The final module for the 2nd production line of Russian gas producer Novatek’s Arctic LNG 2 project, departed from China last week. In February the company will integrate the last three modules ahead of towing the LNG train to the Gydan peninsula this summer. While US sanctions have not yet halted construction, it remains to be seen how much LNG Novatek will be able to sell.

In a major step toward completion of the second train - or liquefaction unit - of Russian gas producer Novatek’s Arctic LNG 2 project, the final prefabricated module left a Chinese construction yard bound for Murmansk in the Russian Arctic last week.

A LNG train consists of various components to process, purify, and convert natural gas to liquefied natural gas (LNG).

The module departed from the Penglai Jutal Offshore Engineering (PJOE) yard in Penglai in the Chinese province of Shandong aboard heavy load carrier Hunter Star on 15 January, shipping data and satellite imagery show. Industry sources confirmed to HNN that this shipment concludes module deliveries from China for Train 2.

Earlier in January two modules shipped from the same yard aboard Red Box’s carriers Audax and Pugnax.

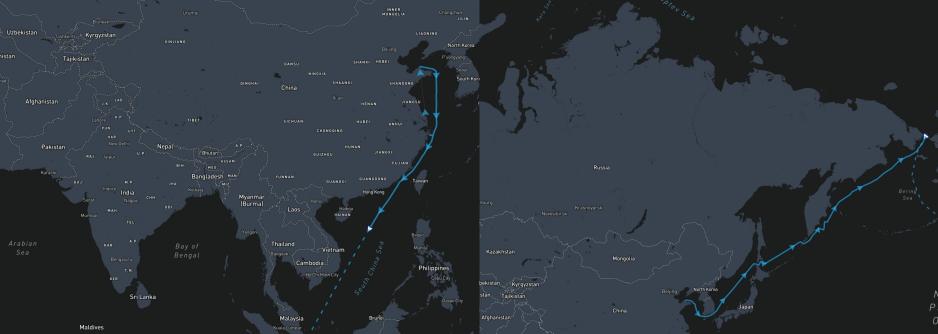

Route of Hunter Star (left) and Audax and Pugnax (right) following their departure from the Penglai Jutal Offshore Engineering (PJOE) yard in the Chinese province of Shandong. (Source: Maritime Optima)

Despite a months-long work stoppage by Chinese builders following Western sanctions in 2022, Novatek ultimately managed to secure all modules, including replacing Western turbines with Chinese imports. The modules will now undergo final assembly at the Belokamenka yard outside Murmansk.

The second train could be ready for sail-away this summer. Novatek aims to tow the gravity based structure (GBS) to the Utrenney terminal in Russia in August, explains Ben Seligman, a project specialist for Arctic oil and gas development.

“The main question in my mind would be the status of the LNG membrane storage system within the GBS, given GTT's departure from Russia a year ago,” Seligman cautions.

Gaztransport & Technigaz, or GTT, is a French multinational naval engineering company specializing in membrane containment systems for the transport and storage of liquefied gas.

Significant uncertainty looms

While the delivery of all twelve modules represents a significant step toward completing Train 2, the project’s overall future has become increasingly uncertain following targeted US sanctions. Novatek’s European, Japanese, and Chinese partners have exited the project under force majeure declarations.

It is possible that prices for sanctioned Russian LNG would be cheaper

Jason Feer, global head of business intelligence at Poten & Partners

The latest round sanctions bar the purchase and transport of LNG from the project. Thus, questions mount who Novatek will sell its LNG to and aboard which vessels it will deliver it. France’s TotalEnergies announced last week that it will not take receipt of any LNG from the project in 2024.

Novatek may try to sell its LNG at a discount on the spot market to buyers in Asia.

“It is possible that prices for sanctioned Russian LNG would be cheaper than for other supplies, but in this case, Chinese importers would have to resell their cargoes from other suppliers and replace them with Russian supply,” explains Jason Feer, global head of business intelligence at Poten & Partners.

“India would be in a similar situation, though they are more price sensitive so discounts on Russian supply may be more attractive."

The project’s future may in part hinge on the ability of Novatek's partners, including China’s state-owned oil major, the China National Offshore Oil Corporation (CNOOC) and China National Petroleum Corp (CNPC), to secure sanction exemptions.