Gas and oil giant Shell is looking to close as many as 1,000 retail gas stations in the coming years, as it pivots toward deployment of electric vehicle (EV) charging stations.

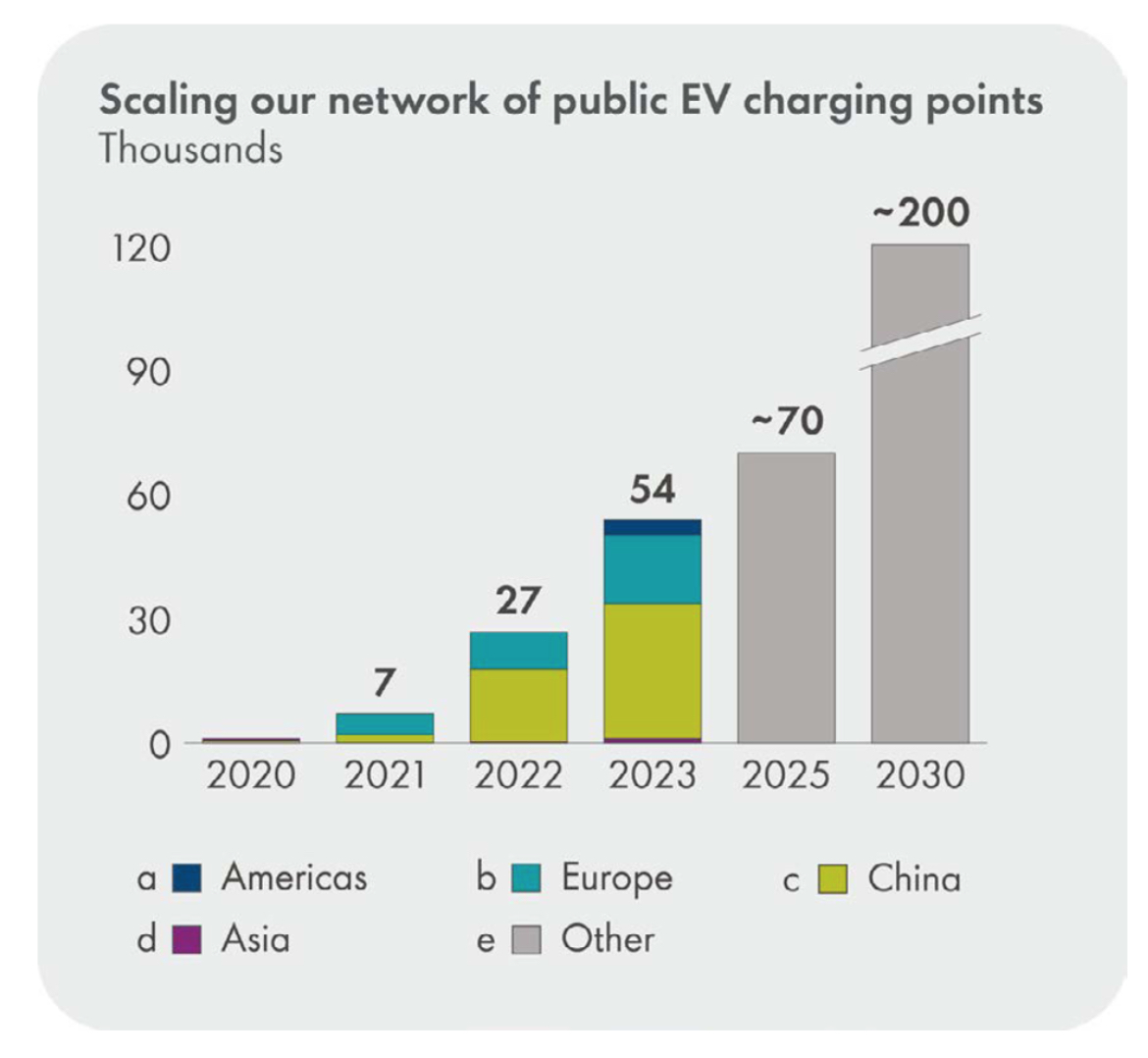

Gas and oil giant Shell is looking to close as many as 1,000 retail gas stations in the coming years, as it pivots toward deployment of electric vehicle (EV) charging stations.In its latest Energy Transition Strategy report, England-based Shell says it plans to close 500 retail sites per year in 2024 and 2025. The company plans to instead focus on scaling its public EV charging network, and in hopes to bring total charging points up to 200,000 by 2030, up from around 54,000 today.

“In total, we plan to divest around 500 Shell-owned sites (including joint ventures) a year in 2024 and 2025,” the company writes on page 28 of the document, as initially spotted by Bloomberg.

The company has also said it plans to focus on public charging stations, rather than on home charging, due to its competitive advantages in the sector.

Credit: Shell

“We are focusing on public charging, rather than home charging, because we believe it will be needed most by our customers,” Shell writes. “We have a major competitive advantage in terms of locations, as our global network of service stations is one of the largest in the world.

“We have other competitive advantages, such as our convenience retail offering which allows us to offer our customers coffee, food and other convenience items as they charge their cars. As we grow our business offering charging for electric vehicles, we expect an internal rate of return of 12 percent or higher.”

The recent energy transition strategy also softens some of the company’s carbon emissions targets for the next 10 years, though it still holds true to original commitments to reach net-zero carbon by 2050. The company is also planning to invest $10 to $15 billion into low-carbon energy solutions between 2023 and the end of 2025.

The report also notes the company’s plans to support key oils used in offshore winds and the development of EV batteries.

“We are growing our premium lubricants portfolio to supply key energy transition sectors such as transformer oils used for offshore wind parks, and cooling fluids to support the development of electric vehicle car batteries.”

Shell also shared a video detailing the 2024 transition strategy, which you can watch below.

ByZachary ViscontiPosted on March 19, 2024Gas and oil giant Shell is looking to close as many as 1,000 retail gas stations in the coming years, as it pivots toward deployment of electric vehicle (EV) charging stations.

In its latest Energy Transition Strategy report, England-based Shell says it plans to close 500 retail sites per year in 2024 and 2025. The company plans to instead focus on scaling its public EV charging network, and in hopes to bring total charging points up to 200,000 by 2030, up from around 54,000 today.

“In total, we plan to divest around 500 Shell-owned sites (including joint ventures) a year in 2024 and 2025,” the company writes on page 28 of the document, as initially spotted by Bloomberg.

The company has also said it plans to focus on public charging stations, rather than on home charging, due to its competitive advantages in the sector.

Credit: Shell

“We are focusing on public charging, rather than home charging, because we believe it will be needed most by our customers,” Shell writes. “We have a major competitive advantage in terms of locations, as our global network of service stations is one of the largest in the world.

“We have other competitive advantages, such as our convenience retail offering which allows us to offer our customers coffee, food and other convenience items as they charge their cars. As we grow our business offering charging for electric vehicles, we expect an internal rate of return of 12 percent or higher.”

The recent energy transition strategy also softens some of the company’s carbon emissions targets for the next 10 years, though it still holds true to original commitments to reach net-zero carbon by 2050. The company is also planning to invest $10 to $15 billion into low-carbon energy solutions between 2023 and the end of 2025.

The report also notes the company’s plans to support key oils used in offshore winds and the development of EV batteries.

“We are growing our premium lubricants portfolio to supply key energy transition sectors such as transformer oils used for offshore wind parks, and cooling fluids to support the development of electric vehicle car batteries.”

Shell also shared a video detailing the 2024 transition strategy, which you can watch below.

Shell acquired the U.S. EV charging network Volta Charge last year, along with signing dozens of other partnerships to support EV charger deployment in the past few years. The company’s charging network, Shell Recharge, made up around 1.7 percent of the public DC fast-charging network in the U.S. as of Q3 last year, according to a recent report from the National Renewable Energy Laboratory (NREL).

Comparatively, Tesla remained the dominant market leader with its Supercharger network, making up 61.7 percent of those in the U.S. While Superchargers were previously only available to EV owners with Tesla vehicles, the automaker has recently started opening them up to other brands, beginning with Ford and Rivian.