Solar has become the lowest-cost form of new generation in the United States, but the economics behind the manufacturing and procurement of photovoltaic cells may jeopardize 2030 goals.

A Clean Energy Associates analysis commissioned by the American Council on Renewable Energy (ACORE) surveys the current health of the U.S. solar sector and explores the potential ramifications of new tariffs resulting from antidumping and countervailing duty (AD/CVD) investigations into solar cells and modules imported from Cambodia, Malaysia, Thailand, and Vietnam. CEA finds new potential AD/CVD tariffs could increase costs to a level that significantly restricts solar supply and installations in the U.S., impeding America’s ability to create jobs, provide clean, affordable energy, and achieve climate targets.

On June 7, the International Trade Commission voted to find “injury or threat of injury” to the U.S. solar manufacturing import from imports of PV cells, whether or not assembled into modules, from the four aforementioned Southeast Asian nations. Those countries accounted for 78% of all U.S. module imports in 2023 and 58% of its cell imports last year.

Potential new duties could raise costs by 10 ¢/W for domestically produced modules and 15 ¢/W for imports, significantly impacting project economics. Duties could apply as early as June 23 (AD) and August 22 (CVD) if there is a “critical circumstances finding” by the ITC.

Christian Roselund, senior policy analyst at Clean Energy Associates, sees potential problems ahead if developers can’t get reliable access to PV cells that are affordable enough to make their projects pencil.

“The 2022 solar anti-circumvention case (brought by Auxin) caused the slowest quarter for solar imports in two years,” Roselund warned, noting the investigation led to an annual decline in total installed solar volume. The 2022 AD/CVD decision led to a price increase from 35 to 55 ¢/W that was only mitigated through Presidential action, which has since expired.

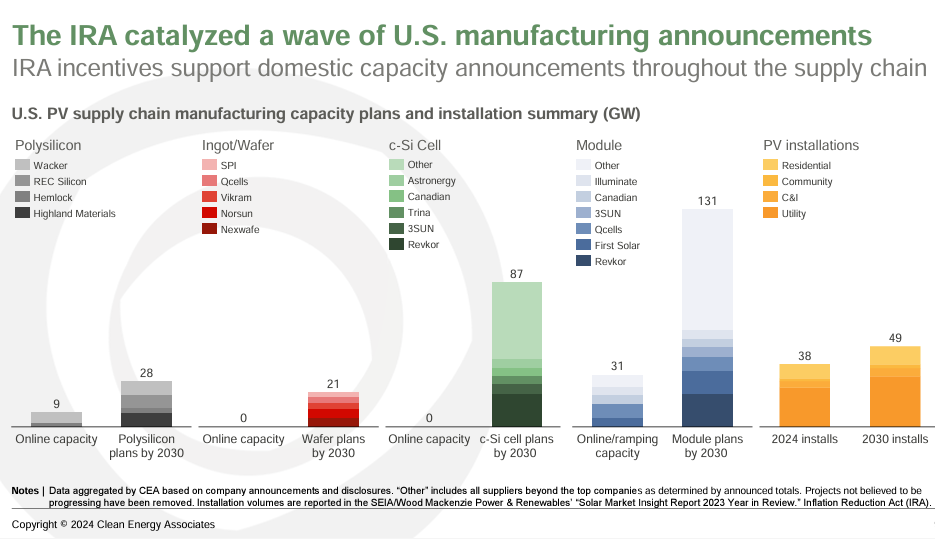

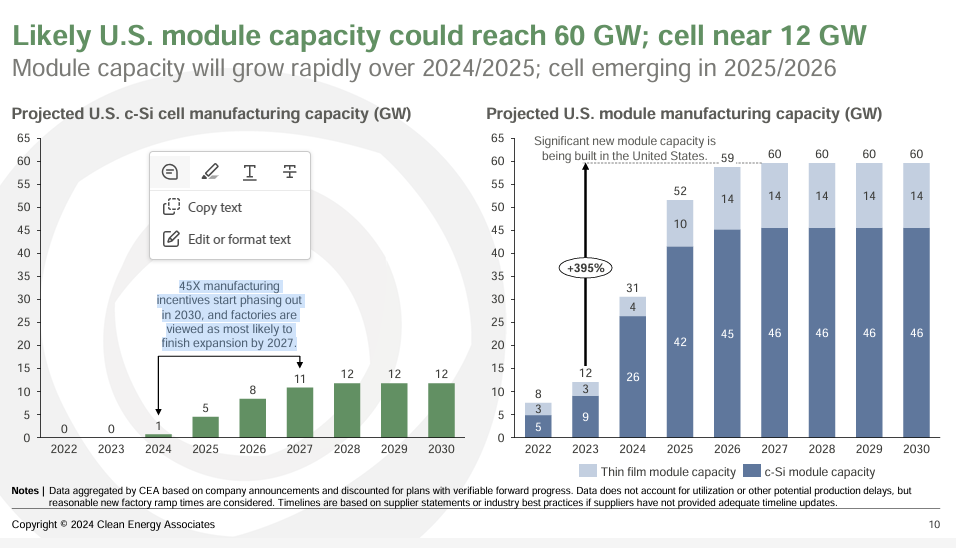

U.S. manufacturers rely heavily on imported cells to run their lines competitively and will need to continue to do so for the foreseeable future, says CEA. While the U.S. is actively constructing the necessary module manufacturing capabilities to support its installation needs, more time is needed to build sufficient cell capacity, and duties on cells could harm growing U.S. module makers. Cell capacity has a longer build-out timeline (over two years) than modules and needs more time to come online due to stringent permitting requirements.

Courtesy: Clean Energy Associates

According to CEA’s projections, the United States will need to import up to 41 GW worth of cells and/or modules to meet its quota of projected installations until Section 201’s phase-out in February 2026. Cell imports during this time will likely add a cost burden to buyers.

“Module manufacturers need cells and they need them at a low cost to make their pro formas work,” said vice president of market intelligence at CEA, Dan Shreve. “Where are those cells going to come from, and at what cost?”

Courtesy: Clean Energy Associates

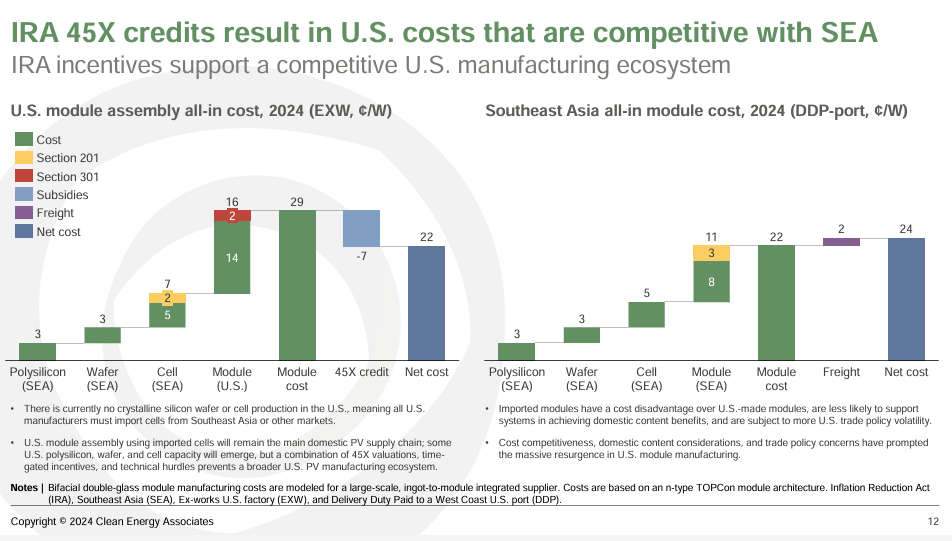

Shreve contends there has never been a better time to bring new domestic capacity online. He argues Inflation Reduction Act (IRA) incentives support a competitive domestic manufacturing system, which can drive the cost per watt down to 22 cents for a U.S.-made cell (compared to 24 cents from a Southeast Asian country).

CEA projects nearly threefold growth in total domestic capacity from 2023 to 2030 and expects 2030 domestic demand for solar cells to be five times the projected U.S. c-Si cell manufacturing capacity.

“Tariffs increase capital costs, increased capital costs has an influence on the price of electricity, which has an effect on demand,” noted Shreve.

Courtesy: Clean Energy Associates

CEA sees only 7 GW of domestic cell manufacturing in a “meaningful state of production ramping,” projecting 12 GW of capacity by 2030- when installation demand will be closer to 60 GW.

Ultimately, Clean Energy Associates contends antidumping and countervailing duties are especially harmful to the solar industry. Duties could raise manufacturing costs, leading to the cancellation of projects with marginal economics and slowing climate goal progress, and leave nearly 34 GW (by 2030) of U.S. PV module capacity without competitively-priced cells.