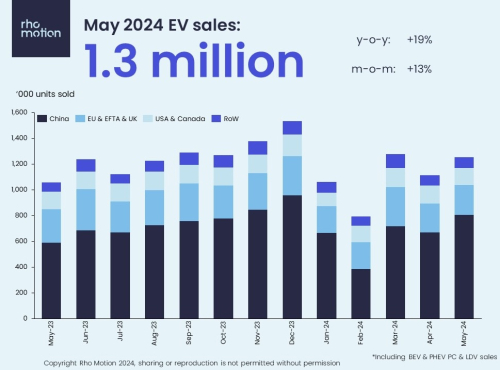

Globally, more than 5 million EVs have been bought so far this year with 1.3 million cars sold in May 2024. This is a 20% increase so far this year compared to this time last year. The Chinese market has grown by 31% during the same period, the EU & EFTA & UK by 4%, and the US & Canada by 5%.

As EU leaders ready themselves to announce their increased tariffs on Chinese EV imports, they will be concerned by the latest stumbling sales figures for the region. If they hope to achieve their ambitious climate goals, they will want to maintain good trade relations with the fastest-growing EV market. Meanwhile, the US & Canada are also suffering a blow to sales figures this year as Tesla struggles to get back into the fast lane and President Biden announces tariffs for Chinese EV and battery imports.

—Charles Lester, Leading EV Data Analyst at Rho Motion

The top two Battery EVs sold in Europe this year have been the Tesla Model Y and Model 3, followed by Volvo’s EX30 that was released late last year. So far in 2024, China’s largest EV manufacturer, BYD, has enjoyed a market share in Europe of 1%, rising from ~0.5% over 2023.

In the US & Canada, EV sales have decreased by 4% m-o-m and decreased by 3% y-o-y. GM continues to ramp up production of its Blazer EV, Equinox EV, and the Honda Prologue at its facility in Ramos Arizpe, Mexico, with almost 50,000 EVs produced this year.

China continues to have the strongest regional growth, increasing by 20% m-o-m and increasing by 36% y-o-y. BYD sold a record number of monthly PHEVs with over 184,000 units sold. Overall, it sold 330,000 EVs in May with BYD representing over one-third of the domestic EV sales market share in China so far this year. Overall in 2024, BYD has reported to have sold 176,000 EVs overseas.

Jan-May 24 v Jan-May 23:

Global: +20%

EU, EFTA & UK: +4% (down from +24% 2023 v 2022)

China: +31%

US & Canada: +5%

May 24 v May 23:

Global: +20%

EU, EFTA & UK: -9%

China: +36%

US & Canada: -3%