The next generation of US solar factories is advancing quickly, unleashed by lucrative tax incentives included in the Inflation Reduction Act. But until the country’s new manufacturing lines are running at capacity, domestic solar installers remain heavily dependent on foreign-made modules.

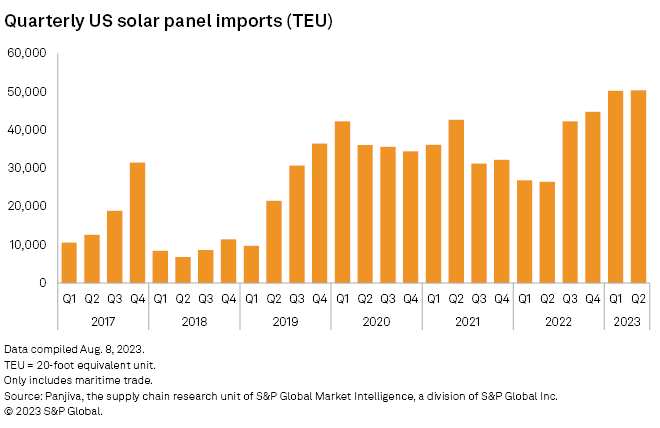

Second-quarter imports of photovoltaic panels surged 90.5% from a year ago to 50,409 twenty-foot equivalent unit shipping containers, according to Panjiva, the supply chain research unit of S&P Global Market Intelligence. The new quarterly high was slightly ahead of the first quarter of 2023 and marked the fourth consecutive quarter of rising imports after President Joe Biden in June 2022 waived tariffs on crystalline-silicon PV cells and panels from Southeast Asia alleged to be circumventing decade-old tariffs on China.

Courtesy: S&P Gobal Market Intelligence

The data comes ahead of the US Commerce Department’s anticipated final decision in August on whether manufacturers are sidestepping tariffs by assembling products in Cambodia, Malaysia, Thailand, and Vietnam using made-in-China components to avoid antidumping and countervailing duties imposed in 2012 by the Obama administration. A December 2022 preliminary decision found that certain imports from Cambodia, Malaysia, Thailand, and Vietnam are circumventing tariffs.

First Solar Vietnam Manufacturing Co. Ltd., an affiliate of Arizona-headquartered thin-film PV maker First Solar Inc., was the single-largest solar exporter to the US during the second quarter of 2023, Panjiva data shows. That was followed by Trina Solar Energy Development Pte. Ltd., a Singapore-based subsidiary of China’s Trina Solar Co. Ltd.; and Boviet Solar Technology Co. Ltd., a Vietnam-domiciled affiliate of Boway Group, also based in China.

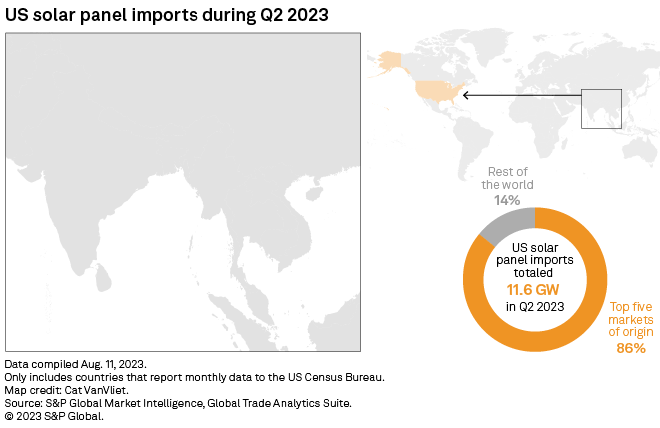

Measured by module capacity rather than shipping containers, US solar panel imports declined nearly 11% in the second quarter of 2023 to 11.6 GW compared with 13 GW in the first quarter of the year, according to the Market Intelligence Global Trade Analytics Suite. Vietnam accounted for the largest share of US PV module imports in the second quarter, with 31.2%, followed by Thailand with 22.5%, Cambodia with 13.7%, and Malaysia with 12.9%.

The four Southeast Asian countries together made up 80.3% of US solar panel imports during the period.

Courtesy: S&P Gobal Market Intelligence

The total 24.6 GW of solar panel imports in the first half of 2023 compare with S&P Global Commodity Insights’ forecast of nearly 36 GW of installed US solar capacity this year. The country’s solar panel production capacity could reach 25.7 GW by the end of 2023, based on domestic manufacturing announcements tracked by Commodity Insights, up from 14.4 GW at the end of 2022.

Since Biden signed the Inflation Reduction Act, the private sector has committed to invest nearly $20 billion in new US solar factories across the supply chain, the Solar Energy Industries Association said Aug. 14. That includes 85 GW of new solar module capacity, 43 GW of cell capacity and 20 GW of crystalline silicon ingot and wafer capacity.