Analysis conducted by Cornwall Insight Australia reveals that certain coal plants in New South Wales (NSW) may benefit from delaying their retirement, following the release of new plans for the VNI West transmission project.

The 'conclusions report' from the Australian Energy Market Operator (AEMO) indicates that under the preferred scenario for the Project, which would see the transmission line crossing the Murray River north of Kerang (Wamba Wamba Country) instead of near Echuca, coal generation may increase in Australia by ~ 1 TWh a year for a period of three years, starting in 2030.

Despite accounting for just 6.5% of the annual expected coal generation during 2030-2033, the increase in transmission limits from VNI West opens up opportunities for NSW coal to export energy to Victoria during periods when wholesale prices in NSW are lower than in Victoria. As a result, NSW may experience higher energy prices during these periods, while Victorian prices may decrease. Combined with the retirement of Eraring and delayed energy transition targets in NSW, this dynamic could lead to increased output and profitability for the remaining coal units in NSW. If a unit is forecast to be profitable, there is limited economic reason to retire that plant, and therefore VNI West has real potential to delay the retirements of NSW coal units.

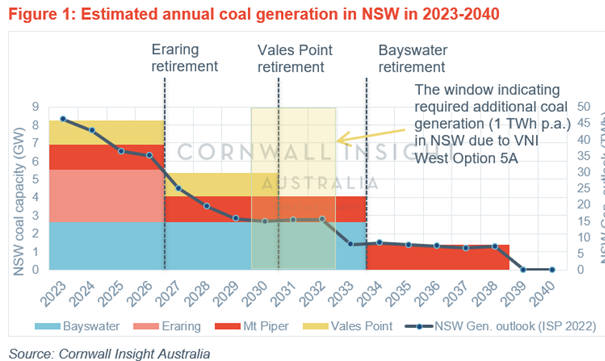

Figure 1 below shows the annual coal generation outlook in NSW (based on 2022 Integrated System Plan (ISP) assumptions), available coal capacity in the state, and the time window that represents the required additional coal generation as a result of VNI West development (~1 TWh a year between 2030-2033).

It is crucial to note that this increase in coal generation may not align with the most efficient solution for emissions reduction. Energy Ministers have recently fast-tracked the introduction of an emissions reduction objective into national energy objectives, raising concerns about the compatibility of the expected coal generation surge with future emission reduction plans.

Mehrdad Aghamohamadi, Energy Market Analyst at Cornwall Insight:

“This projected need for increased coal generation presents an interesting dynamic for the industry, particularly for coal plants. With the anticipated rise in exports to Victoria, alongside the retirement of Eraring and the delayed energy transition targets in NSW, there exists the possibility of a considerable uptick in prices and potentially enhanced profitability, giving coal generators a reason to stay in the game.

“Despite this, it is important to recognise the value of considering the broader implications of this potential delay in retirement plans. While the short-term economic benefits may be evident, it is essential to evaluate the long-term alignment with emission reduction goals and the transition to cleaner energy sources.”