Higher than anticipated gas storage levels in the EU have lowered fears of shortages this winter. With the surplus meaning less gas is required for summer refills, resulting in a welcome reduction in prices.

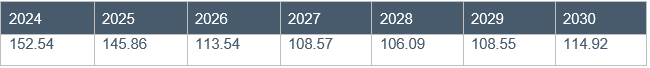

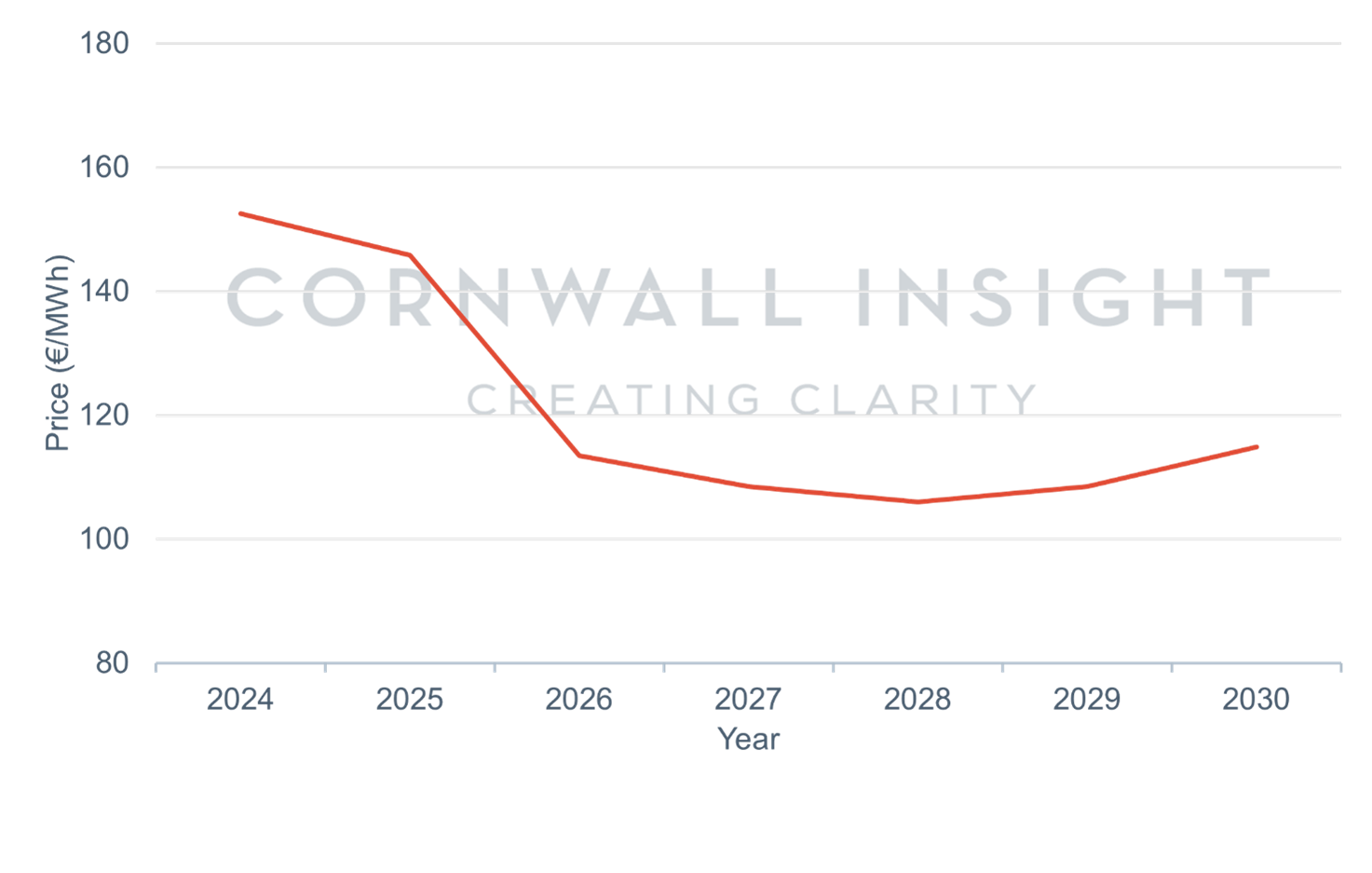

The data, included as part of Cornwall Insight’s fourth 2023 All-Island forward curve, represents a drop of over €34 per MWh1 from the previous quarterly forecast.

Despite the fall, the impact of Europe’s increased reliance on Liquified Natural Gas shipments following the sanctions on imports from Russia, are expected to keep Irish prices above historic averages.

In the medium-term, prices are predicted to continue to drop as Ireland works towards its ambitious 2030 target of 80% renewable energy, phasing out higher priced fossil fuel technologies for more cost-effective renewable generators.

However, power prices in Ireland are expected to rise again in 2029 due to higher demand from data centres and the shift to electric power in various sectors, alongside an increase in exports. These factors keep Irish prices notably above pre-2021 averages, extending to the end of the decade.

Source: Cornwall Insight’s All Island Forward Curve

Reference:

Q3 (Jul – Sept) forecasts for 2024: €186.62/MWh

Q4 (Oct-Dec) forecasts for 2024: €152.54/MWh

Power price forecasts (Q4) – average price per fiscal year (per €/MWh)