An “unprecedented ramp-up of production capacity” over the next two decades is needed to provide enough solar power to completely decarbonize the global electrical system, but that goal can be achieved, according to an analysis led by researchers at the National Renewable Energy Laboratory (NREL).

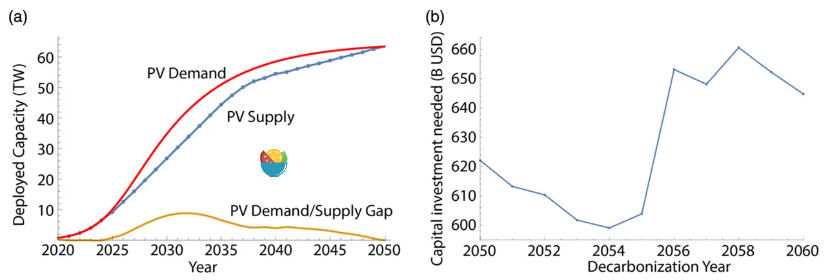

An “unprecedented ramp-up of production capacity” over the next two decades is needed to provide enough solar power to completely decarbonize the global electrical system, but that goal can be achieved, according to an analysis led by researchers at the National Renewable Energy Laboratory (NREL).The target is 63.4 terawatts of installed nameplate capacity of photovoltaics (PV) needed in the decade between 2050 and 2060. That is a 60-fold increase in the amount of installed PV worldwide today.

Jao van de Lagemaat, director of the Chemistry and Nanoscience Center at the U.S. Department of Energy’s NREL, said a “relatively modest demand” in additional PV will be needed even after global decarbonization is reached to keep up with module retirement and population growth. This leads to an expected shock to the manufacturing industry where “suddenly much less manufacturing capacity is needed after decarbonization is achieved.”

The findings are contained in the paper, “Photovoltaic Deployment Scenarios Toward Global Decarbonization: Role of Disruptive Technologies,” which appears in the journal Solar RRL. In addition to van de Lagemaat, the other authors are Michael Woodhouse from NREL and Billy Stanbery from Colorado School of Mines.

The analysis is intended to capture the scale and temporal dynamics of the financing needed to build the manufacturing capacity to produce enough PV modules. Among the assumptions the researchers made is that after the decarbonization goal is reached, manufacturers will be reluctant to build new factories because of the drop in demand trajectories for PV modules. The factories are assumed to have a 15-year lifetime, so new ones will only be built if they are projected to sustain full output throughout their useful lifetime.

The analysis also assumes the lifespan of a PV module will increase considerably, which further exacerbates the shock to solar manufacturing because it will take longer before replacement will be needed. Researchers have been experimenting with extending the longevity of these modules from an average of 30 years in 2020 to 50 years by 2040.

To reach the decarbonization target, manufacturers will need to scale up production capacity to reach 2.9–3.7 terawatts a year within 10–15 years, a goal that will cost from $600 billion to $660 billion. The analysis shows that these goals can be reached using existing technology and using expected further cost reductions in the mature technologies that use silicon and cadmium telluride.

Disruptive solar technologies — highly efficient alternatives to the mature technologies — are going to help further lower the cost of the transition. Those technologies, such as perovskites and tandem photovoltaics that combine existing solar technologies and disruptive ones in a single much-higher-efficiency package, are forecast to be deployed at about a terawatt annually and could potentially be cheaper to manufacture than silicon PV on a per-watt basis but must be proven in the marketplace first.

In the case that these disruptive technologies can be realized, the researchers noted, cost savings for manufacturers amounting to hundreds of billions of dollars can be realized, leading to a more sustainable solar manufacturing industry.

Disruptive technologies will have an overall manufacturing market opportunity between $1 trillion and $2 trillion even if the total amount of PV installed is substantially less than 63.4 terawatts, according to the analysis, with the rest generated by other sources of renewable or carbon-free energy such as wind and nuclear.

“There are economically viable trajectories that get to the needed manufacturing capacity to produce the amount of PV needed to completely decarbonize the world’s energy economy,” van de Lagemaat said. “Emerging technologies could potentially lower the cost of this deployment significantly if they get commercialized in time.”

NREL’s internal Laboratory Directed Research and Development program funded the research.