The country will need five or more cargoes of liquefied natural gas a month from January through at least the end of March to fill energy supply gaps, according to traders with knowledge of the talks. Discussions about potential deliveries early next year are still preliminary and cargoes haven’t been contracted yet, they said.

Latin America’s largest economy is going through its worst drought in 40 years, forcing the nation that usually relies mostly on hydro power to burn more gas for electricity generation. The outlook for below-average precipitation in the coming months means that rainfall probably won’t be enough to replenish reservoirs.

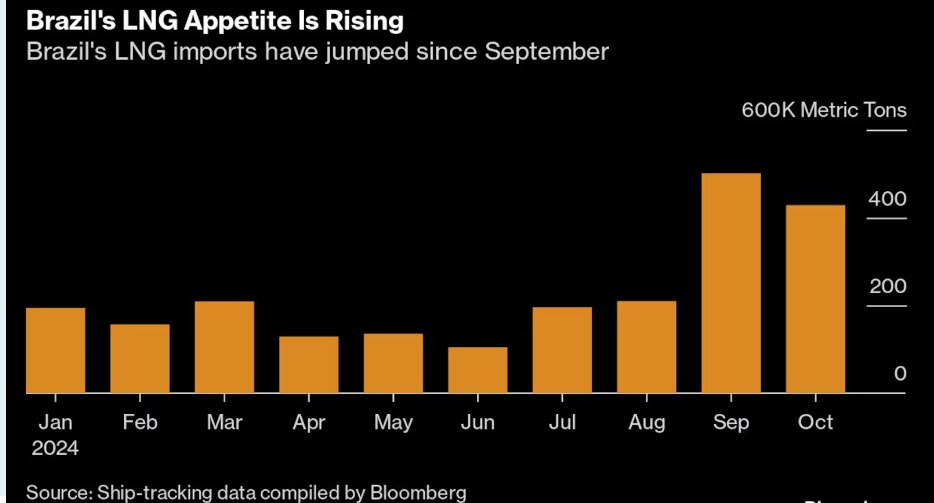

Brazil’s LNG imports have been on the rise since August, ship-tracking data on Bloomberg show. As dam volumes can quickly change, the country typically resorts to LNG purchases on the spot market, rather than the more predictable long-term contracts favored by buyers in Asia and Europe.

Higher demand from Brazil will come at a time when competition for cargoes rises to meet heating needs in the Northern Hemisphere. Egypt also emerged this year as a contender for spot LNG purchases in winter months amid declines in domestic production and higher consumption.

Electricity from power plants that burn gas, coal or other fuels in Brazil this month reached the highest level since December 2021, when a severe drought forced the country to buy record volumes of LNG. Last month, imports of the fuel also jumped to the highest level since then, ship-tracking data compiled by Bloomberg show. So far in October, Brazil imported seven LNG cargoes, according to ship data.

Highlighting the trend, an LNG vessel with a US cargo last weekend diverted from Europe to Brazil. The SM Albatross initially set course for Eemshaven, in the Netherlands, before diverting to Salvador, Brazil, where it’s expected to arrive next Monday.

State-owned Petroleo Brasileiro SA, known as Petrobras, is the biggest LNG buyer in Brazil.

Among private companies, US-based Excelerate Energy Inc. once imported the fuel through a floating terminal leased from Petrobras in the northeastern port city of Salvador and to sell the gas to its customers in Brazil but no longer sells gas downstream of the terminals. In January, Petrobras signed a 10-year agreement to lease the floating terminal from Excelerate.

Gás Natural Açu, a joint venture between BP Plc, EIG Global Energy Partners’ Prumo Logistica, Siemens AG and SPIC Brasil, receives shipments in the Açu port, about 300 kilometers northeast of Rio de Janeiro, for its nearby gas-fired power plants.

Petrobras declined to comment. Excelerate said in an emailed statement that “LNG continues to serve as a reliable backstop to Brazil’s reliance on hydropower and other intermittent sources,” without providing any detail on purchases. Gás Natural Açu didn’t immediately respond to requests for comments.

In the next few months, conditions across southern parts of Brazil and northern Argentina will be dry, according to forecaster MetDesk.

“It has already been fairly dry over the past few months,” said Ben Davis, an energy meteorologist at MetDesk, during a webinar last week, referring to southern Brazil, where most densely populated areas are located. “We are expecting further dry anomalies generally through the Northern Hemisphere winter.”

Brazil’s grid operator, known as ONS, foresees an ongoing reduction in reservoir levels over the next three months, with a recovery in volumes estimated to start in January. It forecasts uncertainties regarding the start and conditions of the wet season. Though some models indicate an increase in rainfall from the second half of October, levels should be lower than the historical average.