Pemex's international trading unit in April began enforcing exports cuts over supply crude contracts to customers in the U.S., Asia and Europe to increase its availability of crude for domestic refining. The reductions have prompted many clients to seek alternative crude grades.

Even before the first round of cuts, Pemex oil exports to all destinations in March fell 29% year-on-year to 687,000 bpd from an overall crude output of 1.53 million bpd, the company reported on Friday.

Planned maintenance at some refineries and a slower-than-expected startup at the new 340,000-bpd Olmeca plant, however, will reduce the need for domestic crude in May, the two sources and an additional person with knowledge of the company's operations said.

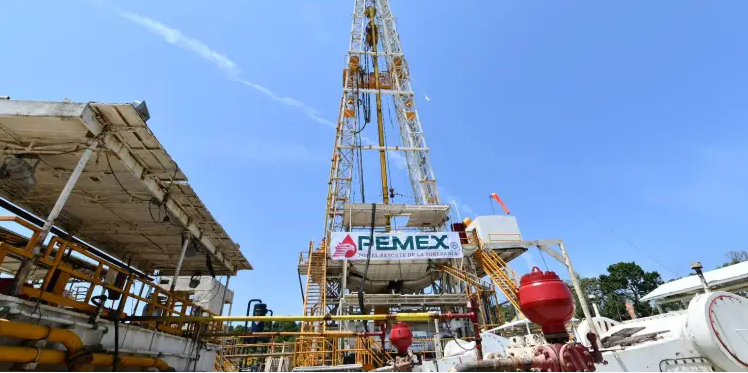

Pemex's Olmeca refinery in the port of Dos Bocas in southeastern Tabasco state, has been running behind schedule and over budget. Earlier on Friday, Pemex executives said that the refinery would start producing diesel next month.

Pemex did not immediately respond to a request for comment.

Recent fires at two Pemex refineries did not impact crude processing at those plants because they happened at unrelated infrastructure, but the company's overall demand for domestic oil is expected to fall next month, the sources added.

Traders expect Pemex and its trading unit to continue using contract provisions in supply contracts this year allowing them to allocate the exports volumes on a monthly basis. That will give them room to adjust volumes available for exports according to domestic refining needs.

As of Friday, Pemex' refineries were processing about 868,000 bpd of crude, one of the sources said, adding that all facilities were in service. In March, oil processing averaged 1.06 million bpd according to official figures.