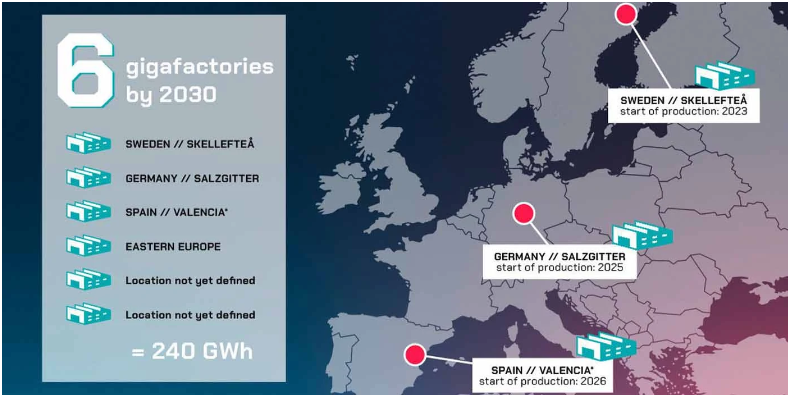

While it was still under the tutelage of ousted CEO Herbert Diess, Volkswagen Group publicly outlined plans for six new battery gigafactories throughout Europe this decade, including a site in Skellefteå, Sweden, through a joint venture with NorthVolt scheduled to open this year.

This past February, VW Group announced that its Seat sub-brand would be revamping its production facilities in Spain to include a new battery facility for other group EVs as well. With three battery plants under construction and four more planned, Volkswagen Group suddenly paused development to await the EU’s response to the US Inflation Reduction Act.

Volkswagen Group then turned its battery production focus to North America. This past December, new CEO Oliver Blume called Canada “one logical option.” By March, however, the US appeared to be the clear target for the Group as it shared it was anticipating claiming between $9.5-$10.5 billion in subsidies and loans from the Inflation Reduction Act (IRA) over the lifetime of its pending battery plant.

As a free trade partner with the US looking to stay relevant in a booming EV production landscape, Canada said, “Sorry, not so fast.” Canada’s industry minister was able to negotiate a deal with Volkswagen that matches those US subsidies in exchange for building the battery factory a bit further north.

Volkswagen battery deal helps Canada keep pace with IRA

In order to lure Volkswagen Group to Canada, the government has agreed to subsidies that could top CAD 13 billion ($9.7 billion) over the course of the next decade that the battery plant is in operation. When complete, the new facility will be operated under Volkswagen Group’s PowerCo business unit and could very well become the largest manufacturing site in the entire country.

Prime Minister Trudeau’s industry minister François-Philippe Champagne negotiated the landmark contract, which will not only provide annual production subsidies to Volkswagen but also includes a CAD 700 million ($517M) grant toward the battery factory’s capital cost.

According to government officials, these negotiated terms match what VW would have received in subsidies from the US government should it have chosen the states as its new home. What’s more clever is that the negotiated deal is proportional to the Inflation Reduction Act. If the US subsidies go away, so do Volkswagen’s in Canada. If they are reduced, Canada’s will too.

Despite losing the bid, the US is still home to ID.4 production at its Chattanooga, Tennessee, plant, which will soon be joined by a new production facility to build upcoming Scout brand EVs in South Carolina.

As a North American country and free trade partner with the US, battery packs assembled in Canada should still enable some level of federal tax credits on future Volkswagen EVs in the US under new terms outlined in the Inflation Reduction Act, including fresh battery guidance detailed by the US Department of Treasury earlier this month.

While not everyone in Canada is elated by the eleven-figure financial commitment to Volkswagen, the industry minister argues the economic value the automaker brings to the country and its supply chain is worth far more than the subsidies. Champagne and his colleagues believe that to protect Canada’s position in automotive production, especially as it goes all-electric, the country must transcend the role as a mere source of critical minerals and become a genuine contributor to advanced EV manufacturing and zero emissions technology.

Being about two hours northeast of an automotive mecca like Detroit should help, as that’s where Volkswagen’s Canadian facility is being planned. It’s expected to have a footprint equivalent to 350 football fields and will create thousands of jobs in Ontario. Champagne stated that over the next 30 years, the Volkswagen battery plant is expected to generate over CAD 200 billion in value for Canada. If true, this deal could end up being worth tenfold in the long term.