Utilities produced just over 4 million kilowatt hours (KWh) of electricity from nuclear plants in the first three months of 2024, up 13.4% from the same period in 2023, according to data compiled by LSEG.

That tally was the highest for the first quarter of the year since 2021's 4.11 million KWh, and indicates that France's power producers have substantially recovered from the series of issues that curbed nuclear generation in recent years.

France's power firms have boosted nuclear generation to highest since 2021

France's power firms have boosted nuclear generation to highest since 2021 France's power firms have boosted nuclear generation to highest since 2021

However, given that France gets around 70% of its electricity from nuclear facilities, and that France is mainland Europe's largest clean power exporter, it is critical that the country's fleet of creaky reactors remain in operational shape and not suffer any fresh production setbacks.

NUCLEAR RECOVERY

France's nuclear reactor fleet faced a swath of output issues since 2022, including extended maintenance issues at aged reactors, hotter-than-normal river temperatures which curtailed cooling operations, and protracted labour negotiations with energy sector workers.

The production issues were most acute in 2022, when nuclear electricity generation dropped by over 22% from the year before to the lowest in 30 years.

As nuclear power accounts for roughly 70% of France's electricity supply, such a sharp plunge in nuclear generation forced French utilities to boost use of natural gas and other power fuels in 2022, just as regional gas markets were upended by Russia's invasion of Ukraine.

This jump in France's use of natural gas exacerbated the gas shortages seen in Europe in 2022, and helped propel regional power prices to their record highs that year.

Nuclear output increased by around 14% in 2023 from 2022's lows, but remains below previous peaks as maintenance work progresses across the country's reactor fleet, data from energy think tank Ember shows.

The average age of France's operational nuclear power plants is around 36 years, and no new ones have been brought online this century, data from International Atomic Energy Agency shows.

CLEAN HELP

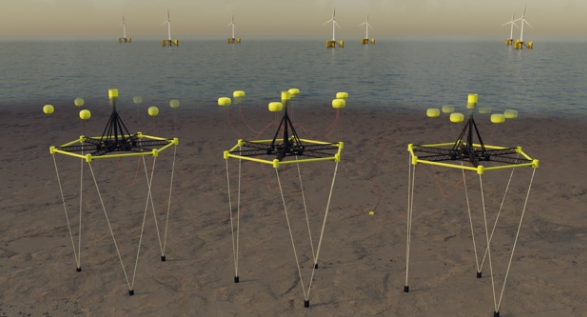

While the advanced age of the nuclear fleet underscores how important reactor maintenance and repair will be for the country going forward, French power firms have been able to deploy growing volumes of renewable energy in recent years.

In 2023, output from solar and wind farms increased by 18% and 26% respectively from the year before to record highs.

Output from hydro plants also increased sharply last year, by 17% from 2022's levels, which helped push the country's total clean electricity generation to the highest since 2021 and account for a record 24.3% share of total electricity output.

That combination of record renewables output alongside higher nuclear and hydro production helped drive the carbon intensity of France's electricity generation to just 45 grams of carbon dioxide per kilowatt hour in 2023, according to electricitymaps.com.

That total was 37.5% less than the 72 grams of CO2 per KWh generated in 2022, when French utilities were forced to use more natural gas to compensate for the reduced nuclear output.

The low intensity of French electricity production has rendered France a key exporter of clean electricity to neighbouring nations, especially to countries with far higher electricity carbon intensity such as Germany (423 grams of CO2 per KWh), Italy (375g CO2/KWh) and Spain (160g of CO28/KWh).

Surplus nuclear power output has also pushed France's wholesale power costs to the lowest level since early 2021, and well below the power price of Germany, Europe's largest power consumer and a large importer.

Wholesale power prices in France have recently slumped to the largest discount to Germany power prices in more than 4 years

Wholesale power prices in France have recently slumped to the largest discount to Germany power prices in more than 4 years Wholesale power prices in France have recently slumped to the largest discount to Germany power prices in more than 4 years

Additional expansions in solar and wind capacity are expected in 2024 and beyond which could help further reduce France's carbon intensity and boost volumes of exportable clean power.

However, it is clear that nuclear power will remain the main pillar of France's electricity generation system for the next several years.

As such, continuing progress in terms of reactor maintenance and repair will be critical, as France can only play the role of key regional clean power supplier with a fully operational nuclear fleet.

Any setbacks for French nuclear output could have regional consequences, and undermine all of Europe's efforts to transition energy systems away from dirtier fuels.