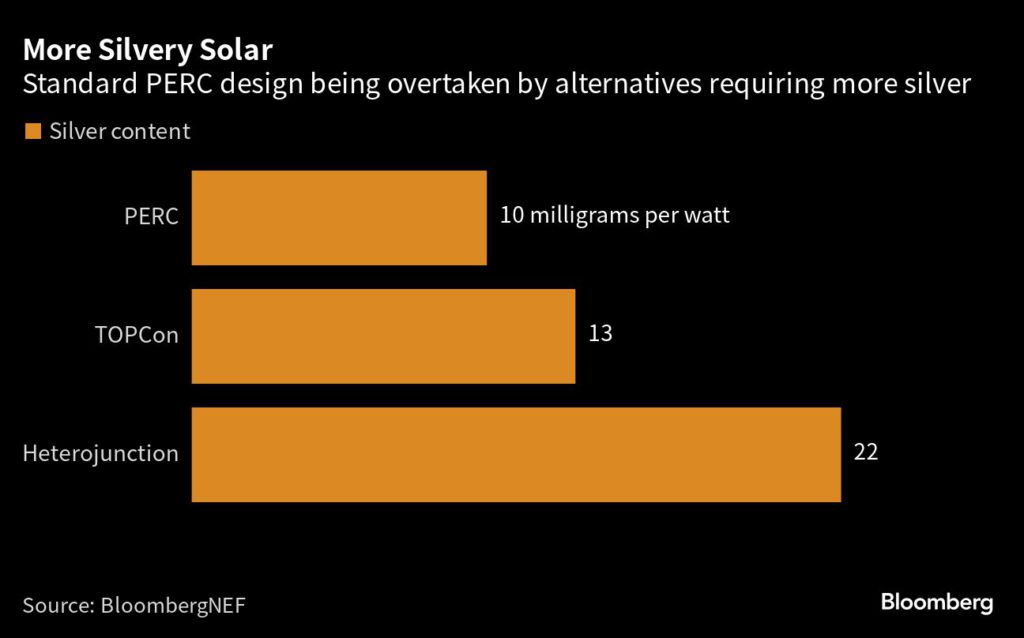

Silver, in paste form, provides a conductive layer on the front and the back of silicon solar cells. But the industry is now beginning to make more efficient versions of cells that use a lot more of the metal, which is set to boost already-increasing consumption.SIGN UP FOR THE ENERGY DIGEST

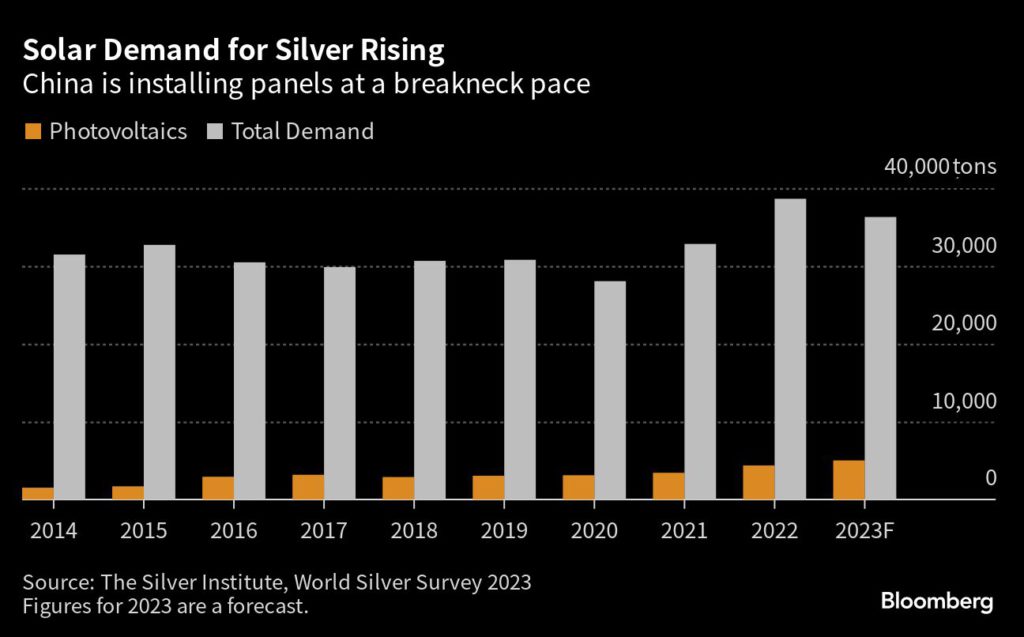

Solar is still a fairly small part of overall silver demand, but it’s growing. It’s forecast to make up 14% of consumption this year, up from around 5% in 2014, according to a report from The Silver Institute, an industry association. Much of the growth is coming from China, which is on track to install more panels this year than the entire total in the US.

Solar is a “great example of how inelastic demand for silver is,” said Gregor Gregersen, founder of Singapore-based dealer Silver Bullion. The solar industry has evolved to become much more efficient with using smaller amounts of silver, but that’s now changing, he said.

The standard passivated emitter and rear contact cell will likely be overtaken in the next two to three years by tunnel oxide passivated contact and heterojunction structures, according to BloombergNEF. While PERC cells need about 10 milligrams of silver per watt, TOPCon cells require 13 milligrams and heterojunction 22 milligrams.

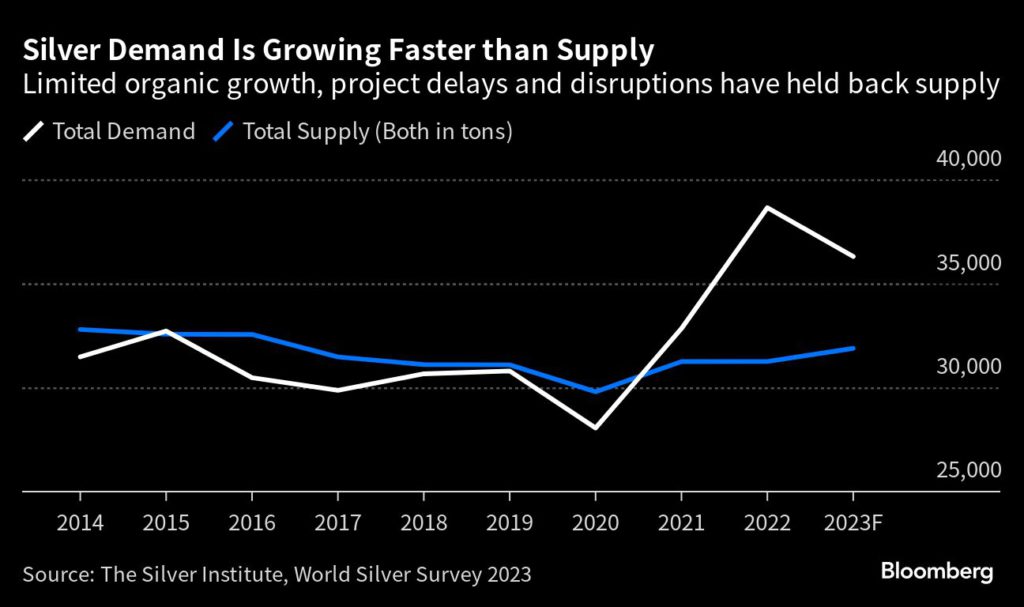

At the same time, supply is starting to look tight. It was flat last year, even as demand rose by nearly a fifth, figures from The Silver Institute show. This year, production is forecast to increase by 2% while industrial consumption climbs 4%.

The trouble for silver buyers is that cranking up supply is far from easy, given the rarity of primary mines. About 80% of supply of the metal comes from lead, zinc, copper and gold projects, with silver a by-product.

And in an environment where miners are already reluctant to commit to large new projects, lower margins in silver compared with other precious and industrial metals mean positive price signals aren’t enough to crank up output. Even newly approved projects could be a decade away from production.

The result is a strain on supply so significant that a study from the University of New South Wales forecasts the solar sector could exhaust between 85–98% of global silver reserves by 2050. The volumes of silver used per cell will increase and it could take about five to 10 years to bring them back to current levels, according to Brett Hallam, one of the authors of the paper.

Chinese solar companies, however, are actively exploring using cheaper alternatives like electroplated copper, though so far results have been mixed. Technologies that use cheaper metals are now sufficiently advanced, and will soon be put into mass production once silver prices surge, according to Zhong Baoshen, chairman of Longi Green Energy Technology Co., the world’s biggest panel manufacturer.

Silver is currently trading at about $22.70 an ounce. It’s dropped around 5% this year, but is well above where it was before surging in 2020 as the pandemic buoyed demand.

“Substitution will look more interesting when silver’s at say $30 an ounce as opposed to $22 to $23,” said Philip Klapwijk, managing director of Hong Kong-based consultant Precious Metals Insights Ltd. and one of the authors of the silver institute report. There won’t be a “doomsday scenario” where we run out of silver, but “the market will restore an equilibrium at a higher price,” he said.