on offer. Domestic investors dominated the tender making total auction payments of $95 million.

INVESTMENT CONTINUES TO POUR INTO THE MIDDLE EAST

The Middle East, in particular the GCC, has shown consistent investment into key projects over the past year as a number of the member countries strive for production capacity targets, with the UAE and Saudi Arabia being the key drivers of big contract awards.

In February ADNoc Drilling announced plans for a two-year $2.5 billion spending spree on drilling rigs to keep in line with the UAE’s capacity enhancement programme, targeting 5 million barrels per day (mmbbl/d) by 2027. The announcement follows the release of Adnoc’s 2022 financial results, with an additional $1 billion in capex for 2023 and 2024 on top of the original guidance.

Adnoc Drilling expects to increase its combined rig fleet to 142 units by the end of 2024, up from a current fleet of 115 units, of which 74 are onshore drilling rigs.

Adnoc Drilling followed this up on March 3, 2023 announcing it had signed a contract worth $252 million with China Petroleum Technology and Development Corporation for the provision of 10 newbuild 1,500 HP fast desert moving hybrid power land rigs, with the first to be delivered in 4Q 2023.

Additionally, the company will lease four land rigs for onshore drilling projects, meaning 14 rigs in total will be added to the Adnoc Drilling onshore fleet.

Aramco continued pushing for its 13 mmbbl/d production capacity target, signing a long-term well testing agreement with NESR. This will allow the company to apply NESR’s advanced well testing technology on various applications and expand its well testing services. This follows on from a nine-year wireline services platform contract awarded to NESR on 10 January 2023.

As Saudi Arabia pushes to reach its production capacity target, Westwood forecasts that rig utilisation in the Kingdom will reach almost 100 per cent by the mid-2020s, despite the addition of ~50 onshore drilling rigs to the Saudi fleet over the next five years.

Rigs are expected to be added by contractors such as Sanad and Arabian Drilling as well as some international contractors within the region.

Sanad is currently in the process of having 50, 1,500+ HP rigs added to its fleet with the units being manufactured by Aramco’s joint venture (JV) with NOV, Arabian Rig Manufacturing (ARM).

In Oman, Shell’s subsidiary, Shell Integrated Gas Oman BV, started production from the Mabrouk Northeast field in Block 10, with production expected to reach 0.5 billion cubic feet per day (bcf/d) by mid-2024.

While in Kuwait, Kuwait Oil Company (KOC) awarded a $77.5 million contract to an unidentified contractor for the construction of pipelines at the Um Niqa and South Ratqa oilfields.

Elsewhere in the Middle East, Iraqi state-owned company Thi-Qar Oil approved Lukoil’s development proposal for the onshore Eridu oilfield in Block 10. The plan was submitted in November 2021 and indicated its intent to target a plateau production of 250,000 barrels of oil per day (bopd).

Lukoil holds a 60 per cent working interest in the 5,800 square kilometer block with Inpex holding the remaining 40 per cent under a service contract for exploration and production. Since 2017, Lukoil has drilled nine wells in this asset and estimates that 12.9 billion barrels are in place.

NEW DEALS DRIVEN BY THE ENERGY TRANSITION

In a move aimed at accelerating its shift towards carbon neutrality, Adnoc Drilling and Masdar, signed a five-year memorandum of understanding for geothermal drilling. This deal will see the companies evaluate Adnoc Drilling’s potential to provide geothermal drilling services. Adnoc Drilling will also provide advisory and technical support services to Masdar as it takes on geothermal energy projects globally.

In Europe, Wein Energie and OMV announced they are to create a JV to develop geothermal energy in the Vienna basin, Austria. The two companies have already cooperated in the exploration, planning and measurement of the geothermal potential of the eastern Vienna Basin.

Further exploration of the Vienna Basin and exploitation of the existing potential will allow deep geothermal plants to be developed. Wien Energie already operates numerous heat generation plants in Europe and plans to make district heating generation carbon-neutral by 2040. OMV will provide experience in the fields of geology and geophysics as well as drilling and production technology.

In the CCS space, Adnoc commenced its pilot carbon capture drilling campaign in Fujairah in partnership with Masdar, Fujairah Natural Resources Corporation and 44.01, an Omani environmental company.

This project will inject a mixture of carbon dioxide and seawater into peridotite rock formations underground and the company will deploy a direct air capture unit to extract carbon dioxide and install solar panels to power the project in the coming weeks.

This is aligned with the company’s plans to increase its CCS capacity to 5 million tonnes by 2030 after committing $15 billion to reducing its carbon footprint across its operations. This project will be the region’s first carbon-negative project.--OGN