Bifacial solar modules only account for a small share of U.S. sales at present, but that has been growing fast. Able to convert sunlight into electricity from both sides, bifacial solar panels’ energy conversion efficiency can be 20% higher than conventional silicon solar modules, according to industry figures. That’s made them popular with large-scale project developers, as well as at sites where space comes at a premium.

“After evaluating newly available information…demonstrating that global production of bifacial solar panels is increasing, that the exclusion will likely result in significant increases in imports of bifacial solar panels, and that such panels likely will compete with domestically produced monofacial and bifacial CSPV products in the U.S. market, the U.S. Trade Representative has determined, after consultation with the Secretaries of Commerce and Energy, that maintaining the exclusion will undermine the objectives of the safeguard measure,” according to USTR’s announcement.

A sudden reversal

The USTR on June 13 published a notice granting certain requests for exclusions and excluding the products at issue from the safeguard measure’s application. Bifacial solar panels made solely of bifacial solar cells were among those granted exemptions.

Investors briefly drove up the share prices of U.S.-based manufacturers of high-efficiency solar panels First Solar and Sunpower upon the announcement of the exemption reversal, business news outlets reported. Shares of their Chinese counterparts’ Canadian Solar and Jinko Solar fell.

“We’re obviously disappointed by USTR’s decision to revoke the bifacial panel exemption. USTR granted the exemption only four months ago, and only after a year-long process that included notice and comment and inter-agency review. In an extraordinary and unprecedented turn of events, the exemption was quickly rescinded without any opportunity for public notice and comment. This is unnecessarily squeezing the supply of panels in the United States, thereby inflating prices for consumers. In its rush to judgement, USTR missed an opportunity to address the significant shortage of domestic solar panels and its decision will slow the growth of an American economic engine. We look forward to making our case during the pending midterm review,” Abigail Ross Hopper, president and CEO of the U.S. Solar Energy Industries Association (SEIA), said in a statement.

Industry players were looking forward to a healthy pick-up in sales and deployment of bifacial solar panels in the wake of the tariff exemption’s announcement. That was due to several factors, California’s solar homes mandate, rising investments in solar and renewable energy on the part of U.S. corporations, and cities and states announcing more ambitious renewable energy and climate change goals among them.

The Sec. 201 import duty exemption for bifacial solar cells and modules “represents one of the best solutions yet for an industry that’s been dealing with tariffs since January 2018, and we hope it will help level the playing field for U.S. manufacturers. SEIA has been lobbying diligently for exclusions for bifacial modules, so we’re pleased with this ruling,” veteran industry executive Gary Liardon said in an interview at the time.

Healthy growth expected nonetheless

Still, all things considered, the situation is not that negative. We still believe that bifacial solar sales on the whole are going to take off. Yes, we could see the effects pushing U.S. sales downward, but the tariffs will be lowered 5% per year and phased out in coming years.

All things considered, da Silva and Lux see a rising global market trend regarding demand for bifacial solar panels. “Nowadays it’s most polycrystalline silicon [panels being deployed],” da Silva said in an interview. She also pointed out that manufacturers are making greater use of n-type doping (as opposed to the more commonly used p-type doping), which results in higher efficiency PV cells and modules.

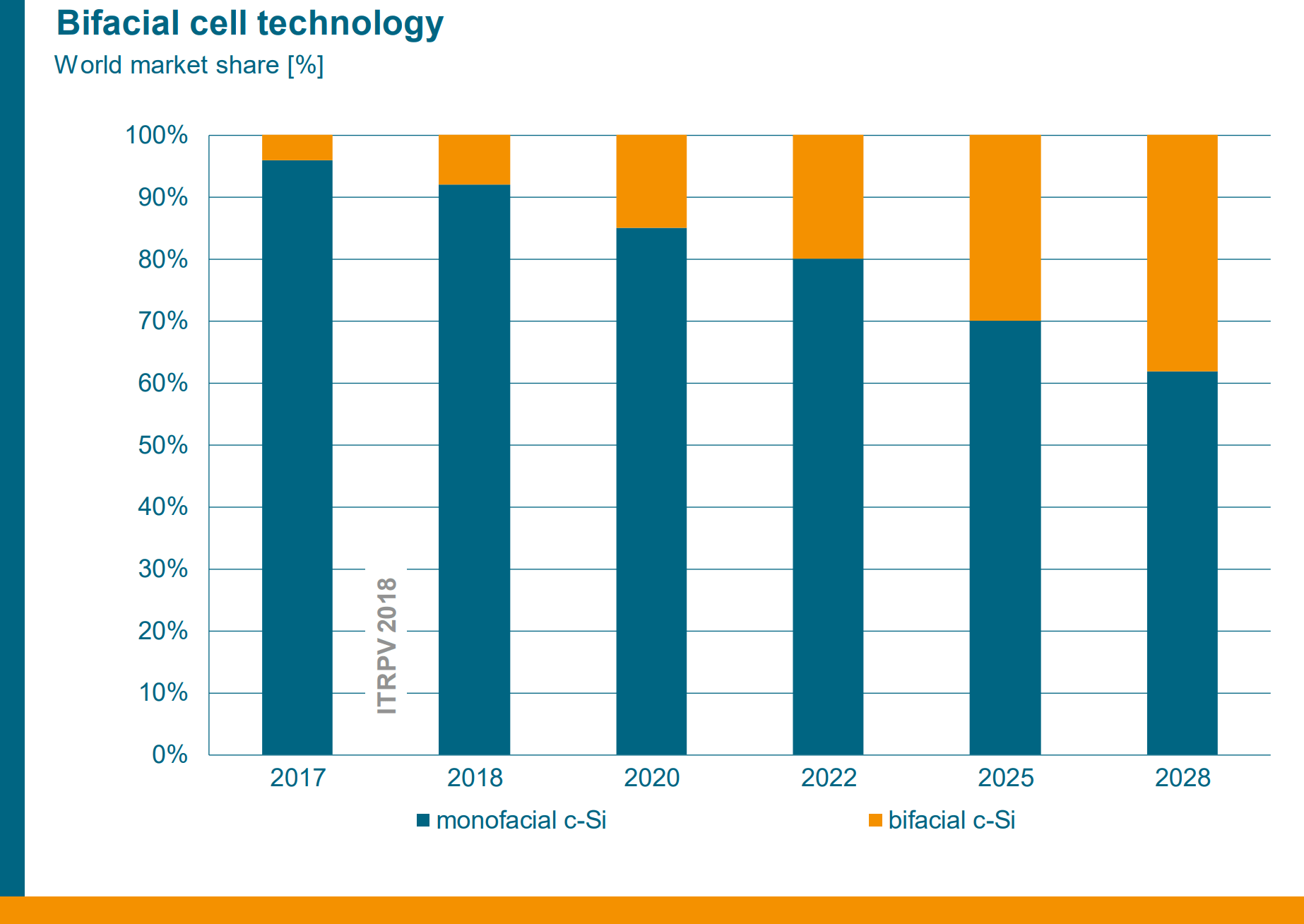

Lux and other industry analysts foresee healthy growth in sales and installations of bifacial solar panels worldwide despite reversal of the U.S. import tariff exemption. “By 2028, expectations are that bifacial solar panels will account for around 40% of the market,” she highlighted.

We don’t believe the main interest here is in the U.S. The main issue with bifacial solar is that there are no standards right now—no standardization of energy prediction tools, no standardized testing or certification of performance. There are no tools to accurately predict power output.

To be sure, bifacial solar cell and module metrics are based priced on a variety of variable factors, she continued. Absorption [of solar energy] takes place on both sides of the panel, which leads to more in the way of differences between bifacial and conventional solar cells and modules when it comes to site location, da Silva pointed out.

Solar PV panel output gains from reflected ground light, measured by albedo, in locations such as Canada that get a lot of snow, are much different than in other locations where the albedo effect is lower, the Netherlands, for instance, according to da Silva. “Studies out there have shown up to 21% gains with bifacial on average, some up to 25%. We believe between 5%–15% is safe bet, but it’s very difficult to say without proper tools or measurement standards.”

Then there are gains to be had by manufacturers that could add momentum to the falling trend in the cost of solar energy given sufficient increases in bifacial solar module use and scaling up of manufacturing capacity to reach sufficient economies of scale, industry analysts point out.