Neste Corp. released first quarter financial results on April 28, reporting the company’s renewable products segment benefitted from robust demand for renewable diesel and favorable feedstock pricing during the three-month period.

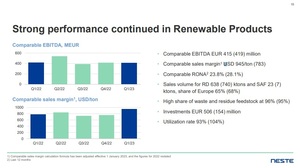

According to Neste President and CEO Matti Lehmus, the renewable products segment posted a strong comparable EBITDA for EUR 415 million, compared to EUR 419 million during the same period of 2022. Strong renewable diesel demand and favorable feedstock pricing helped the segment achieve a record-high comparable sales

margin of $945 per ton, Lehmus said. Comparable sales margin was at $783 per ton during the first quarter of 2022. “This achievement was supported by the flexibility of our global optimization model and taking full advantage of the feedstock market opportunities,” he added.

Sales volumes for renewable diesel and sustainable aviation fuel (SAF) fell to 660,000 tons, impacted by a fire at the Rotterdam refinery in December 2022. During the first quarter, approximately 65 percent of renewable diesel and SAF volumes were sold into the European Market, with 35 percent sold into North American Markets, compared to 68 percent and 32 percent, respectively, during the same period of last year.

Neste’s renewable diesel production facilities had an average utilization rate of 93 percent during the first quarter, down from 104 percent during the same quarter of 2022. The portion of waste and residue inputs was 96 percent, up slightly from 95 percent during the first quarter of 2022.

Moving into the second quarter of 2023, Neste expects renewable diesel and SAF sales volumes to be up 30 to 50 percent when compared to the first quarter of the year, subject to the ramp-up pace of the capacity expansion in Singapore and Neste’s joint venture with Marathon in Martinez, California. According to Neste, the Martinez project began startup activities in February, while the expanded Singapore facility started up production in mid-April. Together, the projects are expected to increase Neste’s renewable products capacity to 5.5 million tons by the end of the year. The company is also increasing SAF production capacities in Singapore and Rotterdam, targeting the optionality to produce up to 1.5 million metric tons of SAF in 2024. The Rotterdam expansion project is expected to increase renewable products nameplate capacity to 6.8 million metric tons by the end of 2026, with SAF optionality at 2.2 million metric tons.