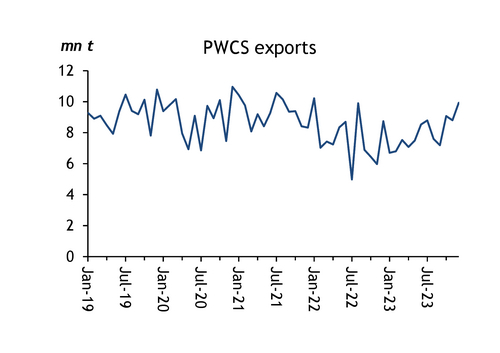

The PWCS terminals at Newcastle in New South Wales (NSW) shipped 9.93mn t in December, up from 8.8mn t in November and from 8.74mn t in December 2022, according to port data. PWCS shipped 95.51mn t in 2023, up from 91.89mn t in 2022 but down from the record 111.33mn t shipped in 2021.

PWCS coal exports peaked in 2021 as the war in Ukraine altered generation fuel trade flows. Severe flooding and China's informal ban on Australian coal imports cut shipments in 2022, with early 2023 output curbed by flood recovery work. December was the strongest monthly throughput since January 2022 and the long shipping queue could see increased exports in January, which is seasonally a strong month for the port. There were 27 ships waiting outside Newcastle on 8 January, up from 22 in early December and the queue the longest it has been since July 2022 when flooding cut all deliveries to Newcastle.

Chinese demand for PWCS coal remained firm in December, although exports to China were weaker than November and the record high in October, according to initial shipping data collated by Argus.

The Newcastle Coal Infrastructure Group (NCIG) does not release data for its terminal at Newcastle and the Port Authority of NSW has not yet released overall data for December. But initial shipping data suggests that NCIG also ended the year strongly and the wider port in 2023 exceeded its decade low of 136mn t of coal shipped in 2022 by at least 10mn t but come in short of the 156mn t shipped in 2021.

PWCS ran down stocks to 1.05mn t on 31 December from 1.41mn t on 30 November and to the lowest month's end recording since 30 April 2021. There was no track maintenance in December and there is usually none planned for January, which is the major summer holiday month in Australia. Australian Rail Track has not yet released its maintenance plan for 2024 with the first usually scheduled for early February.

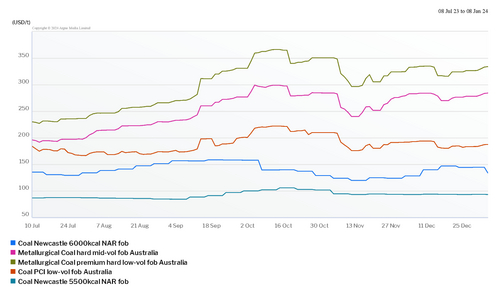

Australian coal price comparisons ($/t)