The global large synchronous motor market is anticipated at US$ 6.5 billion in 2022. The sector is gaining pace as companies provide technologically improved large synchronous motors with high-power and high-speed compressors. The market is estimated to garner US$ 11.4 billion in 2033, recording a CAGR of 5.5% from 2023 to 2033. The market is likely to secure US$ 6.7 billion in 2023.

Key Factors Shaping the Demand Outlook of the Silicon Anode Battery Industry:

· Increasing demand for large synchronous motors in developing nations like India & China

· Increasing demand for water treatment projects globally

· The rapidly growing chemical & petrochemical industry

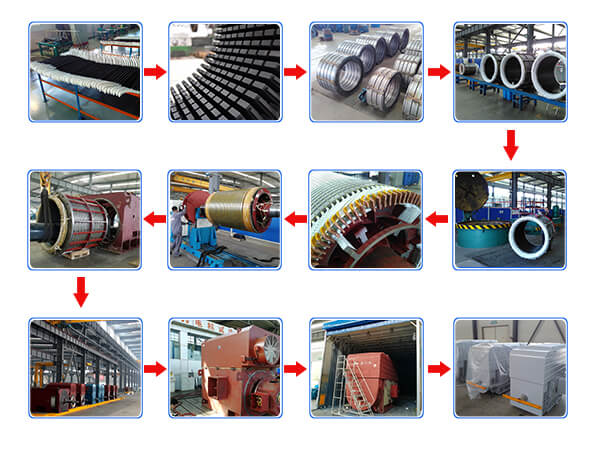

· Advancements in technology, particularly in the design and manufacture of large synchronous motors.

Opportunities in the Silicon Anode Battery Industry:

· Growing demand for large synchronous motors in the automotive sector

· Opportunities for research and development to improve efficiency and affordability

· Increased use of cost-effective manufacturing techniques and advanced raw material

· Advances end-use industries

· Increased demand for energy-efficient storage systems in different industry vertical

Large Synchronous Motor Market Revenue Analysis from 2018 to 2022 Vs Market Outlook for 2023 to 2033

The large synchronous motor market has witnessed substantial growth in recent years. The growth is projected to continue over the next few years owing to the increasing use of synchronous motors in water treatment projects and various industries across the globe.

These motors are used in various applications including compressors, lowers, and others. Considering this the need for a water treatment plant and other activities will create scope for application encouraging growth in coming years. Technological advances in manufacturing drive the demand for large synchronous motors globally.

The market is likely to gain significantly from the upcoming projects in mining, power generation, and other industries. Demand for high-capacity power plants, desalination plants, and other industrial plants will fuel the demand for large synchronous motors.

Some of the leading large synchronous motor manufacturers have already started the customization of motors in the market. According to Future Market Insights, the global market value is estimated to reach US$ 11.4 billion by 2033.

Which Drivers Underpin Large Synchronous Motor Industry Expansion?

Increased Application in Oil & Gas Industry to Drive the Market Growth

The market is expected to witness significant growth during the forecast period owing to the high demand for low energy consumption is met by a large synchronous motor. The large synchronous motor has high precision at a constant speed. Thus large synchronous motors are widely used in the industrial sector.

The exponential boost in demand for highly efficient machine control motors is the key factor encouraging the market growth for large synchronous motors globally. The large synchronous motors are used in various industries for different applications like mining, and water treatment, separation unit & other.

Increasing research & development activities by manufacturers boost the market sales

The leading manufacturers are investing in research & development activities involving large synchronous motors, especially on the size of the large synchronous motors segment. Competitive price offerings, increased end-user satisfaction, and the use of advanced technologies are the result of research development activities.

The increasing demand for energy-efficient and low-power consumption systems across various industry verticals has significantly driven the need for the invention of new models. Technological innovation & entry of new innovative designs have paved the way for different large synchronous motors with high power density & swift acceleration.

Which factors may Hinder the Applications of Large Synchronous Motors?

High Installation Cost May Impede the Sales of Large Synchronous Motors Market

Various regulations and government policies imposed on industries are expected to impact the production, installation, and usage of large synchronous motors.

The maintenance of large synchronous motors is one of the challenges faced by industries. The Complex installation process and high cost may also hinder the market growth during the forecast period.

Country-wise Insights

Why is the Demand Rising in the United States Large Synchronous Motor Market?

The Growing Mining Industry in The Region Drives the Growth of the Large Synchronous Motor Market in the United States

The global large source synchronous market is expected to be dominated by North America. The market is anticipated to expand at a CAGR of 5.2% over the forecast period.

The United States is home to a thriving mining industry, which presents a conducive environment for the sales of large synchronous motors. Besides this, the consistently rising investment in wastewater treatment projects will continue to support the expansion of the market.

Who are the Leading Players in the Large Synchronous Motors Market?

Prominent players in the large synchronous motors market are ABB, General Electric, WEG, Siemens AG, VEM Group, and Hyundai Electric & Energy System Co Ltd, among others. Leading players operating in the global large synchronous motor market are focusing on intensive research and development for launching innovative products and services in the market.

Product innovation is the key strategy adopted by market players. Brand consciousness and aggressive marketing by top players however make it challenging for new entrants in this market. The market players are also emphasizing offering large synchronous motors with high reliability and high performance. The market is benefiting from partnerships with a high focus on innovation.

Toshiba and Mitsubishi-Electric Industrial Systems Corporation announced that they have developed an electrical motor-design support system incorporating Mitsubishi Electric's Maisart® AI technology to dramatically shorten the time required to produce electrical motor designs that achieve the same performance as conventional design methods deployed manually by skilled engineers.

Siemens smart infrastructure added four new devices to its portfolio of Simatic ET 200 SP motor starters, which are used to start electric drivers with power output from 0.1 to 0.4 amperes