All five innovation projects selected in Scotland’s INTOG (Innovation and Targeted Oil & Gas) leasing round have now signed exclusivity agreements with Crown Estate Scotland, which allows the developers to start offshore wind development work while Marine Scotland’s planning process for the INTOG Sectoral Marine Plan (INTOG SMP) is completed.

The INTOG leasing round has three key stages: Exclusivity, Option, and Lease.

If a successful proposed project is in the final INTOG SMP, an option agreement will be offered. This will help enable projects to continue through the planning, consenting, and financing stages. Projects will only progress to a full seabed lease once all these various development stages have been completed, according to Crown Estate Scotland, which is only in charge of the seabed leasing within this process.

As reported in March, Crown Estate Scotland selected 13 applications with a combined capacity of around 5.5 GW in the INTOG leasing round, the world’s first designed to enable offshore wind energy to directly supply offshore oil and gas platforms. Of these, five are small-scale (IN) innovative projects and eight are proposed to be supplying renewable electricity directly to oil and gas infrastructure (TOG).

TOG projects are expected to sign their exclusivity agreements later this year.

The five innovation offshore wind projects, which have a proposed capacity of up to a total of 499 MW, include two 99.5 MW floating offshore wind farms proposed by the BlueFloat Energy and Renantis partnership, Simply Blue Energy’s 100 MW Salamander floating wind farm (in partnership with Subsea 7 and Ørsted), a 50 MW project by BP, and a 100 MW project by ESB.

Each of the five innovation projects has a main field in which innovation is planned to be implemented.

Of the two BlueFloat Energy and Renantis’s floating wind farms, one is dedicated to commercialisation and the other to the supply chain. The latter is also the focus of the Salamander floating wind project.

BP proposes to use its 50 MW offshore wind projects to develop new markets, while ESB is focusing on cost reduction.

Option agreements are expected to be offered next year. To secure an option agreement, developers must provide a Supply Chain Development Statement (SCDS). Information from these statements will be published once option agreements are in place.

Crown Estate Scotland will offer a seabed lease of 25 years for IN projects and 50 years for TOG projects

The analysis, completed with Fraunhofer Institute for Wind Energy Systems (IWES) and ProPlanEn, was conducted via three work packages.

The plausibility and consistency checks of the short-term (one year) measurement data, that was acquired in the framework of another project, were followed by corrections for the influence of neighbouring wind farms on the wind field and the establishment of long-term relations to the historic long-term data.

Finally, a spatial wind field analysis was conducted, with detailed reporting on statistical evaluation and description of the meteorological conditions.

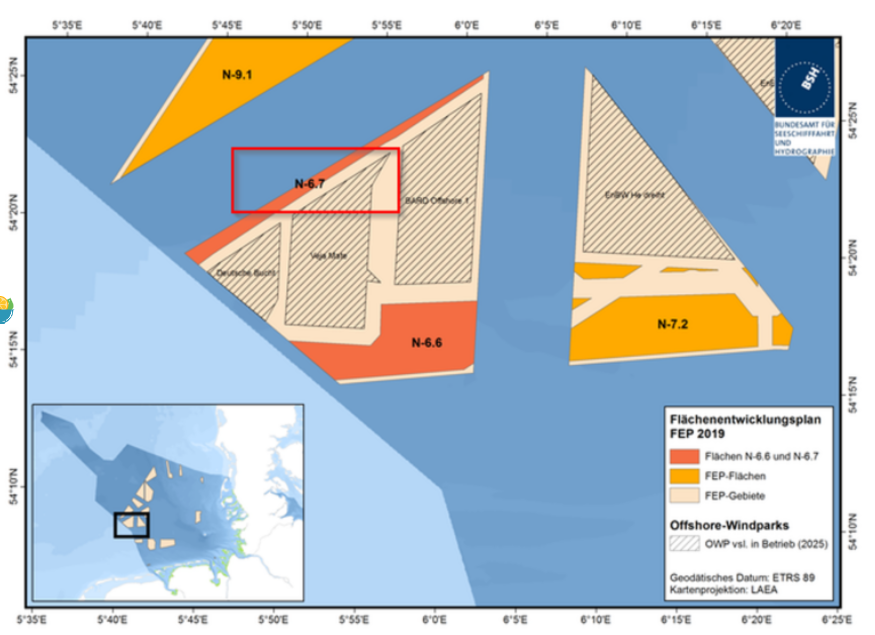

The study’s outcome has now been published by the German Federal Maritime and Hydrographic Agency (BSH), within the scope of the site before the bid date on 1 August 2023.

The data can be utilised by project developers, energy suppliers, and banks in conjunction with the project financing of offshore wind farms.

The German Offshore Wind Energy Act for offshore wind energy has set an adjusted target of 30 GW by 2030, 40 GW by 2035, and 70 GW by 2045. This goal is to be achieved through tenders in accordance with the German Renewable Sources Act.

The N-6.7 area is located some 100 kilometres northwest of the island Borkum. The area is expected to support a capacity of up to 270 MW, while the N-6.6 up to 630 MW.

Both areas are planned to be put out to tender in September 2024 and put into operation in 2029.