The Ways and Means Committee of the U.S. House of Representatives on Nov. 19 released a draft tax package for clean energy projects that includes a five-year extension of the 30% solar Investment Tax Credit (ITC), along with new incentives for energy storage.

The legislation also supports incentives for electric vehicles (EVs), offshore and onshore wind farms, and energy efficiency measures, among other items.

“This bill will build on existing tax incentives that promote renewable energy and increase efficiency and create new models for technology and activity to reduce our carbon footprint,” Mike Thompson (D-Calif.), chairman of the Subcommittee on Select Revenue Measures, said in a statement Tuesday.

Critics of the package include six groups—Americans for Tax Reform, Americans for Prosperity, the Center for a Free Economy, FreedomWorks, Heritage Action, and the National Taxpayers Union. Those groups earlier Tuesday shared a letter and asked lawmakers not to extend tax credits or give more support for renewable energy, saying phaseouts of credits adopted in 2015 should be continued.

“Clearly these industries can and should stand on their own two feet. Cronyism tax benefits such as these are bad tax policy,” the groups wrote.

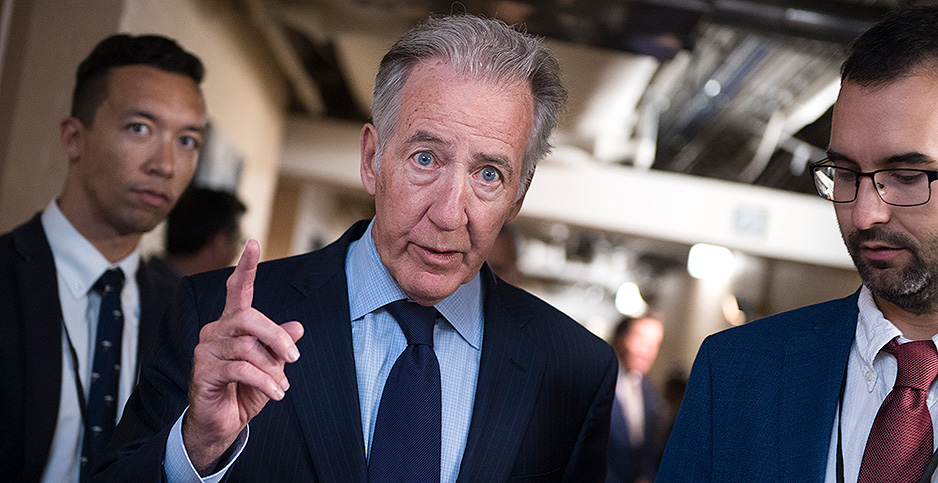

Ken Kimmell, president of the Union of Concerned Scientists, had a different view. “House Ways and Means Chairman Richard Neal recognizes that the tax code works best when it reflects our needs and our values,” Kimmell said. “Tax credits that support clean energy will reduce carbon emissions and create jobs, strengthen local economies, and improve public health at the same time.

“Congress needs to pass as many of these tax incentives as possible before the end of the year to keep clean energy momentum going at a time when the federal government is going backward on addressing the greatest challenge we face: runaway climate change.”

Extensions Through 2024

The measure would extend through 2024 a credit for electricity produced from renewable energy sources, including qualified hydropower. It extends a 30% investment tax credit for solar energy projects, a level that would drop in later years. The measure also extends for one year a credit for carbon oxide sequestration facilities that begin construction before the end of 2024.

It also makes standalone energy storage projects eligible for tax credits; previously, such projects needed to be paired with another renewable energy source.

Other proposals in the draft legislation include preserving the tax credit for wind energy projects at 60% through 2024. A credit for biodiesel production at $1 per gallon would be extended through 2021; the credit would phase out in 2024.

Representatives from the renewable energy sector quickly voiced their support for the measure.