The continuing growth in coal dependence in Vietnam highlights the difficulty of dislodging coal from the power systems of fast-growing countries that rely on cheap and abundant energy sources to generate economic competitiveness.

GROWING CLOUT

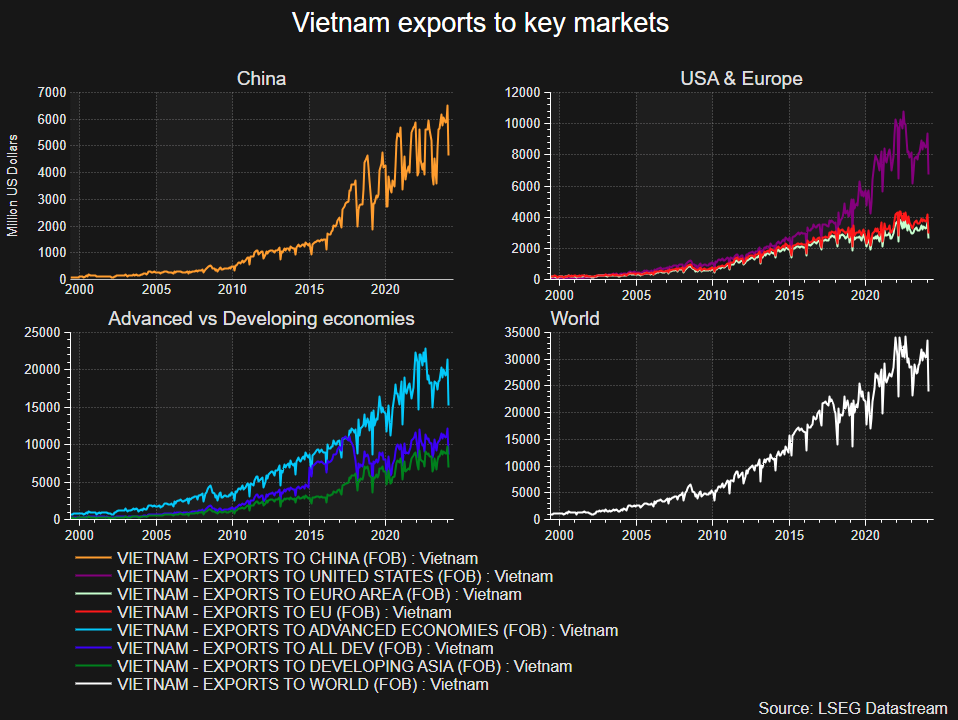

Vietnam has been a major beneficiary of the re-routing of supply chains away from China in recent years, and has seen rapid growth in its manufacturing base and national exports as companies establish and expand production in the country.

In response, Vietnam's gross domestic product (GDP) is projected to grow by twice the global average through 2029, according to the International Monetary Fund (IMF).

Vietnam exports to key markets

But in order to ensure sufficient low-cost energy for this fast-growing manufacturing sector, Vietnam's power producers have had to prioritize the expansion of fossil fuel-powered generation over power sector decarbonization efforts, which remain part of longer-term plans for the country.

The rapid swell in coal use has seen Vietnam overtake South Korea in coal-fired emissions this year, and has put it on track to finish 2024 as the fourth-largest coal emitter in Asia behind China, India and Japan.

COAL CRUTCH

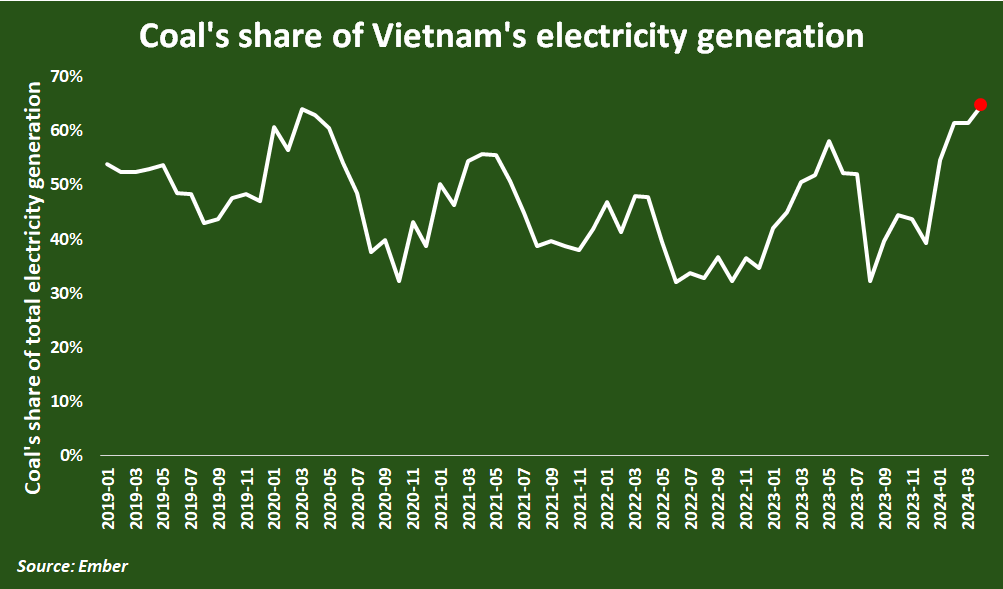

Coal generated a record 64.6% share of Vietnam's electricity generation in April, according to energy think tank Ember, which is up sharply from

Coal's share of Vietnam's electricity generation

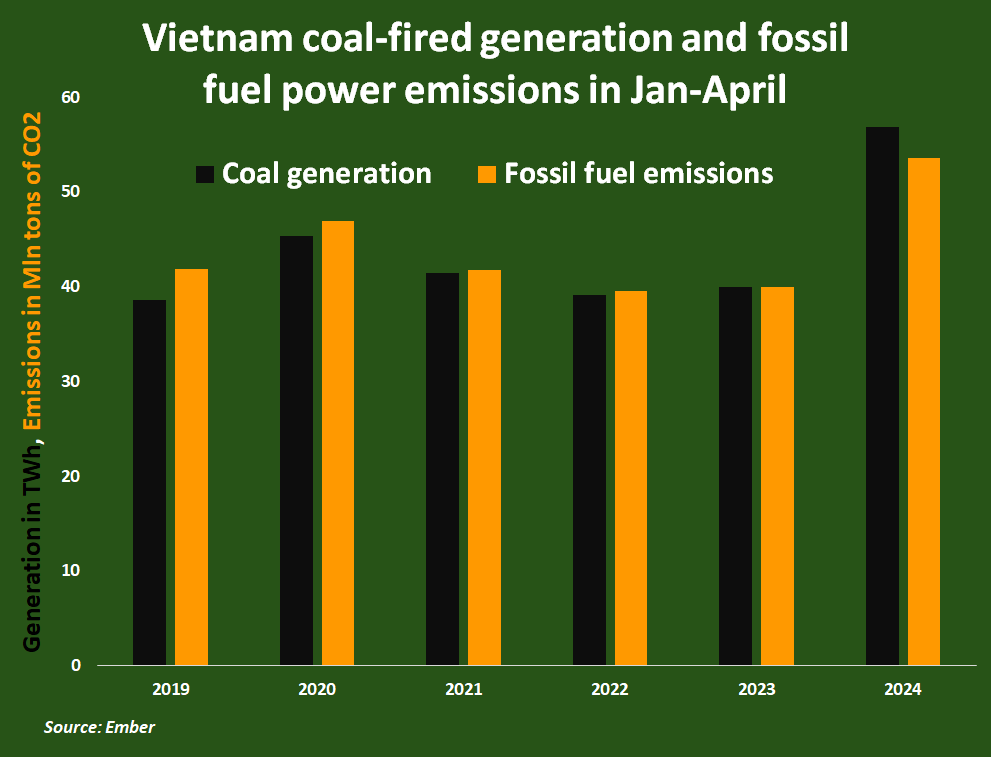

Over the first four months of 2024, total coal-fired electricity generation was 57 terawatt hours (TWh), which was 42.5% more than during the same months in 2023.

Resulting emissions were up 34% to 53.6 million metric tons of carbon dioxide (CO2), Ember data shows.

A key driver behind this year's surge in coal use has been an unusually steep decline in electricity generation from hydro dams, which accounted for an average of around 15% of electricity output so far this year compared to 25% during the same period in 2023.

Vietnam's power firms have also trimmed output from natural gas through April by about 15% from the same months in 2023.

The reduced output from hydro and gas plants has helped cement coal's status as the leading power source in Vietnam, especially during the recent heat wave across Asia that boosted demand for air conditioning throughout the region.

IMPORT HIKES

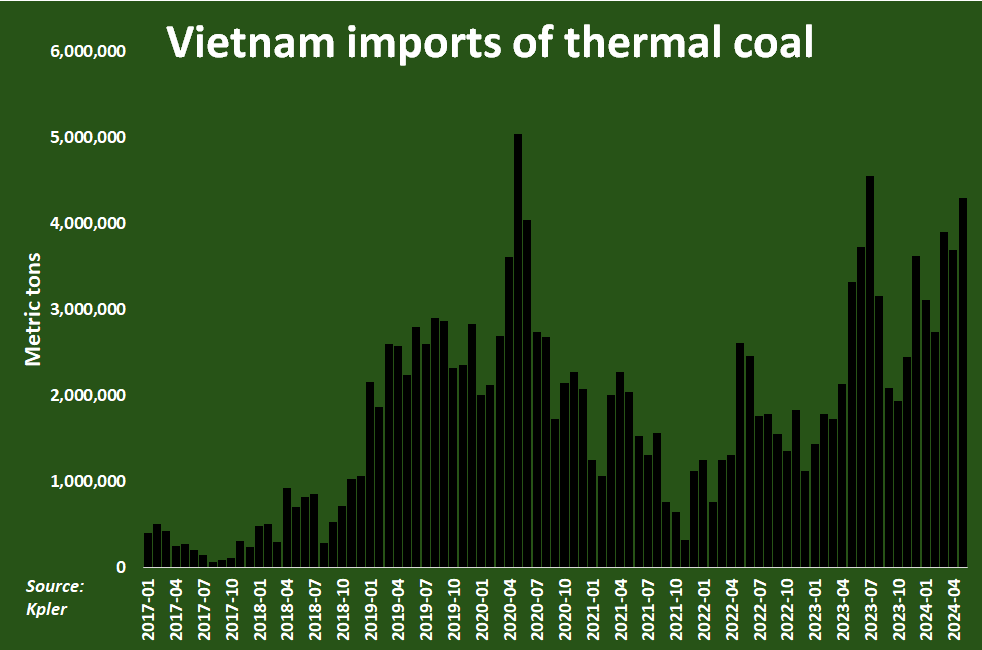

To keep pace with the accelerated coal burn in power stations, Vietnam boosted thermal coal imports by 71% over the first five months of 2024 from the same period in 2023, data from Kpler shows.

The 17.8 million metric tons of thermal coal shipped in by Vietnam through May marks a more than 7 million ton rise from the same period a year ago, and means the country has imported more than 55% of 2023's full-year total in only five months.

Vietnam thermal coal imports

Vietnam's coal import surge contrasted with contractions in coal purchases so far this year in Japan, South Korea, Taiwan and Thailand, and ensured that Vietnam increased its share of global thermal imports to around 4.3% so far this year from an average of 3.1% in 2023.

If the recent spell of above-normal temperatures persists through the coming months, additional imports are likely, and mean that Vietnam's previous annual record tally of 33.1 million tons set in 2020 could be eclipsed this year.

As Vietnam is already on track to set new annual records in coal-fired generation and emissions, setting a new coal import record would round out the country's status as a major and growing player in global coal markets despite ongoing efforts to cut coal use elsewhere.