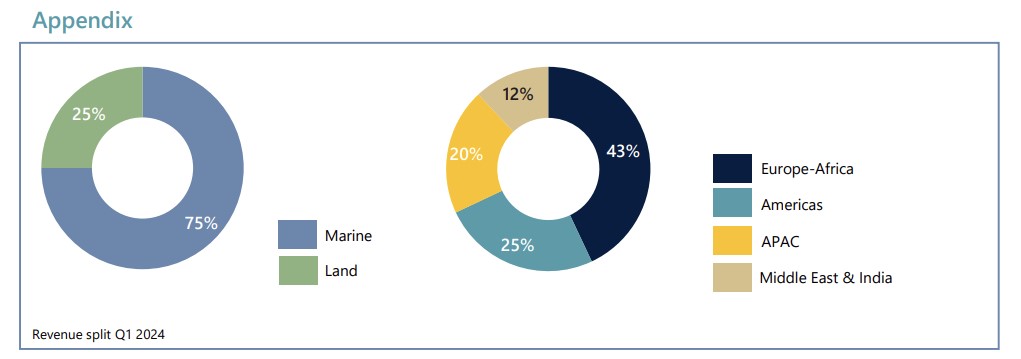

Revenue in the first quarter was EUR 503.2 million, a 9 per cent increase compared to EUR 465.8 million in the first quarter of 2023. In the Marine segment, revenue grew by 13.8 per cent, from EUR 335.1 million in the first quarter of 2023 to EUR 378.2 million in the first quarter of 2024, enabled by the expansion of the geotechnical fleet.

Overall, vessel utilization was 65 per cent versus 68 per cent in the comparable period last year, due to scheduled maintenance and lower utilization of the geophysical fleet. While infrastructure revenue increased, Land declined by 3.5 per cent, from EUR 130.7 million in the first quarter of 2023 to EUR 125 million for the first quarter of 2024, overall due to a lower number of nearshore LNG projects in the US, Fugro said.

Despite the typically slow first quarter, the company reported an 8.8 per cent EBIT margin, said to be driven by an overall strong Marine performance, most notably in Europe-Africa, as a result of excellent project execution and improved terms and conditions.

Source: Fugro

Operating cash flow before changes in working capital increased by EUR 24 million to EUR 66.2 million, while working capital increased compared to an exceptionally low level at year-end 2023 (at 8.9 per cent of revenue), by EUR 91.4 million in total. Capex amounted to EUR 32.7 million.

On balance, free cash flow decreased by EUR 73.6 million to negative EUR 58 million. Net debt amounted to EUR 198.6 million compared to EUR 110.5 million at year-end 2023 mainly due to higher working capital.

According to Fugro, the 12-month backlog was up in both Marine and Land as a result of double-digit growth in Europe-Africa and Asia Pacific.

“The year 2024 is off to a good start. We are capturing a significant part of site characterisations in the offshore wind market, which continues to be buoyant as a result of the energy transition in numerous countries. Many governments are demonstrating their commitment to carbon reduction roadmaps, for example by responding swiftly to recent delays in several offshore wind projects by increasing prices for the energy that the owners of these developments generate,” said Mark Heine, Fugro’s CEO.

“In this typically low winter season, we reported a strongly improved EBIT margin of 8.8% driven by an overall robust performance in Marine, fueled by excellent operational execution, operating leverage and improved terms & conditions; despite still increasing cost levels.”

Recent awards

In the Europe-Africa region, Fugro secured detailed geotechnical surveys for Dogger Bank South offshore wind project sites off the northeast coast of England, a geophysical UXO identification and clearance project for TenneT on 2 GW offshore grid connection projects offshore Germany, a fully remote pipeline inspection in the North Sea under a three-year framework agreement using the newest Blue Essence uncrewed surface vessel, and geotechnical investigation to support the design of a hydrogen-ready gasfired power plant for RWE in Germany.

In the Americas, the Dutch company received an AUV survey contract in the Gulf of Mexico for BP to deliver deepwater geophysical data for Tiber and Kaskida projects, a geotechnical site investigation for an upstream operator in Trinidad to support foundation engineering for offshore infrastructure, and a remote sensing and mapping project to assess 3,900-kilometre transmission corridor for a US-based power company.

Speaking about Asia Pacific, a survey contract on INPEX’s Abadi LNG and carbon capture and storage project (CCS) in Indonesia was secured, as well as geotechnical investigations for four offshore wind developments in Japan, South Korea and Taiwan and positioning and construction support services at the Yunlin offshore wind farm in the Taiwan Strait.

Finally, in the Middle East & India region, Fugro will conduct a comprehensive program of geophysical, geotechnical, and ROV crossing services for ADNOC’s Hail and Ghasha project, the deployment of LiDAR buoy for India’s National Institute of Wind Energy off the Tamil Nadu coast, site characterization and asset integrity operations for Technip in relation to the Dorra gas field, and onshore ground investigations for NEOM infrastructure developments.

Full-year outlook

In line with the new strategy Towards Full Potential and related mid-term guidance, Fugro said it expects continued revenue growth, primarily driven by the energy markets, EBIT margin within the mid-term target range of 11-15 per cent, ongoing investments in assets, technology, people and execution excellence, as well as a capex of around EUR 250 million.

“The implementation of our new strategy, Towards Full Potential, is getting underway. Ongoing investment in our people, technology and execution excellence is key. Despite tight labour markets, we are successful in attracting the people we need to support our clients. In the first quarter, we hired over 500 people, and voluntary staff turnover declined to 8%. Also, the conversion of Fugro Resilience and Fugro Resolve to geotechnical vessels is nearing completion, further boosting our earnings capacity,” Heine said.

“While carefully navigating macro-economic and geopolitical uncertainties, we are well-positioned to benefit from the energy transition, massive infrastructure investments and urgently needed climate change adaptation.”