US power prices have been lower in 2023 from 2022 due to lower natural gas prices along with modest power demand, and it will be important to watch coal-fired power plant retirements and hydropower capacity in the Western US going forward, S&P Global Commodity Insights power market analysts said May 24.

"Gas prices have remained fairly low, with Henry Hub prices averaging about $2.20/MMBtu in April down about 60% from December of last year," Etienne Gabel, research and analysis director at S&P Global, said during a webinar discussing the team's most recent North American Electricity Short-Term Outlook.Looking forward, it will be important to watch how gas supply and demand will evolve, how gas prices evolve, how electricity demand evolves, how this will affect the power supply mix, and ultimately how these factors will impact power prices, Gabel said.

After a relatively mild winter in January and February, "things bounced back in March" and, in April, power demand was down roughly 1%, said Shayne Willett, a power market analyst with S&P Global.

"We've seen wholesale power prices, both peak and off-peak, suppressed largely due to the natural gas environment, but we also have supplemental factors like increased renewables buildout and the hydropower situation," Willett said.

Power generation supply

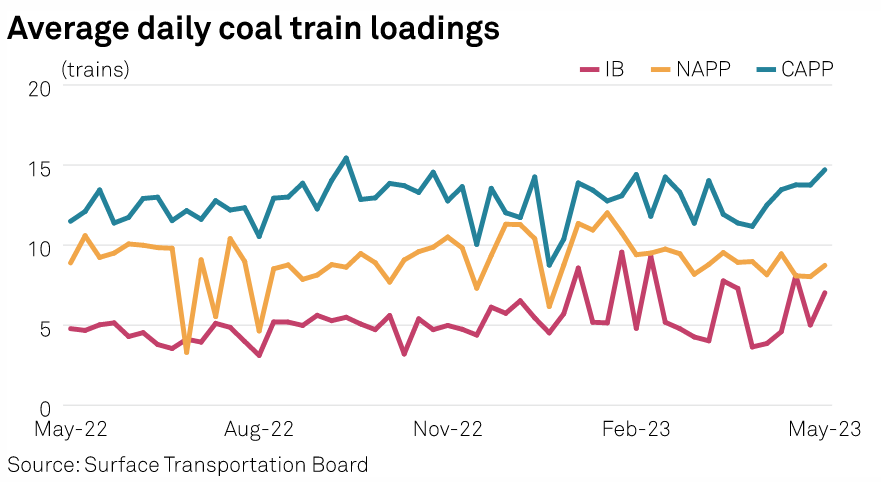

Total US coal production for 2023 is forecast to be more than 580 million st and deliveries through the first quarter reached more than 150 million st. "We expect Q2 to moderate a bit" but still produce over 140 million st, especially as transportation constraints ease, he said, referring to potential 2022 rail worker strikes.

Coal-fired power demand in April was around 23 million st, down from 27 million st since March, Willett said. Coal-fired power generation in the Lower-48 states has been "trending to its lowest point in recent history," even as total power generation is trending upward, he added.

Over a decade ago, coal accounted for 131 aGW, or nearly 34%, of total power generation and in April 2023 coal generated an average of 59 GW accounting for only 14% of total generation, Willett said. By May 2027, analysts expect coal-fired power generation to drop to 37 aGW.

"In the short term, we do expect coal to bounce back this summer and, in the winter, when we see peak conditions," he said.

Regarding natural gas, the analysts expect Henry Hub prices to increase to $2.45/MMBtu in May and for the rest of the summer it is expected to be around $2.66/MMBtu. Looking further ahead, gas prices are expected to average around $3.50/MMBtu in 2025 and $5.00/MMBtu in 2027.

As gas production growth outpaces demand, analysts expect the market to be well supplied with production averaging about 3.6 Bcf/d while demand is expected to grow at around 1.3 Bcf/d.

"We expect over 40 GW of coal capacity to retire between now and 2027, with the Mid-Continent region leading the way with over 17 GW," Willett said, adding that as of 2023, the coal fleet stands at over 260 GW.

Another big story so far this year has been heavy precipitation in the Western US, which saw well above-average precipitation. California, specifically, saw snow levels at 235% above normal, he said. That is expected to lead to a spike in hydropower generation this summer to levels not seen since August 2019 given extreme drought conditions that hit the region in recent years, Willett said.

The increased hydropower generation is likely to come at the expense of gas-fired generation and the region is currently experiencing an early-season heat wave, which has accelerated snow melt, thus affecting hydropower output, he said.

In April, hydropower accounted for less than 50% of total Pacific Northwest power generation, which was uncommonly low but, as of May 24, hydropower output had tripled from those levels, Willett said.