But the robust demand did little to move prices as Indonesia and Australia, the two largest shippers of the fuel used mainly to generate electricity, saw strong gains in exports.

Asia's imports of seaborne thermal coal reached 83.69 million metric tons in December, up from 78.87 million in November and the highest in records compiled by commodity analysts Kpler going back to January 2017.

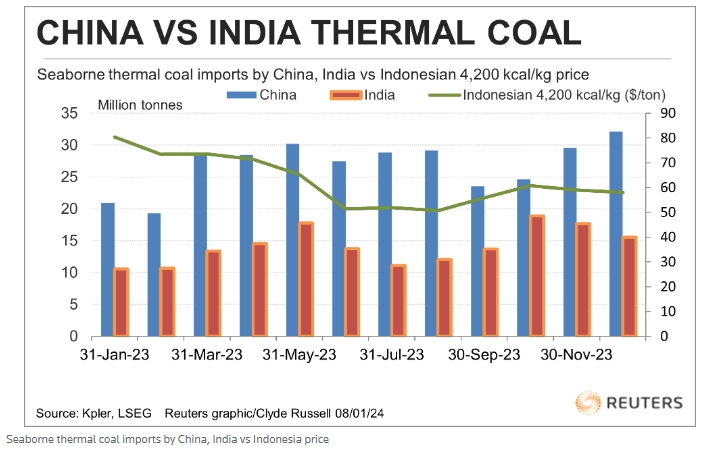

The strength was led by China, with seaborne thermal coal imports of 32.08 million tons, another record high according to Kpler data, and up from 29.57 million in November.

China's appetite for imported thermal coal soared in 2023 as coal-fired power generation rose amid lower hydropower output and rising electricity demand as the economy posted a modest recovery from the weakness caused by Beijing's previous strict zero-COVID policy.

It's also worth noting that China's domestic coal production has also been rising, with November output hitting a record high on a daily basis of 13.8 million tons, besting the previous peak of 13.5 million from March last year.

In the first 11 months of last year China, the world's biggest coal producer, consumer and importer, saw production rise 2.9% to 4.24 billion tons.

Despite the rising domestic output, imports have remained competitive because of lower prices for the main grades of Indonesian and Australian coal that form the bulk of China's imports.

Indonesian coal with an energy content of 4,200 kilocalories per kilogram (kcal/kg) , as assessed by commodity price reporting agency Argus, dropped to $57.82 a metric ton in the week to Jan. 7, a two-month low and 36% below the level at the start of 2023.

Australian coal with an energy content of 5,500 kcal/kg also dropped last week, falling to $93.23 a ton, a five-week low and 30.1% weaker than in the same week in 2023.

Indonesia's exports of thermal coal hit 48.05 million tons in December, the most since March last year, with China taking the lion's share at 20.99 million, also the most since March.

INDIA MODERATES

One of the reasons why the strong demand for Indonesian thermal coal isn't showing up in higher prices, is that India, the second-biggest coal importer, has been trimming purchases.

India imported 15.53 million tons of seaborne thermal coal in December, down from 17.65 million in November and the lowest since September.

It's also worth noting that India has been diversifying its coal suppliers somewhat, taking higher volumes from South Africa, with imports from the swing supplier to both the Atlantic and Indian basins rising to 2.78 million tons in December from 2.67 million in November.

In December, South Africa's share of India's imports was 17.9%, while in July last year it was 9.6%.

FAR EAST DEMAND

If softer demand from India is helping to keep a lid on prices for lower energy coal grades, weakness in the price of the premium fuel is down to muted demand in the main buyers of this type, Japan and South Korea, Asia's third- and fourth-biggest importers respectively.

Japan's imports of seaborne thermal coal did rise in December, to 10.64 million tons from 8.79 million in November.

However, the December volume was still more than 1 million tons adrift of the 11.87 million imported in the same month in 2022.

South Korea landed 7.30 million tons in December, up from 6.10 million in November but below the 7.55 million from December last year.

Japan and South Korea mainly buy coal priced against Australian 6,000 kcal/kg fuel, and this grade ended at $131.99 a ton on Jan. 5, according to data from trading platform globalCOAL.

The price has dropped for three consecutive weeks, having recently peaked at $157.01 a ton in the seven days to Dec. 15.

The peak so far in the current northern winter is also substantially below the peaks around $415 a ton from the winter of 2022-23, when prices were still elevated amid concerns that the loss of Russian coal and pipeline natural gas in the wake of Moscow's invasion of Ukraine would cause an energy crisis in Europe.

The overall picture for the seaborne thermal coal market in Asia is that supply has risen by enough to offset strong demand by China.

The outlook for the first quarter of 2024 will largely depend on whether China continues to favour imports, or whether domestic output takes a greater share of power generation and non-fossil fuel alternatives, such as hydro, wind and solar also pick up.

The opinions expressed here are those of the author, a columnist for Reuters.