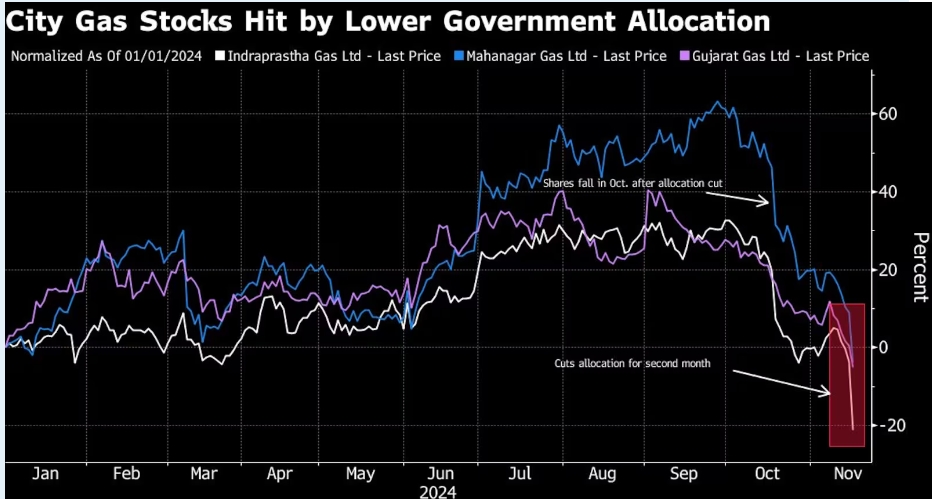

The shares of Indraprastha Gas Ltd. slumped nearly 20%, the most in over twelve years, while that of Mahanagar Gas Ltd. fell more than 18%. Brokerages including JPMorgan Chase & Co. and Jefferies Financial Group downgraded both the stocks after the gas distributors said allocation decreased by as much as 20%.

The selloff has erased all the stock gains of 2024 for major players in the industry. Both Mahanagar and Indraprastha said that the move will impact their profitability and that they’re exploring ways to bridge the supply shortfall.

India provides gas to certain retailers at an administered rate which is determined by the government from time to time. If the supply isn’t large enough, those retailers will have to buy from the open market, likely at higher prices. In that case, retailers are expected to increase prices themselves, which would add to inflationary pressures at a time when the country is already struggling to contain vegetable prices.

The cut for a second month suggests “cheap domestic gas will soon be taken away fully,” Jefferies analysts wrote in a note. The companies would have to hike prices by 10% to maintain margins at the levels seen before the reduction in allocation, lowering discounts to alternate fuels and affecting volume growth, they said.

Shares of Gujarat Gas Ltd. and Adani Total Gas Ltd. also declined, falling 9% and 4.6%, respectively.

Analysts at Citigroup Inc. and Morgan Stanley also see a hike in the prices of gas as retailers debate growth and margins.