California’s market potential for virtual power plants (VPPs) could hit 7.5 GW by 2035, exceeding 15% of peak demand and 5 times the existing capability, according to a new report from the Brattle Group prepared for GridLab.

The report, California’s Virtual Power Potential: How Five Consumer Technologies Could Improve the State’s Energy Affordability, argues that VPPs could create consumer savings of $550 million per year in California by 2035, and new policies could help facilitate growth in areas limited by a “variety of technical, regulatory, economic, and market barriers.” The estimates are based on achievable participation rates and technologies that are commercially available today, Brattle said.

A residential customer with all four VPP technologies considered in the analysis could potentially receive incentive payments of $500 to $1,000 per year, the report said.

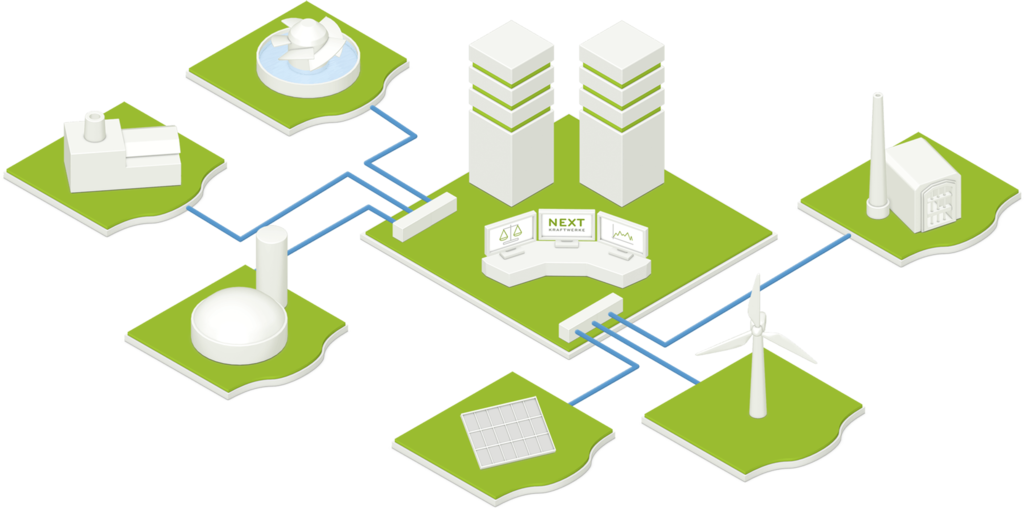

The purpose of the report, Brattle said, was to estimate the market potential for VPP deployment in California, with market potential defined as “all cost-effective VPP capacity that can be developed at achievable, voluntary participation rates by the year 2035.” The report focused on smart-thermostat-based air-conditioning control, behind-the-meter (BTM batteries, residential electric vehicle charging, grid-interactive water heating, and automated demand response for large commercial buildings and industrial facilities. The report argues this “technological diversity” could allow accelerated adoption of a different technology if one specific technology lags behind expectations.

VPP technologies

The report notes that California consumers are already adopting clean and flexible technologies, such as smart thermostats, electric vehicles, and batteries, at a “rapid” rate. VPPs could take advantage of this adoption to create a resource that can “reduce, shift, or generate” electricity when needed, the report says.

Additional VPP technologies could increase the potential estimate, Brattle said, such as vehicle-to-grid capability advancing to the point of commercial development resulting in an increase in EVs, or standalone energy efficiency programs targeting savings during peak hours. Thermal energy storage, behavioral demand response, and managed EV fleet charging are other sources of “virtual” capacity, the report says.

Consumer savings

By 2035, a statewide portfolio of VPPs could avoid over $750 million per year in traditional power system costs, the report said. The majority of VPP costs would come in the form of participant incentive payments, with an estimated $500 million per year paid back to participating consumers.

Individual households participating in all four VPP options examined in the study could possibly receive $500 to $1000 per year from their contributions. Additionally, the report says, the lower cost of power for VPPs would be lower than alternative power supply options, which could result in net cost savings for all ratepayers, including non-participants.

California’s VPP potential

In addition to the cost benefits analyzed in the study, Brattle says VPPs could reduce risks associated with interconnection delays, as VPPs can be “built” as quickly as customers adopt new technologies and enroll in programs. VPPs can also scale flexibly as demand grows, the report says.

However, achieving the VPP potential estimated in the report would require “high but achievable” levels of technology adoption and enrollment. Statewide policy goals could help, the report says. California has a 7,000 MW load shifting goal and load management standards that could facilitate VPP adoption, and new draft legislation could establish the equivalent of a renewable portfolio standard for VPPs across the state, the report said.