Blue said the company will “continue to explore that option” after being asked on the call, NBC Philadelphia reported, but it understands that “any co-location option is going to have to make sense for us, our potential counterparty and stakeholders in Connecticut.”

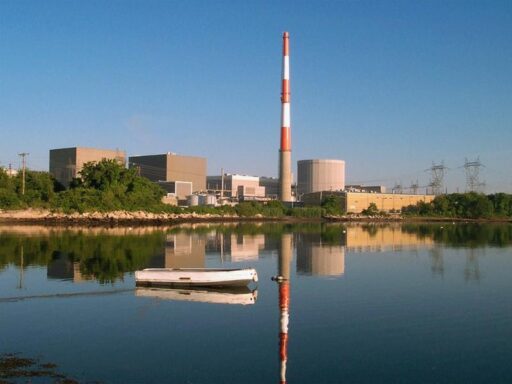

Millstone power station has 2,100 MW of generating capacity. Unit 1 was commissioned in 1970 and closed more than 10 years ago. Units 2 and 3 are licensed through 2035 and 2045, respectively.

In 2022, Connecticut state legislators passed a bill that would exempt the Millstone facility from a construction moratorium. The measure would allow the option of on-site expansion at the site.

Generally, the state’s moratorium prohibits new construction on new nuclear facilities until the Department of Energy and Environmental Protection Agency find that the federal government has identified and approved a way to dispose of nuclear waste. Lawmakers spoke favorably about the growth and potential of small modular reactors (SMRs) – Dominion indicated it supported the bill but had no plans to add an SMR at the Millstone site “as their commercial viability is still many years away.”

Earlier this year, Blue said Dominion is receiving requests to power larger data centre campuses that require total capacity ranging from 300 MW to as many as “several gigawatts.”

The statement is another reflection of the significant load growth in Dominion’s territory that has accelerated in recent years, largely driven by data centres and their AI computing needs.

Dominion has connected 94 data centres totaling over four GW of capacity over the last approximately five years, Blue told investors. The utility’s territory includes Northern Virginia, which is the largest and most dynamic data centre market in the world.

Blue said the utility expected to connect an additional 15 data centres in 2024.

Dominion has not only seen a larger number of data centre customer requests in recent years, but the size of each facility request (in terms of MW) has grown larger. Blue said historically, a single data centre had a demand of 30MW or more. More recent requests indicate a demand of 60-90MW, or greater. Now, he said data centre campuses with multiple buildings could require several gigawatts.

In the US alone, data centre demand is expected to reach 35GW by 2030, up from 17GW in 2022, McKinsey & Company projects.

Grid operators and utilities are projecting significant load growth driven by electrification, new manufacturing, and data center development. This is especially true throughout the PJM Interconnection. Dominion Energy’s service territory is located within the PJM footprint.

According to the company’s annual report filed with regulators earlier this year, data centres represented 24% and 21% of Dominion’s electricity sales in 2023 and 2022, respectively.