As the UKs energy system decarbonises, more renewables will enter the market meaning that energy generation will become increasingly intermittent. This heightens the need for greater flexibility services – such as batteries – to supply energy at time of low solar and wind generation.

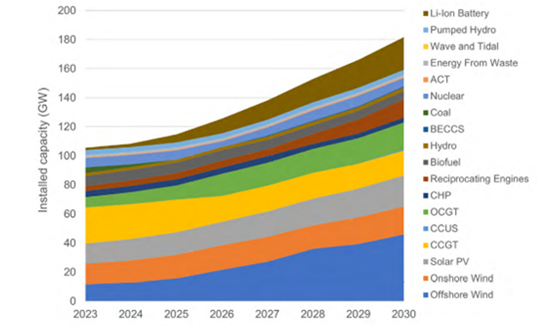

Forecasted renewable and non-renewable GB generation and storage capacity until 2030

Graph: Cornwall Insight.

The paper states that batteries play a “pivotal role” for the UKs short-term energy storage but that more viable option must be considered for durations surpassing four hours.

Alternative electricity storage technologies explored by the report to accommodate longer storage durations include compressed air or pumped hydropower.

To unlock these new technologies, the report suggests introducing grant and tax incentives to bolster their development.

The development process could be sped up by implementing capacity market mandates which could compensate generators for fixed costs associated with maintain long-duration capacity, continued the report.

Another suggestion offered by the report was a Contracts for Difference (CfD) style scheme to provide storage operators a fixed price guarantee for electricity generation by long-duration storage assets.

Using Australia’s ‘Long-Term Energy Service Agreements’ – which offer up to 40-year long contracts with a similar ‘cap-and-floor’ structure as the UKs CfD scheme – both organisations believe that the approach could both attract investors with a steady revenue stream and enhance market stability.

The report follow an announcement in April 2023 that the Department for Energy Security and Net Zero (DESNZ) would grant £30 million to three long-duration energy storage projects using new energy storage techniques.

“On the path towards enhancing energy storage capabilities, numerous challenges lie ahead, including grid capacity constraints and financial uncertainties. However, amidst these obstacles, there exists an array of opportunities to expand storage capacities, boost flexibility, and actively contribute towards the UK's net zero goal," said Dr Matthew Chadwick, lead research analyst at Cornwall Insight.

“With the stakes higher than ever, the report underscores the critical role that financial incentives play in driving innovation and accelerating the development of long-duration energy storage technologies. By implementing a strategic combination of grants, tax incentives, capacity market mandates, and contract schemes, the government can catalyse the growth of a robust and diversified long-duration energy storage sector. Such advancements would not only ensure a reliable and resilient electricity system but also position the UK as a global leader in sustainable energy solutions, ultimately paving the way towards achieving its ambitious net zero targets.”

James Carter, head of UK energy and natural resources at DLA Piper added: “The role of energy storage in the UK’s energy future cannot be underestimated. It is the critical support structure which delivers stability and security of supply in a volatile market. It can be seen as a keystone in the development of an energy system which allows the UK to move at the pace required to a cleaner, greener economy.

“Although the UK’s electricity storage sector faces various challenges, including supply chain vulnerability and the potential for revenue volatility, there also remain significant opportunities, particularly in the context of the growth of long-duration energy storage. It is in this context that we have prepared this report, focused on the opportunity which energy storage presents.”