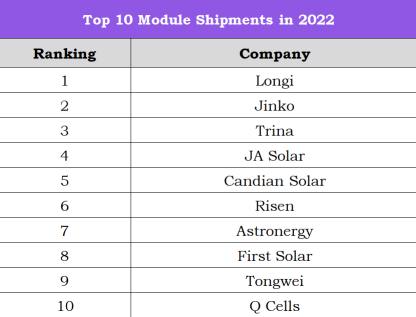

Industry consultancy InfoLink recently has released their rankings of top 10 module shipments in the world in 2022, revealing a more fierce competition among manufacturers.

Top 10 module shipments in the world in 2022

The trend in the module segment highlights the clear division between manufacturers, with the top five manufacturers being similar to last year, while the ranking of the other five shows a significant shift.

The top five shipment manufacturers in 2022 are Longi, Jinko Solar, Trina Solar, JA Solar, and Canadian Solar. Although Longi declined to third place in H1 2022, it caught up in the second half with quarterly shipment of 12-15 GW, maintaining its first place for three consecutive years, with a year-on-year growth rate of about 26%, which is the smallest among the top four manufacturers. Jinko Solar once returned to the top in H1, however, it missed the crown by a margin of 1-2 GW, while the shipments significantly increased by 109% compared to 2021.

With the support of domestic and foreign channel sales, Trina Solar has achieved stable growth with an annual growth rate of about 74%, and its shipments have remained stable in the top three. JA Solar claimed the fourth for its stable layout, cost control, and overseas channel operation, which led to stable growth in shipments, with an annual growth rate of about 67%,

The rest of top 10 are Canadian Solar, Risen Energy, Astronergy, First Solar, Tongwei Solar and Q Cells. Among them, the first three have a shipment volume of approximately 10 GW or more, while about 8-10 GW or less for the 8th to 10th.

First Solar has steadily ranked eighth due to its growth in the US market and an increase of approximately 18% in shipment volume. However, the ranking of Q Cells has been declining for three consecutive years, and the progress of expansion projects this year still needs to be monitored.

Notably, during the fierce competition, Tongwei Solar has made a stunning appearance and made to the list of modules.

The manufacturers behind the list, such as Das Solar, Suntech, Huansheng, etc., also saw their overall shipment climb to 7-8 GW in 2022, only a gap of about 0.3-1.8 GW compared to the 10th ranked manufacturer, and they all have very positive shipment targets in 2023.

The trend of intense competition among module manufacturers began to take place at the end of 2022, and this year, they will face more severe competitive challenges.

Seen from the list, the proportion of M10 (182mm) and G12 (210mm) of the top 10 (excluding First Solar) is about 81%, with M10 accounting for the majority and G12 covers about 26%. M6 (166mm) and other specifications are about 14%.

The top four manufacturers’ shipping targets are around 60 GW or even as high as 90 GW, with a planned total of approximately 265-290 GW. Among them, the proportion of new technology product shipping plans is about 30-35%, with TOPCon planning as the bulk.

The shipping target of intermediate manufacturers is about 20-40 GW, and the subsequent ranking manufacturers plan to be around 10-20 GW. The gap between module stages has increased, and this year, under the pressure of surplus and technological transformation, the competition in the second tier will become more intense.