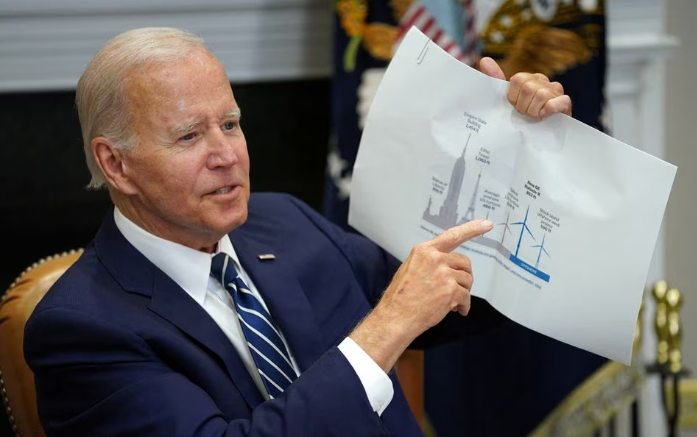

That is why players in the nascent U.S. offshore wind industry are looking beyond the grid when the Biden administration holds the first-ever offshore wind auction in the Gulf of Mexico on Tuesday, eyeing the sale instead as a way to fuel a new green hydrogen supply chain for the region's vast industrial corridor.

Hydrogen is a low-emissions fuel made by electrolyzing water that can help decarbonize heavy-emitting industries and transportation. It is considered "green" if produced with renewable energy and "gray" if the process is fueled with carbon-emitting natural gas.

The Gulf Coast auction would be a break from previous federal offshore wind lease sales, held mainly in the Northeast, where developers have spent billions of dollars on acreage for projects meant to link into lucrative power markets and access state-level subsidies for carbon-free electricity.

"When we get to the Gulf, (offshore wind) will start becoming much more disconnected from the grid," said Cheryl Stahl, principal project manager at risk assessment firm DNV. "The Gulf gets to be sort of a breeding ground for innovative solutions."

The Interior Department's Bureau of Ocean Energy Management (BOEM) will auction three areas off Louisiana and Texas to offshore wind developers on Aug. 29, the first such sale in the region already teeming with oil and gas pipeline and port infrastructure.

The sale is part of the administration's goal to slash power sector emissions and combat climate change.

A BOEM spokesperson, John Filostrat, said the Gulf "is uniquely positioned to transition to a renewable energy future, including the development and implementation of the production and use of green hydrogen."

Companies qualified to bid at Tuesday’s sale include units of companies already established in the U.S. offshore wind industry like Shell (SHEL.L), Invenergy and TotalEnergies (TTEF.PA).

In comments to BOEM on the planned Gulf sale earlier this year, those three companies noted the potential of offshore wind to produce green hydrogen in the region.

"The Gulf of Mexico is uniquely situated to facilitate and benefit from green hydrogen production via offshore wind," Shell said in April, pointing to the region's existing port and pipeline infrastructure as well as new federal funding for green hydrogen development.

Shell, Invenergy and TotalEnergies did not respond to questions about their plans for the upcoming auction.

The American Clean Power Association, a trade group that represents offshore wind and other renewable energy developers, also said in its comments to BOEM that green hydrogen would "increase market viability of offshore wind."

A DIFFERENT MARKET

The Gulf auction is not expected to attract anywhere near the billions of dollars in bids an offshore wind lease sale off New York and New Jersey generated in February 2022.

Those states have passed laws that require utilities to buy power from offshore wind projects - mandates considered critical for a technology that is estimated to produce electricity at twice the cost of a natural gas plant.

Northeast states also boast some of the highest power prices in the country, making expensive offshore wind more competitive.

Texas and Louisiana, by contrast, have no legal mandates for clean energy, have slower average wind speeds than the Northeast, higher risks from seasonal hurricanes, and much lower retail power prices.

Even in Texas, where offshore wind could provide a new resource for its fragile grid, developers would need to find buyers willing to pay above-market prices for that electricity, because it is not subsidized by the state.

In the Gulf, "it's harder to justify an investment decision," said Alon Carmel, a partner at PA Consulting who advises offshore wind companies.

He said, however, that tax credits for hydrogen in President Joe Biden's Inflation Reduction Act have made the proposition of pairing offshore wind with hydrogen production more attractive, adding that he would not be surprised to see wind developers in the Gulf turn to hydrogen for revenue.

Lacy McManus, an executive with the economic development agency Greater New Orleans Inc, which is leading a federally-backed project to create a green hydrogen "cluster" in South Louisiana, said the region's existing petroleum industry could provide a ready market as they seek to satisfy investor demands to lower their carbon intensity.

"They want to start replacing these gray hydrogen feedstocks and fuel sources with green," McManus said. "Wind provides that at the scale and capacity that we need in the industrial sector."