The bond, which matures in July 2033, was heavily oversubscribed with over A$6bn in bids from more than 60 investors, according to the WA government.

State treasurer Rita Saffioti described the green bond as a "use of proceeds bond" to support projects such as WA's investment to decarbonise the main electricity grid. This will include batteries and wind farms, electric vehicle charging infrastructure and rebates and standalone power systems.

"Investors are increasingly interested in ESG performance and I commend the Western Australian Treasury Corporation for the extensive work to issue the green bond and build the state's ESG credentials with investors over the past two years," Saffioti said.

Coal comprises around a third of WA's electricity mix and weather-related shortages led to imports from the east Australia last year. The government has also pledged to shut the two remaining state-owned coal-fired power plants by 2030.

A 500MW battery storage system in the southern WA coal town of Collie will form part of an estimated A$3.8bn investment in new power infrastructure in WA's main power network, the South West Interconnected System (SWIS). Separate from Australia's National Electricity Market, SWIS supplies WA's capital of Perth and the area south of the city.

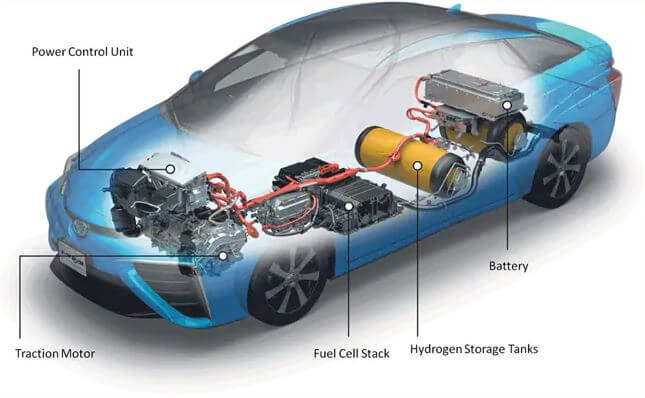

WA is planning a massive expansion of renewable power generation to become a major green hydrogen exporter. Around two-thirds of the nation's total announced investment for hydrogen projects are planned in WA, which is already the nation's largest energy exporter through its LNG sector.

The WA government in January allocated land for seven industrial projects worth A$70bn, including hydrogen and ammonia plants in a bid to develop industrial hubs for the Pilbara region in the state's northwest.