Rising exports from the region will have a 'game-changing' effect on global gas markets, consultancy says

In February, Adnoc delivered the first LNG cargo from the Middle East to Brunsbuttel Port in Germany. Photo: Adnoc

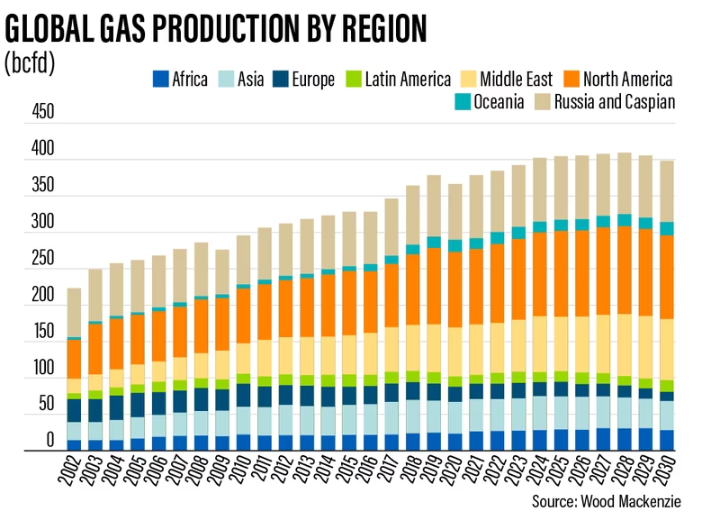

The Middle East is expected to spend up to $120 billion to boost natural gas production by more than 19 per cent by 2030, according to energy consultancy Wood Mackenzie.

The region’s natural gas output will rise to 86 billion standard cubic feet a day by the end of the decade, from 72 bcfd currently,it said in a report on Friday.

“The Middle East can be part of the solution for the global gas markets as the region continues to ramp up production from its gigantic gas reserves,” said Alexandre Araman, principal analyst for Middle East Upstream at Wood Mackenzie.

“To fulfil the level of production growth that we have predicted, investments in non-associated gas projects are set to reach a record $25 billion this year and a cumulative total of $120 billion by the end of the decade.”

Exports of liquefied natural gas surged last year, particularly from the Gulf region, as European countries scrambled to secure alternative sources of energy.

Around half of the 14 bcfd increase will be exported, having a “game-changing” effect on global gas markets, Wood Mackenzie said.

The remaining half will meet rising domestic demand.

Wood Mackenzie estimates that Qatar's LNG exports will reach 126 million tonnes per annum by 2030, while Abu Dhabi's new LNG facility will enable exports of 15.4 mtpa starting in 2028.

On Tuesday, Adnoc said its planned low-carbon LNG project will move forward in Al Ruwais Industrial City in Abu Dhabi.

Adnoc Gas, a unit of Adnoc, has access to 95 per cent of the UAE's natural gas reserves, estimated to be the world's seventh largest. It also supplies more than 60 per cent of the country's gas needs.

In February, the state-owned energy company and Germany's RWE announced the delivery of the first LNG shipment from the UAE to Germany.

Last year, QatarEnergy signed two sales and purchase agreements with ConocoPhillips to deliver up to 2 million mtpa of LNG to Germany.

Increased gas production in the Middle East can match Europe's power sector gas consumption and help energy companies in addressing sustainability, security, and affordability challenges, Wood Mackenzie said.

For international companies, gas projects in the region present attractive opportunities, the report said.

Natural gas, which accounts for about 35 per cent of their Middle East production mix, generates more than 70 per cent of the value, the report found.

A steep decline in natural gas prices and higher storage levels have eased the pressure on global gas markets this year, the International Energy Agency said in a report this week.

Global LNG trade reached a high of $450 billion in 2022 amid a surge in European demand as the region reduced its reliance on Russian gas imports, the energy agency said in a February report.

Despite a rise in demand, LNG supply grew only 5.5 per cent last year, mostly due to maintenance at large export terminals and as Freeport LNG’s Texas-based plant — one of the world’s largest export centres of the supercooled fuel — was shut down after a fire in June 2022.