The looming battle over the U.S. debt ceiling could result in the repeal of the sustainable aviation fuel (SAF), clean fuels, clean hydrogen and renewable diesel/biodiesel tax credits, along with the scaling back of the 45Q tax credit for carbon capture and storage (CCS).

The U.S. hit its debt ceiling in January, spurring the U.S. Department of Treasury to begin taking extraordinary measures to prevent default. Those measures, to date, have allowed the government to keep paying its bills on time. Without congressional action to raise the debt ceiling, the U.S. is expected to hit its spending limit this summer, with some estimates indicating that could happen as soon as mid-June. If that spending limit it hit, the U.S. could default on its debt for the first time in its history, which economists say would be devastating to the economy.

The debt ceiling, enacted by congress, sets a limit on the amount of national debt that can be incurred by the U.S. Treasury. It was first implemented during World War I. According to the Department of Treasury, Congress has acted 78 times since 1960 to permanently raise, temporarily raise, or revise the debt limit—49 times under Republican presidents and 29 times under Democratic presidents. Until recent years, these votes were considered fairly routine, but have since become a partisan battleground.

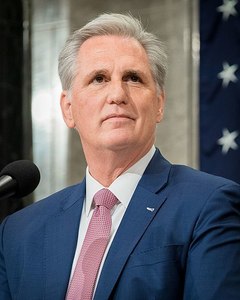

Speaker of the House Kevin McCarthy on April 19 released the House GOP’s plan to address the debt ceiling, the Limit, Save and Grow Act of 2023. The bill spans more than 300 pages and aims to repeal several tax credits that are important to the U.S. biofuels industry.

Specifically, the bill would repeal the SAF tax credit created by the Inflation Reduction Act, which was signed by President Joe Biden in August 2022. That credit supports the sale and use of SAF, starting at $1.25 per gallon for SAF that achieves a 50 percent greenhouse gas (GHG) reduction when compared to a baseline fossil fuel. An additional 1 cent per gallon is available for each percentage point by which the lifecycle GHG emission reduction of the fuel exceeds 50 percent. The tax credit is capped at $1.75 per gallon.

McCarthy’s bill also aims to repeal the IRA’s Clean Fuel Production Tax Credit. That technology-neutral tax credit aims to support the production of low-emissions transportation fuel and would apply to transportation fuel produced and sold in 2025, 2026 and 2027. To qualify, the fuel would have to achieve a GHG reduction of approximately 40 percent when compared to diesel.

In addition, the Limit, Save and Grow Act of 2023 would repeal the IRA’s newly established Section 45V production tax credit (PTC) for clean hydrogen. The credit currently applies to clean hydrogen produced at qualified facilities that begin construction before the end of 2032. The credit applies to hydrogen produced after the end of 2022. Depending on the specific project, the credit could range from 12 cents per kilogram to $3 per kilogram.

McCarthy’s bill also repeals several tax credits that were in existence before the IRA, including the biodiesel and renewable diesel tax credit. That credit was extended through the end of 2024 by the IRA, but would sunset at the end of 2022 under McCarthy’s plan. His bill would implement similar sunsets for the alternative fuel mixture credit, incentives for second generation biofuel, and the alternative fuel refueling property credit.

The Limit, Save and Grow Act of 2023 would not eliminate the 45Q tax credit for CCS, but it would roll back many of the improvements and expansions to the credit implemented by the IRA.

Repeal of these biofuel-related tax credits would likely impede the growth of the U.S. biofuels industry. “With stable, forward-looking tax policy, the biodiesel and renewable diesel industry has made tremendous investments to meet growing demand for cleaner, better fuels,” said Kurt Kovarik, vice president of federal affairs at Clean Fuels Alliance America. “If enacted, the proposal would undermine producers who are making those investments and create unwanted uncertainty.”