The Faraday Institution has published a report analyzing how hydrogen and battery technologies are likely to be used in different sectors within the UK, including transportation, manufacturing, the built environment, and power sectors, to 2050. Both are anticipated to play an increasingly vital role as the UK transitions to a low-carbon future to address critical concerns of climate change and energy security.

Professor Pam Thomas, Chief Executive Officer, Faraday Institution said, "Batteries and hydrogen have distinct characteristics and should largely be viewed as complementary rather than competing technologies. Both will require significant technological advance and extensive scale up of manufacturing and deployment if the UK is to meet its obligation to reach net zero by 2050. The varying timescales of their rollout leads to considerable uncertainties in predicted market share profiles over time."

The report was commissioned by the Faraday Institution and authored by DNV. The sector analysis draws on DNV's knowledge and experience within both the battery and hydrogen industries. The analysis uses DNV's Energy Transition Outlook model, an integrated system-dynamics simulation model covering the energy system that provides an independent view of the energy outlook from now until 2050. The modeling includes data on costs, demand, supply, policy, population and economic indicators.

Hari Vamadevan, Executive Vice President, and Regional Director UK & Ireland of Energy Systems at DNV, said, "As we strive to decarbonize and meet net zero ambitions, the energy landscape will be evolving at a faster pace, with batteries and hydrogen being key contributors to this transition. We are delighted to showcase DNV's unique combination of industry expertise and independent analysis from our Energy Transition Outlook model to forecast the role that each technology will play across the energy demand sectors."

Uncertainties

Long-term forecasting is not an exact science, and considerable uncertainties remain in the relative adoption of hydrogen and battery technologies by sector. In particular, the policy environment remains uncertain and prone to change. The report therefore provides one forecast of the likely path of technological development. The results of DNV's model are based upon current government policy positions and the authors do not speculate on how unstated policy changes in the future may change the model's results.

Both hydrogen and battery technologies need technology advancements, supportive business models, considerable scale up and supply chain development before they can deliver the capacities needed over the time horizon modeled. The uptake of the two technologies in each market sector will depend on the rate of technology development, infrastructure development, capital costs, total cost of ownership, customer perceptions and other policy factors.

The role of hydrogen and batteries in delivering net zero in the UK by 2050

Battery and hydrogen technologies:

are both essential for the UK to achieve Net Zero by 2050.

enable the maximum utilization of renewable energy and provide sustainable, reliable, and affordable energy sources for society.

have distinct characteristics and benefits and should largely be viewed as complementary rather than competing technologies.

Expected energy use of battery systems

The primary use of battery technology is focused on road transport, accounting for 88% of all battery usage split across passenger and commercial vehicles by 2050.

Other important sectors include the power generation and electricity grid sector (for stationary storage and load balancing) as well as aviation.

Energy throughput of battery systems is forecasted to reach 130 TWh/year by 2050.

Expected energy use of hydrogen and hydrogen derived fuels

Hydrogen use is spread across multiple sectors, with aviation, maritime and manufacturing accounting for 79% of all hydrogen use by 2050.

The hydrogen economy is not currently as well developed as the battery economy, becoming increasingly important from 2030 reaching an energy throughput of 105 TWh / year by 2050.

Battery technology dominates road transport while aviation starts to embrace hydrogen from 2040

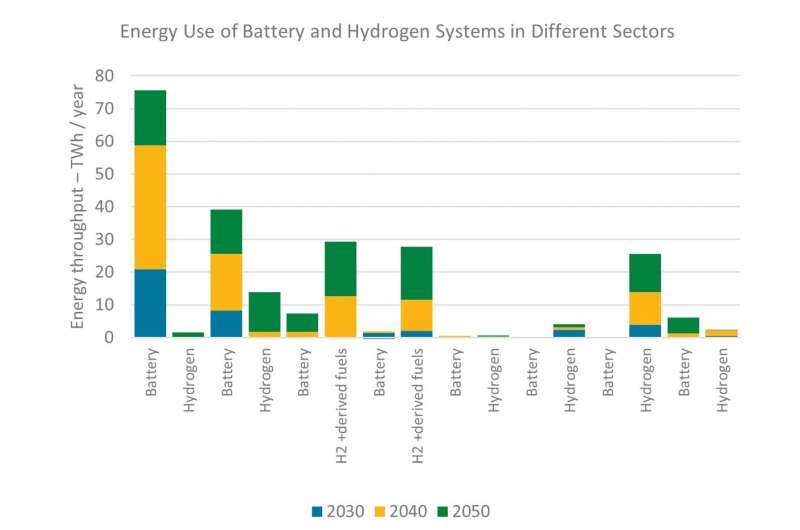

Energy use of battery and hydrogen systems in different sectors

Battery technology will be particularly important across road transport and the power sector, with battery technology already being deployed in the 2020s.

Hydrogen technology will dominate the manufacturing and built environment sectors, while remaining important in the aviation and marine sectors through the production of hydrogen derived fuels. However, significant deployment is not expected until beyond 2030.

Number of UK road vehicles by engine type

Battery technology will dominate road transportation, with over 40 million battery EVs expected on the road by 2050.

Advantages of batteries over hydrogen include higher well-to-wheel efficiencies, lower costs and a more deployable charging infrastructure.

However, hydrogen powered heavy goods vehicles may be viable for high range / high payload applications.

UK aviation energy demand by energy carrier

The direction of low carbon aviation is associated with higher uncertainty than other sectors. A mix of different technologies is likely to be used including hydrogen, batteries, biofuels and synthetic aviation fuels.

Batteries will be focused on eVTOL (electric vertical take-off and landing) and for short-haul flights, with 30% of person trips undertaken by battery-electric aircraft by 2050.

Hydrogen will be used, either directly (7% of energy demand in 2050) or to produce efuels (19% of energy demand in 2050) for medium / long distance flights.

However, the costs of synthetic aviation fuel production must be reduced to displace kerosene.

Battery and hydrogen technology both have niche uses in the maritime, rail and built environment sectors

UK maritime energy demand by energy carrier

Battery powered vessels over short distances are considered viable. This is a small market accounting for 2.5% of energy demand by 2050.

The use of hydrogen in maritime is expected to be constrained to the production of alternative fuels (e.g., ammonia, efuels) accounting for 50% of energy demand by 2050.

UK rail energy demand by energy carrier

Direct electrification of rail lines can be achieved relatively easily, and will continue to expand towards 2050.

Where lines are difficult to electrify, rail will require both hydrogen and battery solutions. The technology used is expected to be driven by route specific requirements and local infrastructure.

Direct rail line electrification will account for 89% of energy demand by 2050.

UK built environment energy demand by energy carrier

The built environment refers to energy use in residential and commercial buildings.

Low-carbon hydrogen could play a key role in decarbonising energy for hard to abate sectors such as heating within the built environment.

Fuel switching to low-carbon hydrogen is one option for reducing emissions from domestic heat, which is currently responsible for some 14% of UK GHG emissions.

Hydrogen plays a key part in manufacturing while batteries provide storage and flexibility for the grid

UK energy demand by carrier for manufacturing industry

Electrification of industrial process is expected to be achieved without widespread use of batteries.

Industrial processes requiring high temperatures cannot be electrified due to the high energy demand.

Direct use of hydrogen in manufacturing will account for 11% of energy demand by 2050, replacing coal in the steel industry and natural gas to provide heat.

Energy storage capacity for different storage technologies

The overlap between batteries and hydrogen is expected to be limited in the power sector, with the technologies complementing each other.

Batteries will take a dominant share of the short duration energy storage requirements. Vehicle-to-grid technology has the potential to provide 445 GWh of storage capacity by 2050.

Hydrogenwill be used to balance demand over a longer seasonal period.