ShareTweetAustralian oil and gas company Beach Energy has made its first move into the offshore wind industry, teaming up with a Belgian company to join a growing number of bidders trying to gain an offshore wind licence in Victoria.

Beach is to take a 25 per cent stake in the new venture, while Parkwind – Belgium’s top offshore wind company, with six operating and under-development offshore wind farms worth €1.55 billion ($A2.5 billion) – is taking the majority 75 per cent stake.

The duo are among the estimated 20-odd bidders for a Victoria offshore wind licence.

This is Beach Energy’s first foray outside the oil and gas industry, but it is following the now well-worn track of other big oil and gas companies seeking to apply their offshore know-how to the wind industry.

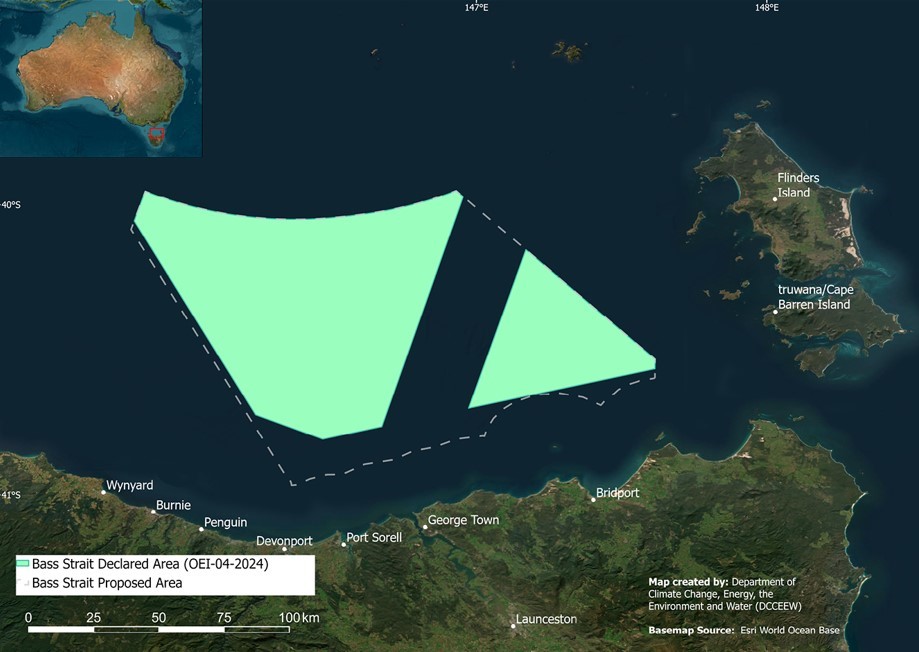

Parkwind sought out Beach Energy as a partner because of its existing operations in the Bass Strait which will help it to understand the technical infrastructure required for that part of Australia, and how to work with local offshore regulators and engage with communities.

The gas explorer has a platform deep in the Bass Strait from which it produces gas from four wells, and built a pipeline to feed that onshore. It also has three other fields which it is exploring nearby.

This experience means it already has employees who know the area and access to increasing sought-after offshore equipment such as vessels.

The two companies say many people in Beach Energy’s Victoria team also have transferrable skills for offshore wind such as community.

Its government liaison team also has relationships with regulators National Offshore Petroleum Titles Administrator (NOPTA) and National Offshore Petroleum Safety and Environmental Management Authority (NOPSEMA), Australia country manager Anil Chanana told RenewEconomy.

“When it comes to planning and installing large infrastructure in marine environments, their knowledge of vessel providers and even the survey vessels required [will be useful],” he says.

Companies like Flotation Energy and Bluefloat, both of which have put in applications for the Victoria licence, are partnering with universities to source future employees in diverse fields like naval architecture and marine geospatial planners.

Tapping into existing boat networks

But the question of how to share limited equipment and boats, much of which is shared with the offshore oil and gas industry, will need to be thrashed out by wind companies when the time comes.

Demand from the global offshore wind industry for vessels is expected to grow seven times between 2021 and 2030.

As of October last year there were only 48 vessels operating in the Europe offshore wind industry, 10 in Asia, 47 in china, and two in US. It takes about four years to build a ship, but some of these vessels are already booked out a decade in advance.

Chanana says Beach Energy’s existing networks with marine vessel contractors is likely to come in useful partnering with other licensees to save costs and time.

“Depending on how many feasibility licences the Commonwealth awards, there is going to be… opportunities for Parkwind and Beach to also collaborate with other offshore wind farm licence awardees,” Chanana said.

“For example we can plan the mobilisation of vessels in such a way that their projects and our projects are surveyed concurrently. There are opportunities for all the successful license holders to collaboration and plan for scarce vessel mob and demob.”

The winning applicants for the Victoria licences are scheduled to be released by the end of 2023, but industry insiders are expecting that timeline to lag into 2024.

Chanana says it is likely to take “several months” for a shortlist of companies to be put together, which may drag the timeline out.

Japan power companies take another stake in Aussie energy

Parkwind was recently sold for $2.5 billion to Jera, a joint venture owned by Japan’s Tepco Fuel & Power and Chubu Electric Power.

The company was originally put up for sale in September, with an estimated price tag of $3.3 billion, because the size of the portfolio had become too large for it owner, the Colruyt Group.

Over the last 13 years Parkwind was built up by the billionaire Belgian retail family Colruyt into a successful offshore company, operating four wind farms in Belgium and Germany with a total capacity of 1 gigawatt (GW), with two being built.

Jera says it wants to continue this expansion, and Parkwind says it is planning to bid for offshore licences in other parts of Australia.

Victoria licence competition

Choosing an experienced Bass Strait partner is an edge Parkwind may need, as it competes with credentialed rivals for an unknown number of licences in the Victoria offshore wind tender.

Victoria has set a target of at least 2GW of offshore wind capacity by 2032, growing rapidly to at least 9GW by 2040, which is equivalent to six Yallourn coal-fired power stations, and has committed to developing the Port of Hastings for the industry and helping establish the right grid connections.

The Gippsland coastline, the first priority area for development in Australia for offshore wind projects, has attracted a swathe of projects, the furtherest-ahead being the 2.2 GW Star of the South project.

Also in the race are Macquarie Group-owned Corio Generation’s 2.5 GW project, the Singapore-based and Australian managed Equis Developments which has partnered with UK giant SSE, Oceanex Energy, Vena Energy’s Blue Marlin project, Orsted, Equinor, Iberdrola, Shell, Alinta Energy, and a host of smaller players.