The new capital will help catalyze Advanced Ionics’ growth and facilitate the initial deployment of its water vapor electrolyzer technology for heavy industry. Water vapor electrolyzers address two of the biggest obstacles to expanding green hydrogen production: cost and electricity requirements.

Advanced Ionics’ technology has the potential to drive down cost and disrupt the hydrogen market. bp has a global portfolio of hydrogen projects, and as the world transitions to a net zero future, it’s important to us to be investing in these technologies and advance the track to deploying green hydrogen. We look forward to working with Advanced Ionics on the next stage of its growth.

—Gareth Burns, vice president of bp ventures

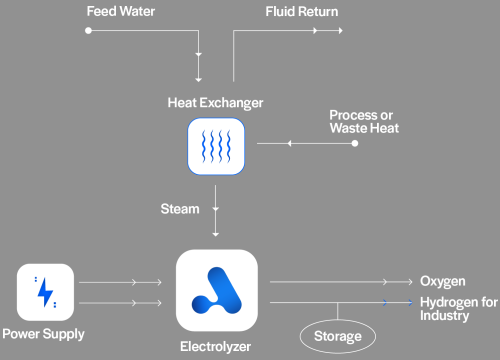

The company’s water vapor electrolyzer helps reduce the cost and electricity requirements for green hydrogen production by symbiotically integrating with standard industrial processes to harness available heat—from 100 ˚C on up. The system is made of widely available steels and other simple materials rather than expensive metals or materials common in other electrolyzers—no expensive platinum-group metals, no iridium, no fluoropolymer membranes.

Electricity use accounts for more than 70% of green hydrogen production costs. Advanced Ionics’ electrolyzer stack requires less than 35 kWh per kilogram of produced hydrogen compared to more than 50 kWh per kilogram for typical electrolyzers. This lower electricity requirement could make green hydrogen accessible for less than $1 per kilogram at scale.

Advanced Ionics will use the funds to expand its team and deliver its next-generation electrolyzer systems to early customers. The company is already demonstrating the efficacy of its product through a pilot program with global energy company Repsol Foundation.

In addition to bp Ventures’ investment, bp will also be exploring pilot opportunities with Advanced Ionics. Other investors in Advanced Ionics include Aster, and angel investor collectives Clean Energy Venture Group and SWAN Impact Network.

Hydrogen is one of bp’s five transition growth engines, which also include bioenergy, convenience, electric vehicle charging, and renewables & power. bp plans to increase its investments in those businesses through this decade, while at the same time investing in today’s energy system, as it delivers its strategy of becoming an integrated energy company.