Disagreement over pricing, plant construction delays and lack of supply contracts are dogging the Southeast Asian manufacturing hub's adoption of LNG, hampering its ambitions to make imported gas a major fuel, industry insiders say.

Vietnam's urgent need to boost electricity supply, laid bare by recent rolling blackouts, has raised concerns among foreign investors about whether Vietnam can remain a reliable option to diversify manufacturing away from China.

Half the businesses in a June poll by the European Chamber of Commerce in Vietnam said the power crisis had hurt investment plans. Some were considering alternatives or pausing spending on factories.

Reuters Graphics

Failure to execute on its LNG plans would mark another blow to Hanoi's climate goals, which include imported and domestic gas as a transition fuel to reduce coal reliance.

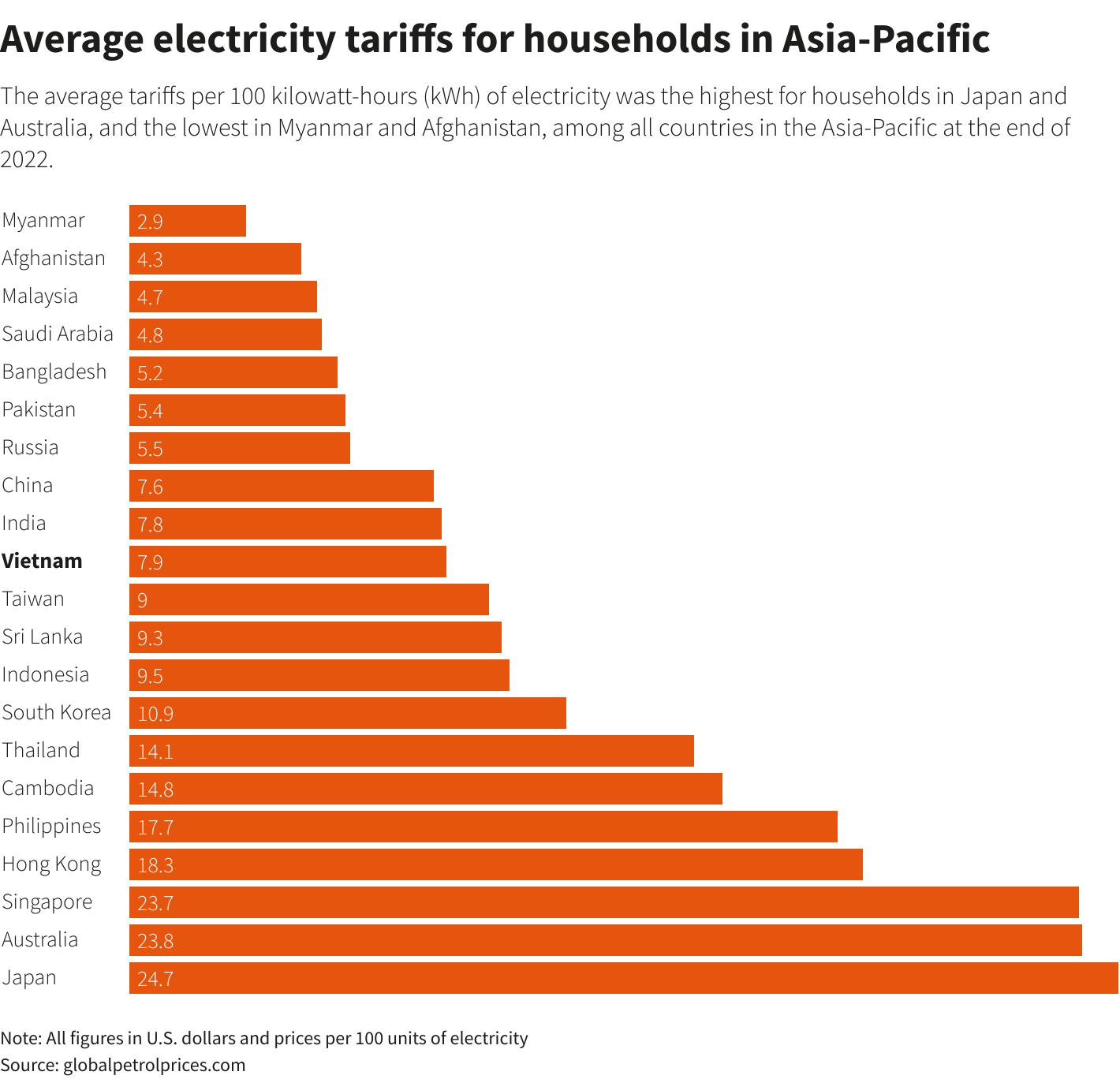

With demand forecast to grow 6% annually for the rest of the decade, Vietnam in May unveiled a $135 billion electricity roadmap that, among other investments, would add 13 power plants fed by gas imported as LNG by 2030.

Reuters Graphics

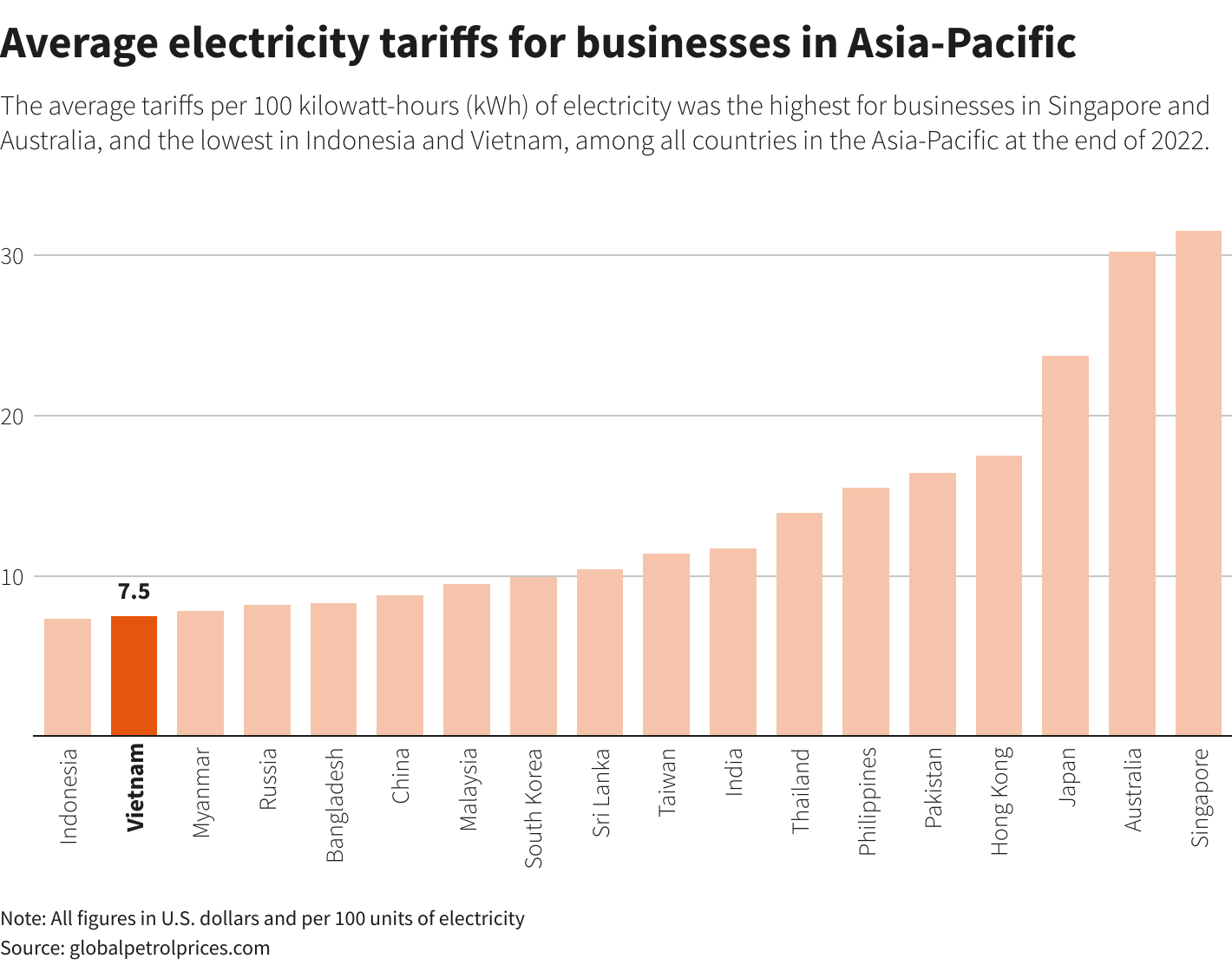

Integrating LNG into its fuel mix, Vietnam would join neighbours Thailand and Singapore as well as the Philippines, a recent-adopter.

Vietnam's industry ministry did not respond to a request for comment on implementing its LNG plan.

TROUBLED PLANTS

The first LNG shipment reached Vietnam last week. The test cargo of super-chilled gas was sent to state-owned PetroVietnam Gas's (PV Gas) (GAS.HM) new Thi Vai terminal near Ho Chi Minh City for conversion back to gas.

Vietnam targets LNG-sourced gas generating up to 22.4 gigawatts (GW) of power by 2030, enough to power 20 million households and account for nearly 15% of national power supply. But Kaushal Ramesh, an analyst at Oslo-based Rystad Energy, said a realistic expectation was just 5 GW.

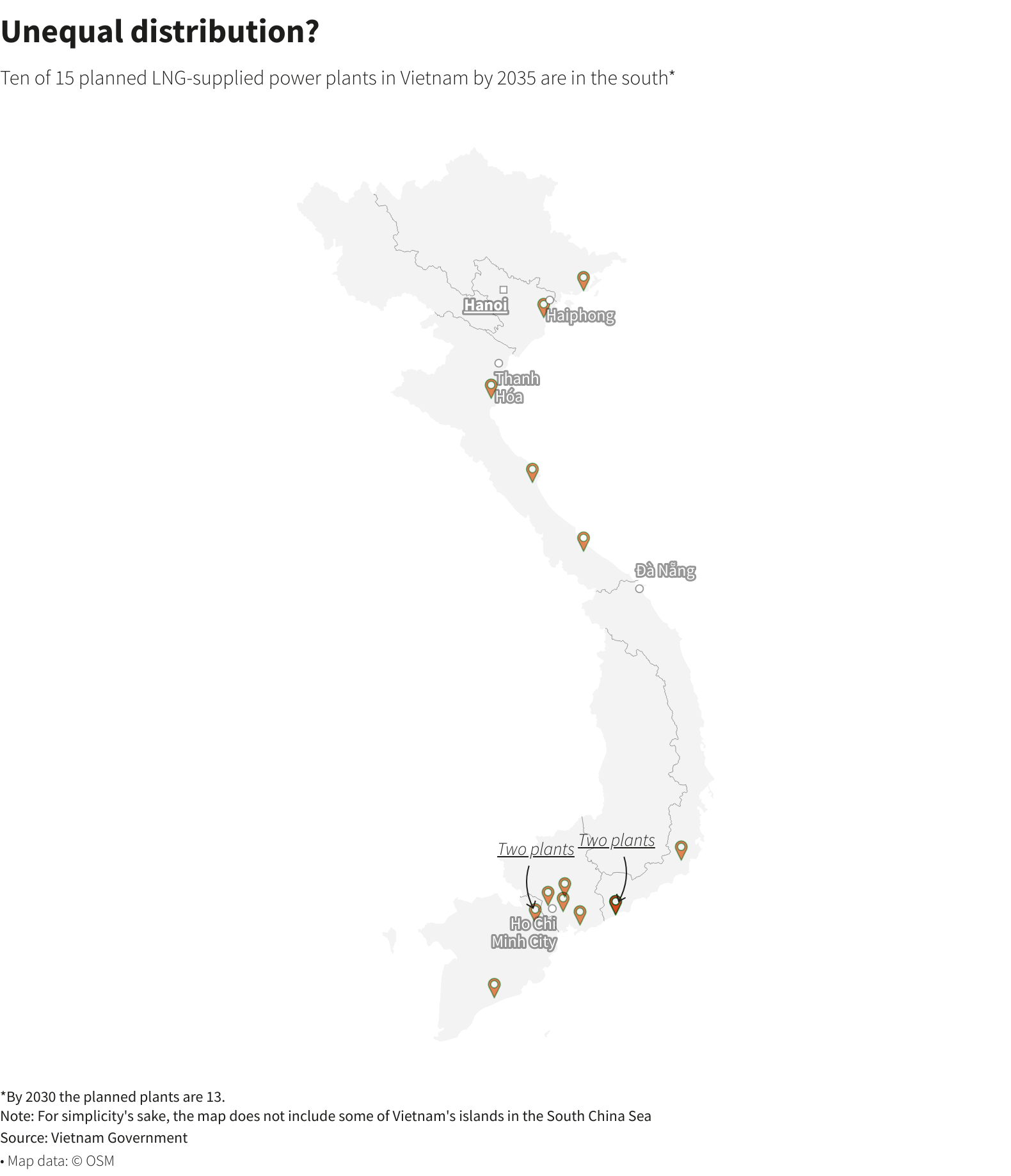

Complicating LNG efforts, much of Vietnam's planned gas power investment is directed to the south of the country despite the under-served north's greater vulnerability to blackouts.

The first northern plant that would be fuelled by imported gas is not scheduled to begin operation until the second half of 2027, said its Japanese developer, Tokyo Gas (9531.T).

Reuters Graphics

Reuters Graphics

The first plant due to come online, the Nhon Trach 3 facility being built by state-run PetroVietnam Power (PV Power) (POW.HM) near Ho Chi Minh City, is scheduled to begin operation in late 2024. Industry sources say 2026 or 2027 is more realistic.

The local authority cited delays caused by lack of long-term contracts and problems over funding and permits.

A key hurdle is that PV Power is struggling to agree with grid operator EVN on the volume of purchases and prices for electricity generated from its plants running on imported gas, now some 50% more expensive than domestic gas, people familiar with the talks said.

PV Power wants to sell at least 80% to 90% of its imported gas-fuelled power to EVN at a set price for two decades, while EVN wants to commit to a lower portion, four sources said.

Plant developers are seeking state guarantees on their power contracts with EVN, warning that lenders would not fund their projects otherwise, an industry insider said.

Disagreements over power pricing contributed to a slow uptake of the wind industry, leaving a significant share of wind farms unplugged from the grid for years and stranding at least 4.6 GW of onshore wind capacity, according to an internal document from a Group of Seven nation, seen by Reuters.

Foreign developers of LNG-supplied plants, which include U.S.-based AES (AES.N) and Japan's Marubeni (8002.T), are closely watching the pricing talks, which could set a benchmark for their negotiations.

Takafumi Akino of Tokyo Gas, which is building an LNG terminal and a gas plant in northern Quang Ninh province, predicted "hard negotiations".

PV Power and EVN did not reply to requests for comment.

The biggest proposed plant earmarked for imported gas, a 3.2 GW project developed by Singapore-based Delta Offshore Energy, is undergoing debt restructuring after defaulting on a $10 million loan from Gulf International Holdings, court documents showed.

Delta Offshore did not respond to requests for comment. Gulf International's parent, Thailand-based Gulf Energy Development (GULF.BK), declined to comment.

LOCKING IN SUPPLY

Delays and uncertainty make it harder to secure long-term LNG supplies as Vietnam must compete with other importers. Buyers across China, South and Southeast Asia have inked a slew of multi-year deals this year.

PV Gas said this month it was in talks with U.S. energy giant ExxonMobil and Russia's Novatek on LNG cooperation.

Two trading sources who asked not to be named due to the sensitivity of the matter said PV Gas had been seeking LNG supplies at "unrealistically low prices".

PV Gas did not respond to requests for comment.

Without long-term LNG supply, Vietnam would be exposed to volatile spot prices, which in Asia spiked to a record $70 per million British thermal units (mmBtu) last year before sinking to $12/mmBtu now.

"There may be suppliers willing to offload some volume to PV Gas, although this is a completely different risk and credit profile compared to what LNG producers are used to," Rystad's Ramesh said.

Reporting by Francesco Guarascio @fraguarascio and Khanh Vu in Hanoi, and Emily Chow in Singapore; Additional reporting by Florence Tan and Phuong Nguyen; Editing by Tony Munroe and William Mallard