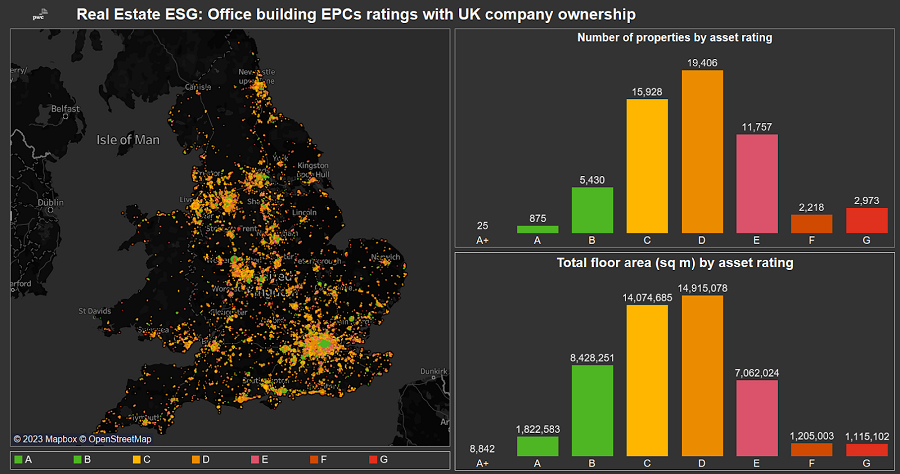

Based on geo-spatial analytics, the data shows this risk is spread right across the UK, with hotspots occurring in the South East, the North West and Central England for buildings rated ‘C’ or below.

Mark Addley, Real Assets Deals Leader, said: “Our analysis illustrates the stark challenge facing UK landlords and developers now. With a potential update to the EPC regulation for commercial real estate targeted for 2027, the clock is ticking to ensure office stock meets the refreshed rules. Even if the legislation timing slips, tenant expectations around ESG credentials will remain.

“For some, the best course of action will be to make tweaks which ensure they are compliant; however by not facing this issue they may end up with a significant challenge down the track. Others may look to completely rebuild or repurpose and depending on the age of the building, demolition may be the best option, however the significant embodied carbon impact of this will need to be taken into account.

“There are positives - for example - well positioned developer investors who operate in other sectors may see these changes as an opportunity to purchase and redevelop offices for other uses such as life sciences, student accommodation or residential developments. We should also remember that high quality office stock in the right locations will remain in demand.

“The key thing will be that developers and landlords plan for the change by ensuring they have a strategy in place that is flexible, and takes into account the lead time that will be required to implement the different approaches.”

Whilst London may house the largest collection of properties, the Midlands is the most at risk of stranded assets with the highest number of F&G rated office assets. The EPC distribution is also indicative of lower class assets that may not meet the wider requirements like access to transport and other amenities, technology enabled space for tenants and lenders alike.

Rob Walker, Leader of Real Estate at PwC UK, said: “With the pandemic fundamentally changing the way we work, plus ongoing macroeconomic shifts, it's clear that the office sub-sector has been particularly negatively impacted.

“What our analysis shows is that there are multiple headwinds from rising inflation and increased construction costs to significant labour shortages and skills gaps. All this adds up to developers - hoping to get ahead of the possible changing EPC requirements - facing a steep challenge.

“The good news is that there is a new office stock in the pipeline, which will present the best in class and no doubt meet the demand from tenants who hope to occupy space with strong ESG credentials.

“However, the drive for such facilities and amenities puts further pressure on CapEx requirements, plus construction as an activity remains a major contributor of greenhouse gas (GHG) emissions worldwide.

“And with a shortage of bricklayers, plasterers, roofers and carpenters, the sector faces a series of stark choices to get ahead of the game. With looming EPC changes, it seems that the drive to create an effective strategy to head this at the pass."