Oil companies and utilities are pushing for their own tax credits for partly fossil fuel-powered projects.

Oil companies and utilities are pushing for their own tax credits for partly fossil fuel-powered projects.Energy companies and utilities across the United States have launched a lobbying campaign in Washington D.C. with regards to pending regulations they claim will determine the outcome of the case for tens of billions of dollars in clean hydrogen fuel investment.

Last year’s novel climate law aimed generous subsidies at projects focusing on green H2 production.

The main focus of funding the projects was to target projects producing clean hydrogen, mainly green H2, which is made using electrolysis powered by renewable energy such as wind and solar, among others. This month, the Treasury department will be issuing tax guidelines that will identify the specific type of H2 projects that will qualify for these substantial subsidies.

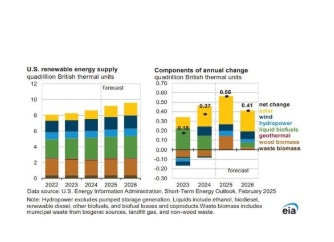

However, as renewable energy continues to represent only a small percentage of the country’s entire power grid, energy companies have been pushing for guidelines that will make room for some H2 production to come from electricity that was generated using fossil fuels.

The debate decision makers now face is how H2 producers will need to prove that they are using adequately renewable power for their processes. The most restrictive proposal from the Treasury would require projects to certify that every hour of H2 production is powered by a renewable – or at least zero-carbon – source of energy. That would mean that zero-carbon energy would be a requirement all day, every day.

Industry lobbyists have been arguing that this definition of clean hydrogen is not yet feasible.

According to industry lobbyists, if the strictest rules were to be implemented, it would require H2 production to shut down at times when renewable energy is unavailable. As an alternative, those oil companies and utilities are urging the Treasury to use an “annual matching” system of subsidies. They say that this would make it possible for producers to purchase renewable electricity credits in amounts equivalent to their annual energy consumption.

They state that this would make clean hydrogen investment more appealing in the United States, making it possible for energy giants to essentially store up the renewable electricity generated during surplus times for later use.

Some H2 producers agree

A Plug Power commissioned study showed that investment would drop by two thirds by 2035 if the clean hydrogen rules implemented are too strict.

The decision of the Treasury “will greatly dictate where the level of interest is and how much of that investment goes towards the US versus other parts of the of the global economy”, said Air Liquide head of North America Adam Peters.

FAQs on Tax Credits for Fossil Fuel-Powered Projects

Q1: What is the main focus of the lobbying campaign by energy companies and utilities? A: The main focus of the lobbying campaign is to push for tax guidelines that would allow for some hydrogen (H2) production to come from electricity generated using fossil fuels, given that renewable energy currently only represents a small percentage of the country’s power grid.

Q2: What were the subsidies in the last year’s novel climate law aimed at? A: The subsidies in last year’s novel climate law were aimed at projects focusing on green H2 production, which is made using electrolysis powered by renewable energy such as wind and solar.

Q3: What is the current debate among decisionmakers regarding H2 production? A: The current debate is about how H2 producers will need to prove they are using adequately renewable power for their processes. The most restrictive proposal would require projects to certify that every hour of H2 production is powered by a renewable or zero-carbon source of energy.

Q4: Why are industry lobbyists arguing against the strict definition of clean hydrogen? A: Industry lobbyists argue that the strict definition of clean hydrogen, which requires every hour of H2 production to be powered by renewable or zero-carbon energy, is not yet feasible. They believe it would require H2 production to shut down when renewable energy is unavailable.

Q5: What is the proposed “annual matching” system of subsidies? A: The “annual matching” system of subsidies proposed by industry lobbyists would allow producers to purchase renewable electricity credits equivalent to their annual energy consumption. This would essentially allow energy giants to store up renewable electricity generated during surplus times for later use.

Q6: What could be the impact of implementing strict clean hydrogen rules? A: According to a study commissioned by Plug Power, investment in clean hydrogen could drop by two thirds by 2035 if the rules implemented are too strict.

Q7: How critical is the Treasury’s decision on clean hydrogen rules? A: The Treasury’s decision on clean hydrogen rules is critical as it will determine the level of interest and investment in the US versus other parts of the global economy, according to Adam Peters, head of North America at Air Liquide.