The results were lifted by strong performances in the oil and gas production and retail marketing businesses and the profit was nearly 25% higher than the same time a year ago, in a sign that CEO Wael Sawan's drive to cut costs is paying off.

Europe's top oil and gas companies are turning in lower refining margins in Europe this quarter after two years of stellar profits.

On Tuesday, BP raised its dividend by 10% after forecast-beating earnings of $2.8 billion. Last week, France's TotalEnergies reported a 6% drop in second-quarter profits hurt by weaker refining margins.

U.S. majors Exxon Mobil and Chevron report on Friday.

"We're seeing the energy system move back towards the pre-2022 normalised level," Sawan told reporters. Energy prices surged in 2022 after Russia invaded Ukraine, pushing oil and gas companies' profits to record highs.

Shell's shares closed 0.5% lower, compared with a 1% decline in the broader European energy index (.SXEP), opens new tab.

Under Sawan, who took office in January 2023, Shell has scaled back renewables and hydrogen operations, retreated from European and Chinese power markets and sold refineries in order to focus on higher margin businesses, primarily in oil and gas.

Shell entered several liquefied natural gas deals in the quarter, underscoring its bet on rising demand for the fuel. It also made investments in new hydrogen and carbon capture projects.

Shell said it achieved cost reductions of $700 million in the first half of 2024, taking total cuts to $1.7 billion since 2022, as part of a savings target of $2 billion to $3 billion by 2025.

"Another resilient quarter from Shell, which marks four in a row of earnings coming in above market expectations," RBC Capital Markets analyst Biraj Borkhataria said.

WEAKER TRADING

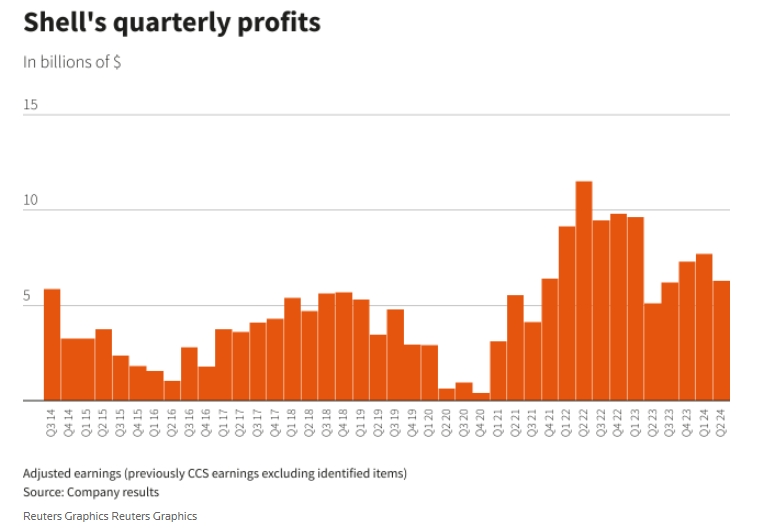

Shell's second-quarter adjusted earnings, its definition of net profit, exceeded analysts' expectations of $6 billion.

Earnings rose from $5.1 billion a year earlier but were lower than the $7.7 billion profit booked in the first quarter.

The British company said it would buy back a further $3.5 billion in shares over the next three months, at a similar rate to the previous quarter. It kept its dividend unchanged at 34 cents per share.

The quarterly fall reflected lower prices and sale volumes as well as weaker trading at Shell's flagship LNG division, which were a result of seasonally lower demand. LNG volumes were also lower because of plant maintenance.

Shell took an impairment of $708 million after the sale of its Singapore refinery. It also took a $783-million impairment after it paused construction of one of Europe's largest biofuel plants a year before it was planned to go online, citing weak market conditions.

Oil, gas and LNG production are expected to be lower in the third quarter due to a heavy maintenance schedule, Shell said.