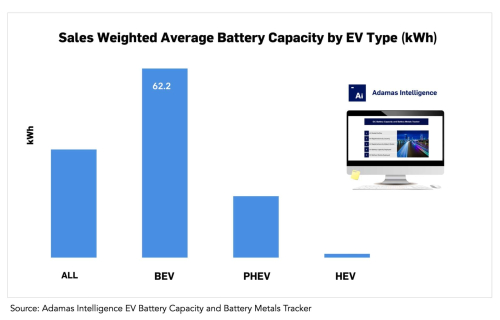

Adamas data shows the rise in battery capacity deployment is driven by the combination of EV sales growth and a steady rise in average battery sizes. Overall, the average passenger electrified vehicle sold globally in July of this year had a battery pack capacity of 35.6 kWh—nearly 10% higher than a year ago.

Automakers are increasing battery power, led by plug-in hybrids with average capacity up 14% year on year. Considering conventional hybrid batteries have been stagnant around the 1.2 kWh mark for years, and HEVs remain a popular choice in a number of large markets, including Japan, the across the board battery size of 35.6 kWh is a pretty “beefy” number, Adamas said.

Over the same period, average BEV battery capacity jumped 9% to an average of 62.2 kWh in July of this year. That’s on par with the battery capacity of the standard range Tesla Model 3 made in China and the Model Y made in Germany.

Batteries of PHEVs had an average size of 20.2 kWh in July, up 14% from the same month the year prior. Popular PHEVs available in China such as the Li Auto L9 sport batteries twice that. Five years ago PHEV drivers had to make do with just 12 kWh, Adamas data shows.

PHEVs enjoyed a 21% global market share year to end-July, up from 16% in 2020. Worldwide, PHEV sales are up 50% year-on-year while 34% more BEVs have been sold over the same period.

In China, PHEVs have cornered 30% of the market this year in terms of unit registrations. In the US the market position of PHEVs has deteriorated and market share in the region is down to just 11% versus 22% in Europe.